Offshore banking involves opening a bank account outside the country in which one resides. People open these accounts for a variety of reasons. This includes protecting their assets from lawsuits, creditors and judgments, as well as tax savings (in some cases) and business expansion. Our intent is to give you the best guide to discuss how to, where to and why to open an offshore bank account. We also discuss laws, definitions and meanings. We will review basic to advanced information in the free online book you will see below.

Banking services in the Western world are in dismal shape. It is a fact.

- Here is what Global Finance says, as of this writing in 2021, of the 30 safest banks in the world:

-

- None of the 30 safest banks in the world none are located in the United States. Zero.

- Out of the top 50 safest banks, only five of them are located in the US.

- Moreover, four of the five US banks on the list are simply small regional farming banks.

- The only national US bank on the list is ranked 50th (last place) out of 50.

- There are six AAA rated offshore banks.

- Of the six AAA rated banks, none are located in the US.

Offshore Banking: A Comprehensive Guide.

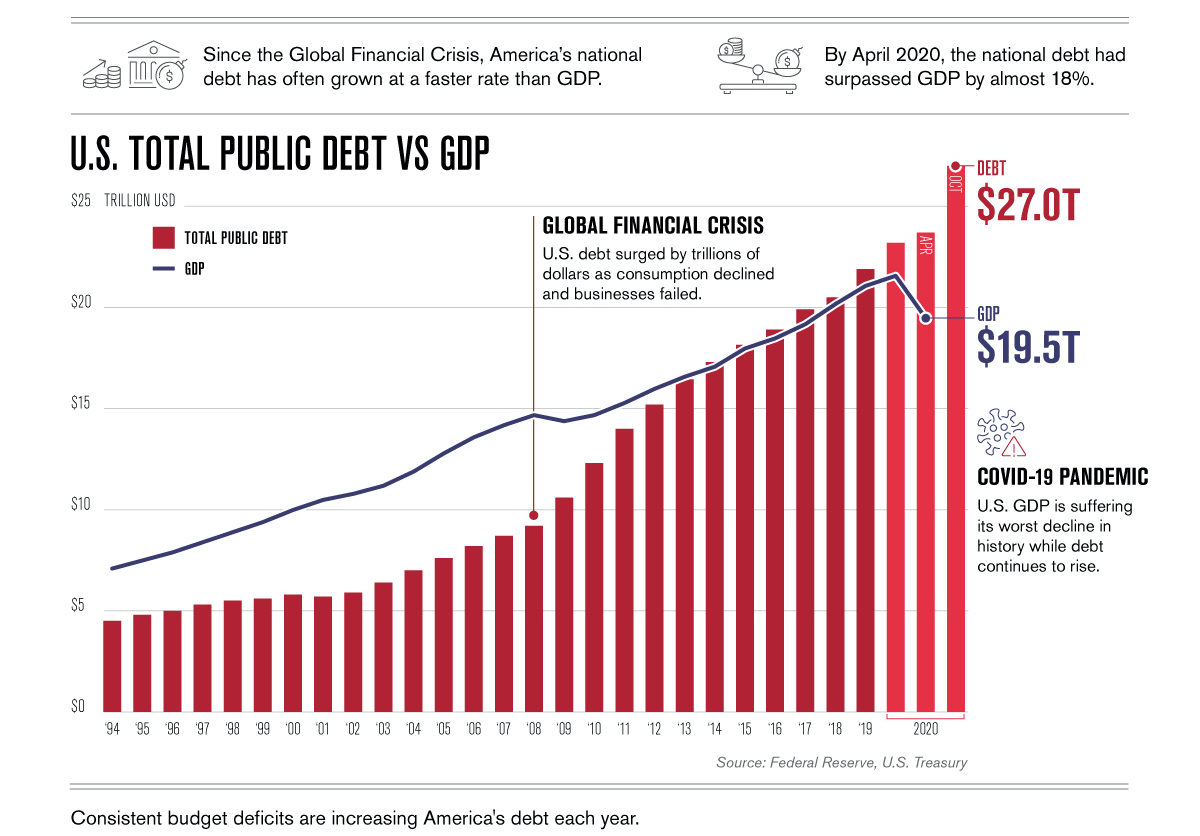

USA: Deep in Debt

Think about it. The USA is the most in-debt country in the world. No other country comes close. Of the four countries with the greatest national debt burden, the US has twice the debt of number two UK and about three and a half times more than numbers three and four France and Germany.

So, the above opening statement is not some attention-getting headline. It is pure fact based on solid evidence. Moreover, the US had its credit rating downgraded by Standard & Poor’s, the most respected corporate and government credit rating agency in the world. US people do not have have laws in their home country prohibiting offshore banking. So, to get started or for more information feel free to use the consultation form or call the numbers on this page. Meanwhile, please see the guide below.

![]()

![]()

New to offshore accounts? Need to brush up your understanding? Want to open an account abroad? The guide below is a tutorial. It provides comprehensive information to both get started and to strengthen your knowledge.

