If you do your research, you will find information showing that one of the main reasons for forming an Irish corporation that Ireland has one of the lowest corporate tax rates in the world. The Double Irish corporation strategy is often used in conjunction with a Dutch company called the Double Irish Dutch Sandwich tax strategy.

Double Irish with a Dutch Sandwich

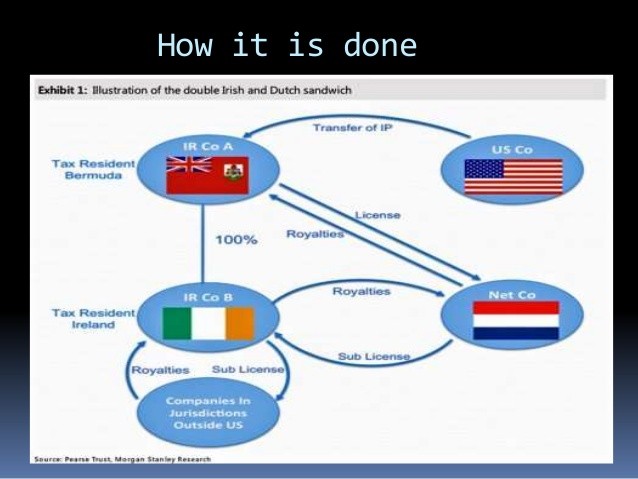

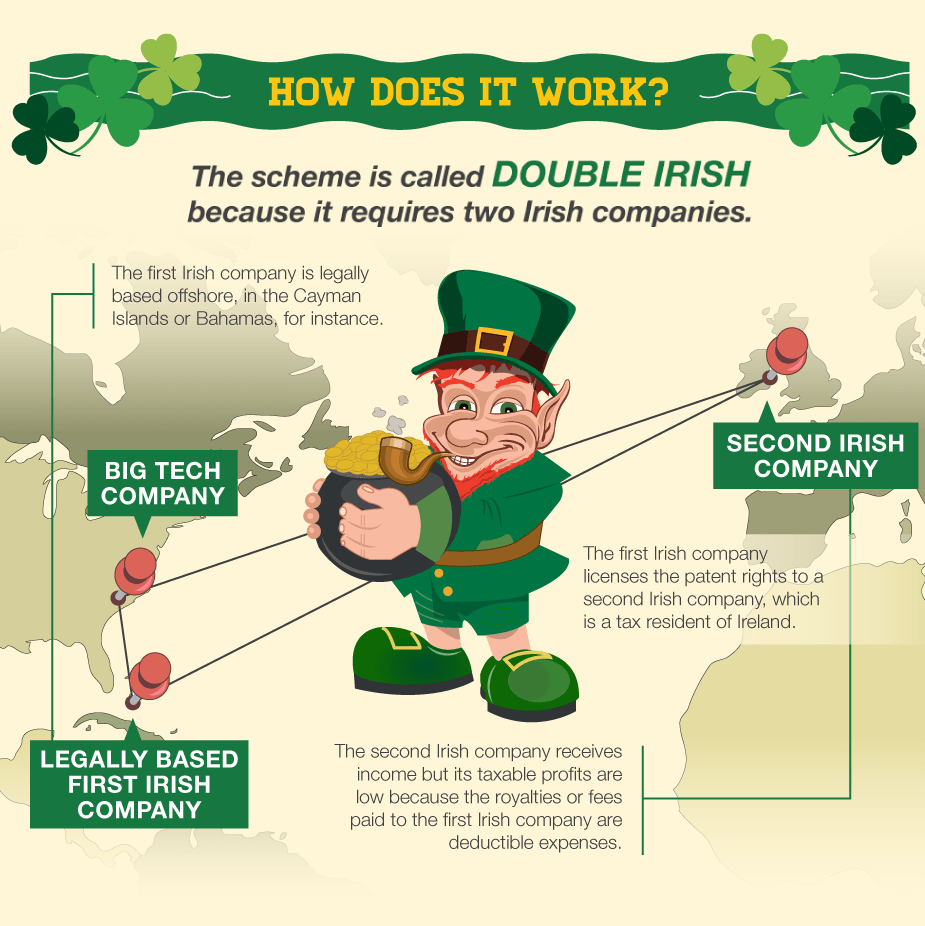

Here is how the Double Irish Dutch Sandwich works.

