A Cyprus International Trust (CIT) was created by the enactment of the Cyprus International Trusts Law of 2011. The CIT offers settlors and beneficiaries the highest asset protection along with tax advantages.

Cyprus requires full jurisdiction over its international trusts without regard of what countries the settlor, beneficiaries are from or where the assets are physically located. Cyprus will ignore all other countries claiming jurisdiction over a CIT. In other words, the Cypriot courts will not acknowledge the jurisdiction of any foreign courts pertaining to the parties and the assets of a CIT. This includes not recognizing foreign tax authorities.

Benefits

A Cyprus International Trust (CIT) can enjoy these benefits:

• Complete Foreign Ownership: Foreigners can form trusts and have foreigners as the only beneficiaries.

• Asset Protection: Cyprus provides strong asset protection laws for its CIT’s.

• Estate Planning: Cyprus will not recognize another country’s heirship laws leaving the wishes for heir’s succession up to the settlor.

• Significant Control: The CIT law allows settlors the right to amend the trust’s provisions, limit the trustee’s powers, become a beneficiary or an enforcer or the protector, become a director in any company owned by the trust, and direct trustees to act and remove them.

• Privacy: Since trusts do not provide the government with the names of the settlor or beneficiaries, all of their information remains private.

• Confidentiality: Cyprus laws require anyone having information regarding a CIT not to disclose without a court order.

• No Taxes: Cyprus does not impose income or estate taxes on CIT’s. Note: beneficiaries who are U.S. taxpayers and others in countries taxing global income must declare all income to their governments.

• Relocation: After formation of a CIT, the settlor and the beneficiaries can relocate to Cyprus and still enjoy the benefits of tax exemption.

• Perpetual: The trust can have an indefinite lifespan.

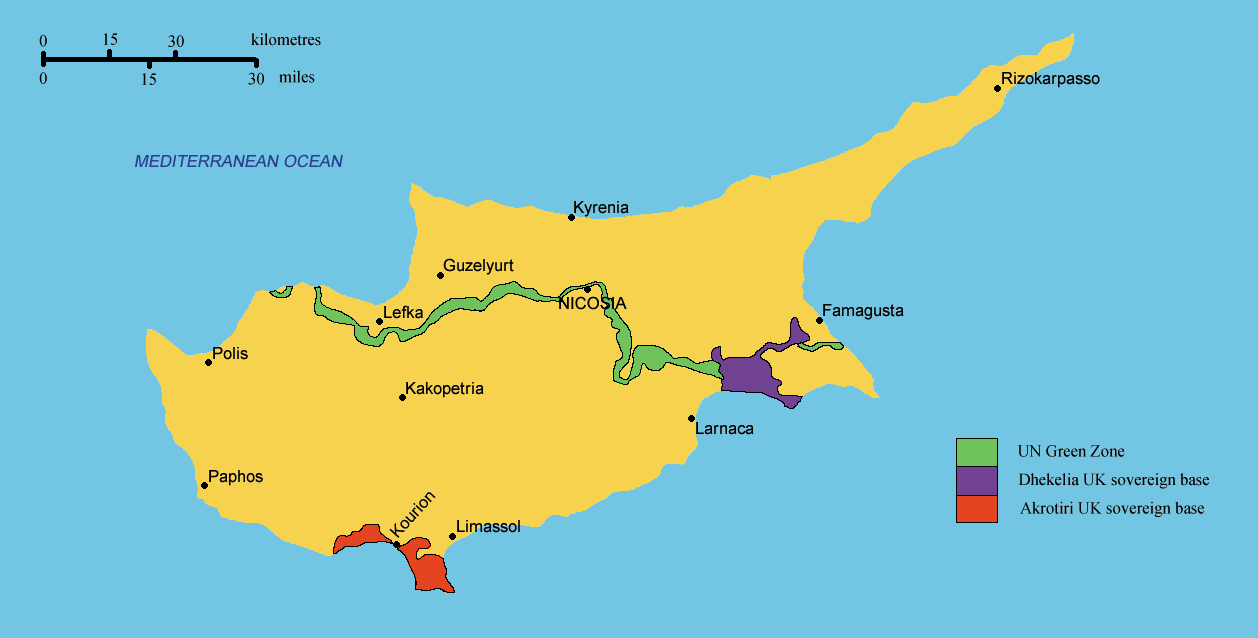

• EU Member: Cyprus is a full member in the European Union (EU).

• English: English is the secondary language in Cyprus.

Cyprus International Trust Name

The trust must use the word “Trust” in its name or “International Trust” or the abbreviation “CIT”.

The trust’s name cannot resemble any other trust’s name on the island.

Qualifications

• The Settlor must be a non-resident of Cyprus only in the year prior to formation of the trust. Settlors have the option to become Cyprus residents after formation of the trust.

• Beneficiaries can be foreigners or Cyprus residents. The trust assets can include immovable Cyprus properties like real estate.

• This allows settlors to relocate to Cyprus after they form their CIT’s and still enjoy the asset protection and tax benefits. It also allows foreign beneficiaries to relocate to Cyprus to enjoy the same benefits. In addition, Cyprus real properties can be purchased and title transferred to the CIT.

