An Andorra Limited Liability Company (LLC) can conduct any type of business within the jurisdiction and globally without paying high tax rates. The corporate tax rate is only 2% for non-resident companies involved in global trade and investments.

In 2012, Andorra passed the Foreign Investment Law which eliminated the requirement that foreigners could not own a majority of the shares in their companies. Foreigners can own all of the shares in the LLC if conducting all business outside of the jurisdiction. The corporate tax rate is only 2% for non-resident LLC’s doing all of their business outside of Andorra.

Background

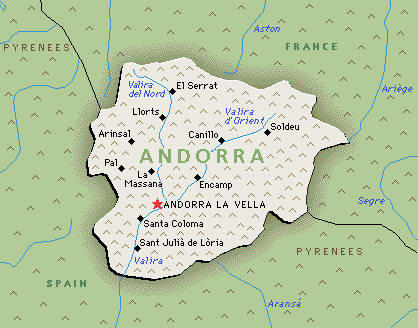

Andorra is officially called “The Principality of Andorra” and is a diminutive state located in the European eastern Pyrenees Mountains and completely landlocked between Spain and France who jointly protect the state. As a protectorate of two European Union (EU) members it enjoys many privileges afforded to EU members.

Tourism during the winter ski season is its main industry ranging from 10 to 12 million tourists per year. This is outstanding given their entire population is less than 57,000 in just 465 square miles (179 square kilometers).

Its political system is a parliamentary democracy where its legislative General Council is freely elected. Officially called a unitary parliamentary semi-elective diarchy.

Andorra Limited Liability Company (LLC) Benefits

An Andorra Limited Liability Company (LLC) takes advantage of the following benefits:

• 100% Foreign Owners: Foreigners may own all of the corporate shares of the LLC.

• Low Taxes: Only 2% corporate tax for non-resident LCC’s doing business outside of Andorra. Note: U.S. taxpayers and other in countries taxing global income must declare all income to their governments.

• Two Shareholders: A minimum of two shareholders can form a LLC.

• One Director: Only one director is required who can be a shareholder.

• Privacy: The names of the shareholders and directors are not included in the public records.

Andorra Limited Liability Company (LLC) Name

LLC’s cannot select a company name resembling any other legal entity in Andorra.

A limited liability company is called a “Societat Limitada” using the initials “SL” where the company must use the term or the abbreviation at the end of its name.

Best Uses

The following are typical uses for the LLC:

• Asset protection structures for conserving a family’s wealth.

• Holding companies where the shares of other corporations are held by the LCC.

• A low taxed company able to conduct business throughout the European Union (EU) with VAT tax exemptions.

Registration

Applications are filed with the Registrar of Companies.

Limited Liability

A shareholder’s liability is limited to the amount contributed towards the share capital.

Shareholders

A minimum of two shareholders are required to form a LLC. They can be citizens of any country and reside outside of Andorra. There are no maximum limits of shareholders.

Corporate shareholders are permitted. Nominee shareholders are prohibited.

Bearer shares are not allowed. Shares cannot be issued without par value.

Directors

A minimum of only one director is required to form a LLC. Directors can be citizens of and reside in any country. A local resident director is not required. One of the shareholders may be the sole director.

Corporate or legal entity directors are prohibited. Directors must be natural persons.

Officers

Officers are not required to be appointed including a company secretary which many other jurisdiction require.

Minimum Capital

The minimum authorized paid-up capital is 3,000 Euro which must be in Euros and not in another currency.

Registered Agent and Registered Office

Every LLC must appoint a local registered agent.

A local physical registered office is not required. However, non-residents must maintain a local office address such as the registered agent’s office address.

Taxes

The normal corporate tax rate is 10%. However, non-resident LLC’s not conducting business within the jurisdiction only pay a 2% corporate tax rate.

Similarly, the capital gains tax rate is also 10%. There are no withholding taxes on dividends and interest paid outside of the jurisdiction.

Their Value Added Tax (VAT) is the lowest in Europe at 4.5%. Although not a member of the European Union (EU) their registered VAT companies will be tax exempt when conducting business with other EU companies.

Note: U.S. residents and those residing in countries taxing worldwide income must declare all income to their governments.

Accounting

Annual accounts are required to be filed with the government. A financial statement will be adequate which will not be included in the public records.

LLC’s must maintain accounting records and keep them in Andorra for at least six years.

Audits are not required as long as for the current and prior years two out of the following three criteria are met:

• The LLC had less than 25 employees;

• The annual turnover was less than 6 million Euro;

• The balance sheet total for assets was less than 3.6 million Euro.

Every LLC must file an annual tax return.

Annual General Meetings

An annual general meeting of the shareholders is required.

Public Records

The names of the shareholders are never part of the public records.

While the names of the directors are filed with the Register of Companies, they are not included in any public records.

Time for Formation

Expect the entire incorporation and registration process to take up to four weeks.

Shelf Companies

Shelf companies are not available to buy in Andorra.

Form an Andorra Limited Liability Company (LLC) Conclusion

An Andorra Limited Liability Company (LLC) enjoys the following benefits: 100% ownership, low taxes, privacy, two shareholders, and one director who can be a shareholder for better control.