Offshore Banking Guide & Free Book

- Chapter 1: Offshore Bank Account: What is It? Why Have One?

– Detailed Information, Tips and How To’s - Chapter 2: The 5 Best Reasons to Open an Offshore Bank Account – Boiling it Down

- Chapter 3:International Banking Information

- Chapter 4: Myths

- Chapter 5: Safety & Security

- Chapter 6: Asset Protection

- Chapter 7: 6 Best Countries– An Offshore Bank List of Jurisdictions

- Chapter 8: Offshore Account Setup – What to Do

- Chapter 9: Credit Card Merchant Accounts

- Chapter 10: Costs

- Chapter 11: Recommended Jurisdictions

- Chapter 12: Swiss Banking

- Bonus Chapter: Bitcoin and other Cryptocurrency

![]()

US Banking Problems

Let’s focus in more closely on the United States banking system.

- Some of the former banking stalwarts in the US do not measure up to standards of banking safety. Bank of America Corporation, for example, was recently notified that it didn’t pass the stress test. The test concluded that the bank was $33.9 billion dollars short of the amount of reserves they needed to sustain two more years of economic difficulties.

- Even the agency that is supposed to insure US banks, the FDIC itself, is far short. They do not have the amount of money that law requires it to have in order to insure the US banking system.

- Moreover, the US Federal Reserve is skating on thin ice. The capital ratio it holds is a paltry 1.24%. Think about it. Lehman Brothers was at 3% when it filed for bankruptcy.

- In a recent assessment, there was $50.7 trillion of debt that was owed by US households, businesses, and governments. This represents a staggering 3.5 times the total annual gross domestic product of the entire United States.

Banking System in Trouble

Therefore it is clear that the US has a severely undercapitalized banking system backed by a thinly funded insurance organization backed by a savagely in-debt government bureaucracy, backed by debt-ridden taxpayers. So, we should not ask, “Is offshore banking safe?” Instead, we should ask, “Is US banking safe?”

We can clearly see, again, that this is not mere hyperbole. It is solid truth based on fact after fact. Indeed, it is a shockingly discomforting realization that sits like a rock in the pit of the stomach.

Have We Been Tricked?

We saw our parents going to the bank, depositing their hard-earned money into banks, believing banks were safe. Of course it’s safe, we may think. It’s a bank, after all.

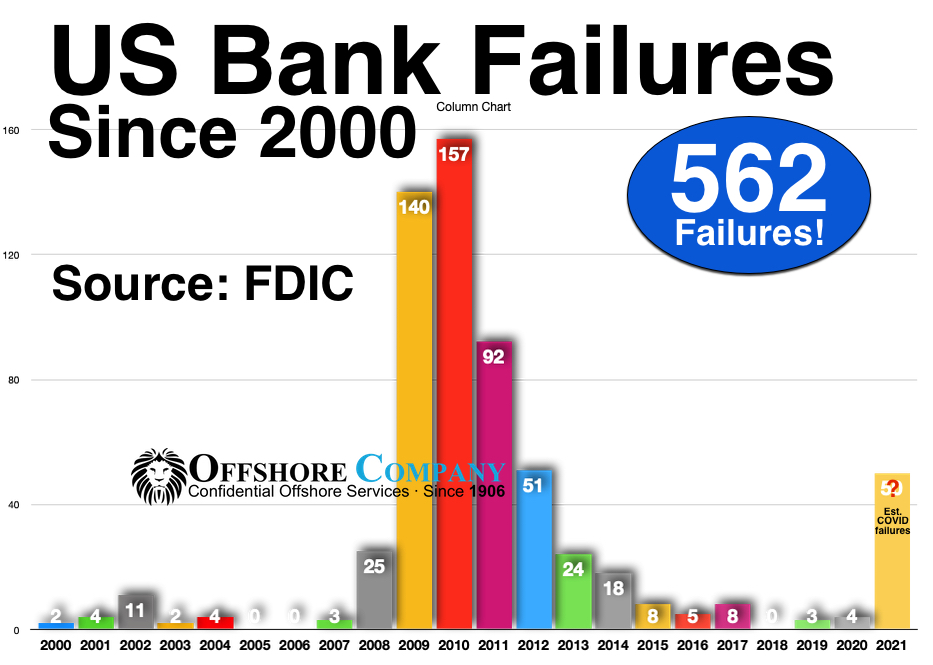

However, looking at the statistics on the FDIC website, from 2000 to the beginning of 2021, 562 US banks failed. Yes, 562. Keep in mind that the FDIC does not insure depositors for the entire account balance. They only cover the first $250,000. Anything above that amount can go “poof” into thin air when your bank fails.

Remember the catastrophic events that ended in calamity for Washington Mutual Bank? This was the biggest bank failure in US history. One day depositors thought everything was fine. The next morning, they woke up and found out that their bank was no more.

This is the way it is today. It may be contrary to the beliefs implanted into us at a younger age. But we all need to awaken to the new reality.

