A Samoa Trust is governed by the Trust Law of 2014 that foreigners find attractive for their families estate plans. The settlor can reserve powers to maintain control over the trust. A settlor can even form his or her own company to act as the trustee for more control.

The 2014 law even established a special type of trust called the Samoa International Special Trust Arrangement (SISTA) allowing the trustee to hold the shares of a Samoa company allowing the current company directors to maintain their control and management without interference from the trustee. In addition, the trustee is not liable for any errors, omissions, willful misconduct or fraud performed by the company’s management.

SISTA can also be used with limited partnerships where the trustee holds partnership assets while permitting the general partner to continue with day to day management.

Foreigners can create trusts with all foreign held assets and non-resident beneficiaries.

Background

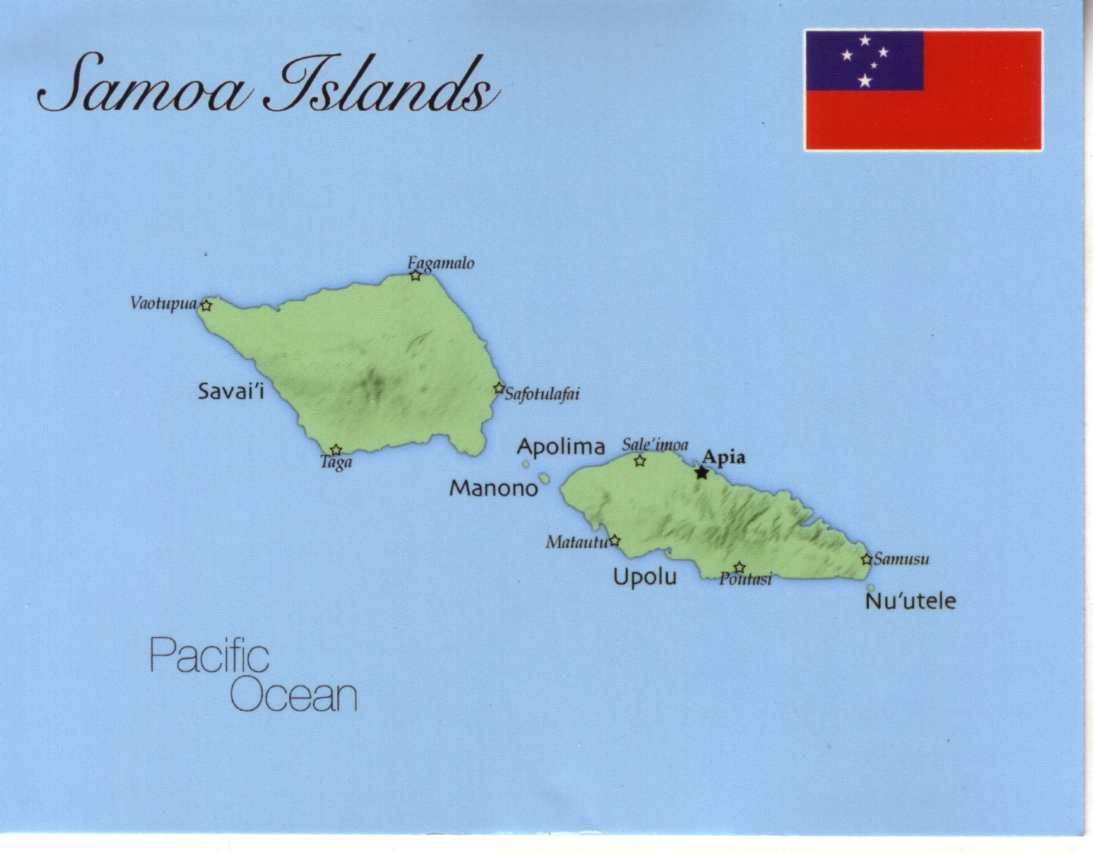

Samoa is officially known as “The Independent State of Samoa” and consists of three main islands. It has a democratically elected parliament with a prime minister. It used to be called Western Samoa and should not be confused with American Samoa which as its name implies is a U.S. Territory.

The Samoa International Finance Authority (SIFA) is a quasi-government corporation overseeing and regulating all international finance centers in Samoa. It was created by the Samoa International Finance Authority Act of 2005.

