Liechtenstein company formation and banking service has become extremely popular. The country has one of the highest per capita incomes in the world. In addition, the Liechtenstein banking sector is one of the strongest and most stable and reputable.

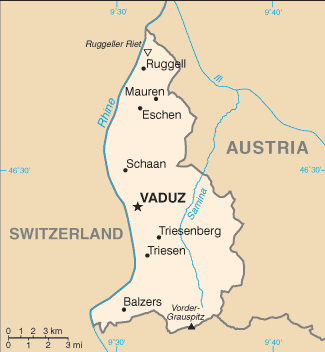

Liechtenstein is located in Central Europe and doubly landlocked. It is officially known as the “Principality of Liechtenstein” where most inhabitants speak German. It is a principality, headed by the Prince of Liechtenstein while being a constitutional monarchy.

Liechtenstein is bordered by Austria to the east, Switzerland to the west, north and south. Its land area is approximately 62 square miles (160 square kilometers) with an estimated population of 38,000. Its capitol is Vaduz.

Economically, the unemployment rate is one of the world’s lowest at 1.6%. Liechtenstein has one of the highest gross domestic products purchasing powers per person in the world. Liechtenstein used to be notorious as a billionaire tax haven. However, its international reputation is now considered very well.

Corporate law in Liechtenstein is based on the Commercial Act of October 12, 1969. According to this law, non-residents of Liechtenstein cannot create businesses inside of the principality. However, non-residents can form offshore companies in Liechtenstein with a foreign representative office by hiring a resident director to register the corporation. There are over 100,000 such resident offices in Liechtenstein.

Liechtenstein and Switzerland are members of a dual customs union. Furthermore, Liechtenstein jointed the European Free Trade Association (AELC) and has also been a member of the European Union since May 1995. These associations through Liechtenstein’s close connection with Switzerland and its participation in the European Economic Union (EEU) means it has great potential for corporations seeking out a region with effective industry, trade, financial services, and foreign investors.

Liechtenstein’s legal system is based on a Civil Code with a Federal Constitutional Court. Unlike common law where judges interpret the law case by case with no precedents, civil laws are codified and applied uniformly.

Benefits

Liechtenstein corporations enjoy many benefits including:

• Corporate Structure: Liechtenstein is known for its superior corporate legal structure.

• Prime European Location: Being in the center of Europe provides convenience to travel to other European countries and conduct business with them.

• Political and Economic Stability: Liechtenstein has been a peaceful principality for centuries with a stable government and economy.

• No Taxes on Worldwide Income: Liechtenstein does not levy corporate or income taxes on profits earned outside its boundaries. However, U.S. citizens and those residing in other countries taxing worldwide income are required to report all income to their tax authorities.

• No Capital Gains Tax: Liechtenstein does not have a capital gains tax.

• Low Corporate Taxes: For corporations earning income within its borders, there is a flat corporate tax rate of 12.5% with a minimum tax of CHF 1,200.

• Strict Confidentiality: The primary business sector in Liechtenstein is the banking and financial services industry. Because of this business focus, the principality places strict levels of secrecy on client information, which generally leads to a culture of confidentiality for the corporations.

• One Shareholder: Liechtenstein corporations can have a minimum of one shareholder.

• Bearer Shares: Liechtenstein corporations can issue bearer shares for the privacy of their shareholders.

• Skilled Workforce: The workforce in Liechtenstein is both skilled and plentiful, giving corporations a talented pool of employees to choose from.

Corporate Name

Liechtenstein corporations must choose names that are not similar to any other corporation. The Name can be in any language as long as the Latin alphabet is applied. For certain words, like a “national” or “international state or place”, permission must be obtained from the government prior to usage.

Office Address and Local Agent

Liechtenstein corporations must have a registered local agent and a local office for process service paperwork and official notices. The main corporation address can be located anywhere in the world.

Shareholders

One shareholder is required. This shareholder can live anywhere in the world.

Liechtenstein corporations can issue nominal shares (with no minimum nominal value), or bearer shares for the privacy of shareholders. Bearer shares can be transferred to others without any recordkeeping. In addition, the issuance of voting shares is permitted.

Directors and Officers

One director is required. This director can live anywhere in the world. A board of directors is necessary and works as the administrative body of the company. The board of directors can be made up of one or several members. These members need to be elected at the general meeting and serve to represent the corporation.

At least one member of the board of directors must have his law office address in Liechtenstein and be in possession of certain professional qualifications.

Authorized Capital

The minimum authorized capital of a Liechtenstein corporation (PLC., Corp.) amounts to 50,000 CHF/ EUR/USD; payment must be made when the corporation files for incorporation. A minimum payment in cash, or with contributions in kind as detailed in the Articles of Association, equaling 25% is required.

Taxes

The corporate tax rate is 12.5%, with a minimum annual tax of CHF 1,200. Dividends are tax exempt in Liechtenstein. However, Liechtenstein Public Limited Companies (PLC) must pay an annual income tax, but are exempt from the payment of capital and coupon tax.

Annual Fees

The annual fee for a corporation in Liechtenstein is 50 thousand Swiss francs.

Public Records

There is no public disclosure of the beneficial owner’s name. However, registration of the owner’s names with the government is necessary.

Accounting and Audit Requirements

Audited annual accounts must be filed with Liechtenstein’s tax authority if commercial activities have occurred within its borders or if the Articles of Association permits such business activities to be undertaken.

Annual General Meeting

No local annual general meeting is necessary, but an annual general meeting must be held. The general meeting has to be summoned at least once a year to approve the annual accounts and deal with any other legal duties and those required by the Articles of Association.

Time Required for Incorporation

A Liechtenstein corporation can be formed in 7 days

Shelf Corporations

Shelf corporations are available to purchase to make incorporation faster.

Form a Corporation in Liechtenstein Conclusion

Liechtenstein corporations enjoy several benefits including: prime European location, political and economic stability, no taxation of worldwide income, no capital gains tax, low corporate tax rate on income earned within its borders, strict confidentiality, one shareholder can incorporate, issuing bearer shares for greater privacy, and a skilled workforce.