Blaring Facts Lead to Offshore Banking

When faced with these blaring facts it narrows us down to a new resolution. When all of the major financial institutions are marginally destitute, when factual confirmations shed light on this truth. Don’t you think it makes sense to hold at least a percentage of your funds abroad in safer climes?

I would certainly think so. I urge you to take action to set up an international account as quickly as possible. Use the phone number or fill out the form on this page. We have helped thousands with their offshore banking needs. Moreover, we have been helping people to protect their assets since 1906.

How to Choose a Jurisdiction

It would be wise to consider jurisdictions in good financial condition, with peaceful governments and longstanding financial services industries. What people and legislatures do is more important than what they say. So, if they have a reputation for financial stability, that goes a long way in picking your financial haven.

What’s This Really All About?

Keep in mind that securing your money offshore is not about evading tax liability in tax havens such as the Cayman Islands or Hong Kong. It is about diversification of assets. The US government, for example, doesn’t really care if you have funds offshore as long as you report your income. Placing money offshore is, by and large, a tax-neutral event. So, it does not generally increase or decrease your taxes. Millions of citizens have offshore accounts and it does not throw up a red flag to tax authorities if you have one, too.

With the advent of online banking, online wiring ability, telephone banking and debit cards, banking offshore is not really that much different than banking down the street. Plus, it is very common to find to find banks that offer interest rates that are higher, often much higher, than what local banks pay.

Think about it. Wages in the US are very high compared to other nations. Real estate prices are high. Taxes are high. Employee medical insurance is through the roof. Those expenses take a huge chunk of a bank’s profits in the US, the UK, Canada and other higher-priced countries. If the offshore bank’s expenses are less, there will be much more left over to pay to you, their depositor.

Why US Banks Hide the Facts

Your local bank is obviously not going to take out a TV ad telling you that you can get a much interest better rate offshore. Foreign banks, without domestic banking licenses, cannot legally advertise locally. So how else would you know? They aren’t going to tell you that offshore banks are stronger than the bank down the street.

Strongest Offshore Banks

Switzerland, Germany, Australia, Singapore, Hong Kong and many other countries have many very strong, safe banks. Yours truly has the inside scoop, based on decades of experience, on which offshore banking centers will open accounts for foreigners, offer growth investments, are financially resilient, have convenient services, and are truly pleasant to work with.

It’s Your Money – Get Help

It is extremely important to have the guidance of someone with experience in setting up accounts offshore. Any bank can make themselves look great. But only someone with experience — and we have set up thousands of accounts offshore — can tell you which ones really treat their depositors right. After all, we are talking about your money here. Sure, it may cost a little. Probably a lot less than you think. But it’s better than the devastating alternative of choosing the wrong bank.

Offshore Bank Account Tips

Offshore bank account providers cannot legally advertise onshore. Moreover, domestic banks are big political donors. Thus, there is a combination of lack of information and downright misinformation circulated about offshore accounts. As a result, some people have the false impression that it is illegal – it most definitely is not. Some think that it is a way to evade taxes – it is not. Some think criminals use it extensively – this is extremely rare because a bank can lose its license for accepting unclean proceeds.

The truth is, if you are from the US or the UK, for example, that as long as you report your worldwide income, the government could care less. Consider that there are trillions of dollars flying back and forth across our borders every year. Thus, your account will likely not make a ripple on the federal radar.

What are My Options?

There are some amazing options available for someone looking for an offshore bank account. There are offshore banks that specialize in asset protection from lawsuits. Other banks cater to those who need high-volume business transaction accounts. Others specialize in money management for investors. There are also banks that offshore low-cost online stock trading for do-it-yourself traders. Some require minimal deposits, such as $2000 US. Others cater to high net worth individuals and require significant deposits, when opening a bank account, of $250,000 US or more.

Some pay higher interest rates than domestic banks, due to lower cost structures. Others pay rates comparable to domestic markets. Some offshore jurisdictions, such as the Cook Islands, do not recognize foreign judgments. So, when combined with an offshore trust, they cater to those seeking asset protection.

When setting up foreign bank accounts, due diligence and the know-your customer regulations are universal. Those banking systems that allow foreign bank accounts are leery about accepting foreigners who are seeking tax evasion from their home countries. They will also scrutinize your application to make sure that your source of funds are legal. Thus, if you want to open an offshore bank account, be prepared. They will require you to provide full disclosure of your identity and where your deposit came from.

Offshore Banking Remotely Via the Internet

All banks require you to provide proper identification. Some banks will allow you to provide documentation via mail. Others require you to show up in person. Because of our relationship with multiple banks worldwide, we are an “eligible introducer” so that we are able to open accounts for clients remotely where people cannot do so for themselves. Moreover, a vast majority of offshore banks will not even open accounts for US or Canadian people. We know the ones that will open accounts for foreigners, and without the need to travel. Use the form on this page or the number above to obtain further answers to questions about banking offshore.