The laws of Samoa are founded on English Common Laws. From 1914 until it was granted independence in 1962, Samoa was a New Zealand Colony. This is why English is the official second language.

Offshore Trust Benefits

A Samoa Trust can take advantage of the following benefits:

• 100% Foreign Control: The settlor, beneficiaries, trustee, protector, and enforcer can all be foreigners. All of the assets can be held in other countries.

• Privacy: Non-commercial trusts do not register with the government. Commercially active trust register, but the names of the settlor and beneficiaries and assets descriptions and locations remain private.

• Fast Formation: Trust can be formed on one day.

• No Taxes: Non-resident settlors and beneficiaries pay no taxes. However, U.S. residents and others subject to global taxation must report all income to their governments.

• Asset Protection: Creditors have two years to file claims. Samoa courts will not recognize foreign court judgments or laws conflicting with Samoa’s laws.

• Estate Planning: Perpetual life trusts provide many generations of estate planning and legal tax avoidance.

• Settlor’s Control: Settlor’s can retain powers and appoint overseers to protect beneficiaries and the trust’s purposes.

• English: As a former New Zealand Colony, English is one of its official languages.

Samoa Trust Name

Trust can never adopt the same or similar name to any other legal entity in Samoa.

The trust’s name must end with the word “Trust”.

Registration

Since the 2014 law, trusts not engaged in active business no longer have to register with the Samoa government. However, trusts seeking to engage in commercial activities must register.

Formation

Trust can be quickly prepared as no formal format is required. The legal documents can be written in any language as long as there is an accurate translation in English.

Asset Protection

Samoa’s laws only give a creditor two years after a trust is created or transfer of a specific asset sought by the creditor into the trust to file a claim. Otherwise, after the two year window, creditors’ claims will be barred from seizing the trust’s assets even if a foreign court grants a judgment or a court order.

Foreign judgments are not enforced by the Samoa courts including claims of foreign succession rights and judgments after a marital divorce.

Foreign succession laws are not recognized by the Samoa courts.

Probate Avoidance

With a Samoa trust, there may be no need for a testamentary will or court probate process after the settlor’s death. This will save the settlor’s heir’s time and money as probate proceedings costs and time consumption can be excessive.

Duration

Trusts can be forever (perpetual) or for a fixed period.

Settlor

The settlor can be a citizen of any country and reside anywhere.

Trust Instrument

The settlor has wide discretion and freedom in preparing a trust instrument detailing the powers of the trustees and the rights of the beneficiaries and how investments are managed along with appointing nominees and custodians.

The settlor can reserve powers to manage trust assets, investments, and to modify the trust.

The 2014 law allows for “Prescribed Directions” to be provided by anyone named in the trust instrument to be given to the trustee who is protected from liabilities for complying with the directions.

Trustee

The settlor can establish in the trust instruments what powers and duties the trustee can have in relation to managing the trust.

Trustees do not have to be Samoa residents and can be citizens from any country residing anywhere. Trustees can either be natural persons or legal entities.

If only one trustee is appointed at the time of formation, only one trustee will be required. If no trustee is appointed upon formation, the 2014 Act requires at least two trustees.

Beneficiaries

Beneficiaries cannot be residents of Samoa. Therefore, they also can be citizens of and residing in any country.

Protector and Enforcer

A trust can establish a protector to protect the rights of the beneficiaries. In addition, an enforcer may also be appointed to make sure the trustee follows the purposes and the terms of the trust instrument. Both can have powers to add, remove beneficiaries and trustees or to overrule decisions by the trustees. The trust instruments define the powers and roles of the protector and the enforcer.

Taxes

As long as the settlor and the beneficiaries are not Samoa residents, the trust will not pay corporate taxes and the beneficiaries will not pay income, estate, or inheritance taxes.

Note: United States taxpayers and everyone forced to pay global income taxes must disclose all income to their tax authorities.

Public Records

Non-commercially active trusts do not register with the government. Trust involved with commercial activities must register but the assets descriptions and locations along with the names of the settlor and beneficiaries remain private.

Formation Time

Trusts can be prepared in one day.

Conclusion

A Samoa Trust can enjoy the following benefits: total foreign control, privacy, no taxes, asset protection, estate planning, fast formation, settlor can control, and English is one of the official languages.