• At least one of the Trustees must be a permanent Cyprus resident.

Sale of Trust Property

Trust properties can be sold without any challenges from foreign countries and their courts claiming inconsistency between Cyprus laws and the other country’s laws. For instance, countries which do not recognize trusts cannot challenge the CIT nor the succession rights of beneficiaries.

This strengthens asset protection and estate succession planning strategies.

Settlor’s Rights

A settlor can change the governing law of a CIT to take advantage of future changes in other jurisdiction’s laws. In addition, the settlor can amend, vary, or revoke terms of the CIT. This includes imposing a stipulation limiting the trustee’s power to be subject to the settlor’s consent or any other designated person of the CIT. None of these changes can affect the validity of the CIT.

Settlor’s can now:

• Be a beneficiary in a CIT;

• Retain powers for him/herself;

• Become the enforcer or protector of the CIT;

• Amend, vary, or revoke terms of the trust;

• Apply any capital or income of the CIT’s property;

• Become a director or an officer of any company owned by the CIT;

• Order the trustee to act in certain ways in relation to trust property; and

• Remove or appoint any enforcer, trustee, protector, or beneficiary.

Duration of Trust

The CIT has no limits on how long they may exist.

Trustee’s Extended Investment Powers

The new law enables trustees to invest in different types of properties worldwide including in Cyprus. Trustees can also invest in the shares of Cyprus companies.

Uses for a CIT

Typical Structure – A typical trust or an offshore company or an onshore company are three available options. For instance, a trust owns the shares of an offshore company which owns the shares of an onshore Cyprus company.

Foundation or Trust – A CIT can work in conjunction with another country’s private foundation like a Nevis Private Foundation.

Uses of the different structures includes:

1. Tax minimizing and asset protection – assets and investment or trading operations are owned by companies in no tax or low taxes countries as subsidiaries belonging to the CIT. Then the assets, gains, profits and properties all accumulate with little or no taxes.

All of these incomes are the property of the CIT which can own them throughout the CIT’s lifespan providing tax-free income.

This allows clients to accumulate wealth with tax efficiency under their control without “owning” the assets which will withstand legal challenges from other counties.

2. Asset Protection from Claims – The CIT cannot become void due to bankruptcy or as a company goes into liquidation. Only the Cypriot Courts can dissolve a CIT.

The only manner in which creditors can obtain a Cypriot Court order in their favor is to convince the court that the CIT was set up as a sham to defraud creditors. However, such a claim can only be made within two years of the questioned assets being transferred to the CIT.

3. Planning for Relocation – Prior to immigration to Cyprus shelter assets in order to legally avoid taxes in both countries and protect the assets.

4. Estate Planning – Distribution of assets to the beneficiaries could be structured for a successful succession to the heirs and avoiding “breaking up” of the succession.

The CIT can avoid “forced inheritance” laws in other countries because Cyprus will not recognize such laws. As long as the settlor is of sound mind and an adult in the country of his or her permanent residency.

5. Corporate Tax-Planning – CIT’s can be used in global corporate tax structuring of multinational companies and subsidiaries along with pension planning.

6. Strict Confidentiality – No person can have access to a CIT’s information because the trust documents are private documents. If the trust documents allow, a beneficiary can gain access to certain information. The law makes it clear that those in access to information about a CIT are strictly prohibited from disclosing any information unless a Cyprus Court orders disclosure as part of a criminal or civil proceeding.

7. No Income or Estate Taxes – The law specifically states that a CIT is exempt from taxes on sources earned outside of Cyprus and no estate tax will be imposed on the trust’s assets.

Definition of a Trust

A “Trust” is a duty or an obligation created when a natural person or legal entity called the “Trustee” is appointed to possess properties in order to hold them on behalf of others called the “Beneficiaries”. The person transferring assets to the Trust is called the “Donor” or “Settlor”.

The Trustee acts in the best interests of the beneficiaries when holding and managing the assets like a fiduciary. The trustee must be a permanent resident of Cyprus and can be a natural person or a Cypriot company.

Registration

The CIT must be registered with the Cyprus Securities & Exchange Commission. The following information will be required for registration:

• Name of the Trust;

• Trustees full names and address;

• Date the Trust was established;

• The most recent date of amendments to the Cyprus International Trusts Law; and

• Termination date of the Trust (definite duration or indefinite).

Taxes

Cyprus does not impose income or estate taxes on a CIT. However, beneficiaries who are Americans or residing in a country taxing worldwide income must declare all income to their governments.

Public Records

Only the name of the Trustee is part of the public records. The names of the settlor and the beneficiaries are not included in the public records.

Time to Form a Trust

The CIT can become registered in one business day if all the required information is filed.

Conclusion

A Cyprus International Trust (CIT) can enjoy these benefits: complete foreign ownership, control over the parties, no taxes, asset protection, estate planning, privacy, confidentiality, possible relocation to Cyprus and maintain tax benefits, perpetual life, EU membership, and English is the second official language.