- First, we set up and two Irish corporations and a Dutch corporation.

- Then, you send profits through the first Irish company.

- Those profits are then paid to a Dutch company.

- Finally, the profits are moves to a second Irish company that has its headquarters in a tax haven such as Bermuda, Nevis or the Cayman Islands, for example.

This widely-used strategy has let certain companies reduce corporate taxes to virtually zero. We use the word “sandwich” because of the manner in which funds are moved. Again, the funds are first moved to an Irish company, then to a Dutch company, in The Netherlands, and then to another Irish company.

Due to international pressure, this strategy may end soon. The Double Irish With A Dutch Sandwich strategy is slated to end in 2020. Even if or when it does, one may still have the ability to take advantage of Ireland’s low corporate tax rates. Corporate taxes in Ireland are extraordinarily low as one can see by the chart below.

The Republic of Ireland has two corporate tax rates:

• 12.5% for trading income (e.g. operating a business)

• 25% for non-trading income (e.g. passive income such as developing land & oil exploration)

Compare these countries:

| Country | Corporate Tax Rate |

| Japan | 38.01% |

| United States | 35% (to 15%) |

| Argentina | 35% |

| Brazil | 34% |

| France | 33.33% |

| Italy | 31.4% |

| Canada | 31% (to 16%) (federal + provincial) |

| India | 30% |

| Spain | 35%-25% |

| Australia | 30% |

| Germany | 29.8% |

| China | 25% |

| UK | 24%-20% |

| Russia | 20% |

| Ireland | 12.5% (active, trading income) |

So, we can see that Ireland’s corporate tax rates are less than half of those in many other countries. That is a main factor in the attraction of many international companies forming Irish corporations.

Irish Corporation Tax Savings

Research and Development Tax Credit

In addition, Ireland has research and development (R&D) Tax Credit program. Qualified R&D costs earn a 25% tax credit that offset corporate taxes plus and additional tax deduction at 12.5%. The reason is to promote foreign and local companies to perform R&D in Ireland.

How Big Companies Cut Tax in Ireland

Tim Cook, CEO of Apple Corporation, one of the most valuable companies in the world as of this writing formed more than one offshore company subsidiary. He reported to the US Senate hearing on tax, two of its Irish subsidiaries pay about 2% in tax. Apple’s tax policy chief, Phillip Bullock confirmed the two Irish subsidiaries – Apple Operations Europe and Apple Sales International – paid around 2% in tax.

Mr. Cook stated that funds earned outside of the US were “taxed in the local market.” Then the company transfers proceeds to Apple Operations International. This company is filed in Ireland but managed and controlled in the USA. Because AOI does not qualify as an Irish resident under Irish tax law, which applies a “management and control” test for residence, it does not pay Irish taxes. As the Senate report stated, “AOI is incorporated in Ireland; thus, under US law, it is not tax resident in the US. AOI is also not tax resident in Ireland because it does not meet the fact-specific residency requirements of Irish law.”

One of the Irish subsidiaries of Apple that has an address in the city of Cork got paid $29.9 billion in dividends from Apple-affiliated offshore companies from 2009 to 2012. This accounted for 30% of Apple’s global profits. Apple received the benefit of the difference between Irish and US tax residency laws.

The Apple CEO said his company paid $6 billion in US federal taxes in 2012. It has created or supports at least 600,000 jobs in the US. Many world-changing inventions were introduced by Apple, including the Mac, iPhone, iPad, iTunes, App Store, etc.

Other International Companies

Several other international companies, such as Facebook and Google, have located their European headquarters in the Republic of Ireland to take benefit from its low corporate tax rates. It is important to get licensed tax advice from a CPA in the jurisdiction where you are required to pay taxes before using such a strategy.

“It’s all about competition,” says one low tax advocate who chose to remain anonymous. “The world is getting smaller. If the prices at Sears are too high, I’m going to Wal-Mart and vice versa. So, if the US doesn’t like it, they should lower their corporate taxes and be more competitive.”

To establish an Irish Corporation, call the number on this page for more information.