A Seychelles Special License Company (CSL) is governed by the Companies Special License Act of 2003. In addition, other laws may affect a SLC like the Companies Ordinance of 1972. Foreigners can own a CSL with no requirement for local residents involvement.

A CSL differs from an IBC in that it is a low tax legal entity (1.5% tax rate) which avoids the stigma and blacklisting of zero tax companies. In addition, a CSL can take advantage of the numerous double taxation agreements which the Seychelles is a party. Every CSL is considered a Seychelles tax-resident company allowing for business in and outside of the Seychelles.

Background

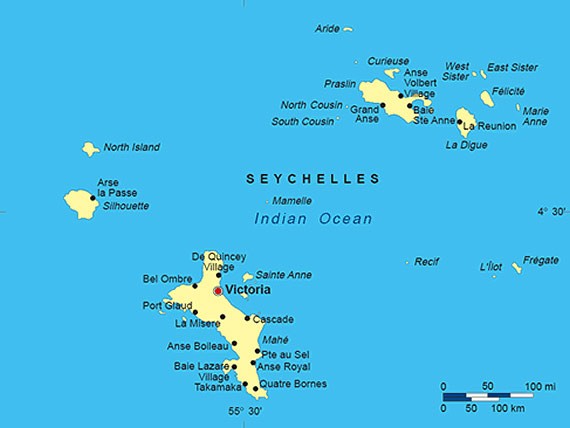

Over 100 islands makes up the Seychelles located on the Indian Ocean. A former British territory which gained its independence in 1976. Its unitary presidential republic political system includes a president and an elected legislature.

Benefits

A Seychelles Special License Company (CSL) enjoys the following benefits:

• Complete Foreign Owners: The CSL can be completely owned by foreigners.

• Low Taxes: A Seychelles CSL company only pays a corporate tax rate of 1.5% of its global income. Note, United States taxpayers and everyone subject to worldwide taxation must report all income to their tax agencies.

• Two Shareholders: Only two shareholders are required to form a CSL.

• Two Directors: The minimum number of directors is two.

• Flexible Business: CSL’s can engage in a wide range of business activities in the Seychelles and internationally.

• No Minimum Capital: There is no required minimum authorized capital.

• English: One of the official languages of the Seychelles is English. The other is French.

Special License Company (CSL) Name

A similar or identical company name to another Seychelles registered company is prohibited. A company name cannot imply Seychelles patronage or from any government agency.

The company name may be in any language as long as a French or English translation is provided. All documents can be in English.

The “CSL” suffix at the end of the company name is required.

Business Activities

As a “domestic” company, the CSL can conduct business inside the Seychelles. The CSL can place some of its administration, customer support services, technical services, or logistics in the Seychelles where special exemptions are available. For example, CSL’s operating in the Seychelles are exempt from duties on equipment imported and Social Security tax payments.

CSL’s can be formed to engage in offshore banking, investment management, investment advice, offshore insurance and re-insurance, marketing, investment services, as a holding company, franchising, intellectual property, and human resources. It may also operate as a Seychelles International Trade Zone Licensee.

Of course, there are no limits on the types of business activities a CSL can conduct in other countries such as global trading in goods and services.

Registration

An application for a CSL must include the Articles of Association, Memorandum, beneficial owners’ names and addresses with a declaration including the company secretary and directors’ names and addresses filed with the Registrar of Companies. Upon approval, a Certificate of Incorporation will be issued by the Registrar.

A business plan explaining the business objectives and types of activities to be conducted. A three year financial forecast describing the marketing strategies and capitalization. These will be reviewed by the Financial Services Authority (FSA) which will issue a Certificate of Approval. This will allow the applicant to proceed with the incorporation process with the Registrar. After receiving its Certificate of Incorporation, the FSA will issue the Special License making it a formal CSL.

Shareholders

A minimum of two shareholders are required to form a CSL in the Seychelles. Shareholders may be natural persons or corporations and can be nationals of and reside in any country.

The names, addresses, and other vital details about the shareholders are required to be filed with the Registrar.

Bearer shares are prohibited. However, permitted classes of shares include: registered shares, shares with or without voting rights, preference shares, redeemable shares, and shares of no par value.

Directors

There must be a minimum of two directors who can be citizens of and residing in any other country. Directors must be individuals as corporation or other legal entities are not permitted.

The names, addresses, and other important information regarding the directors must be filed with the Registrar.

Officers

The only required officer for a CSL is the Company Secretary whose name and important details must be filed with the Registrar. The company secretary must be a Seychelles resident or a Seychelles corporation.

Accounting

Tax returns, accounts, and information pertaining to the beneficial owners must be filed with the FSA. However, this information will not be available to the public.

While accounts records and books must be maintained for every company at the registered office, these do not have to be filed with the Registrar.

Audits are not required.

Registered Office and Service Provider

Every CSL must appoint a local licensed Corporate Service Provider and maintain a registered office in the Seychelles. The name and details of the service provider must be filed with the Registrar.

Minimum Share Capital

There is no minimum share capital requirement. Shares can be denominated in any currency. However, at least 10% of the minimum authorized capital must be issued and paid up.

Annual General Meeting

An annual general meeting of shareholders is mandatory and can be held anywhere.

Taxes

Every CSL is subject to a 1.5% corporate tax rate on global income. This may be offset with any double taxation agreements that the Seychelles may have with other countries.

There are no withholding taxes on dividends, royalties, and interest. In addition, there are no stamp duties on any share transfers, property transfers, and transactions.

Note: American taxpayers and residents of countries taxing worldwide income must declare all income to their tax agencies.

Public Records

The public records will contain the actual beneficial owners of the CSL. The company’s business plan will also be part of the public records.

Registration Time

A Seychelles CSL can expect to be registered and licensed in one month.

Shelf Companies

CSL shelf companies cannot be purchased in the Seychelles.

Conclusion

A Seychelles Limited Liability Company (LLC) has these benefits: low taxation, 100% foreign ownership, two shareholders required, two required directors, flexible business activities, no required minimum capital, and English is one of its official languages.