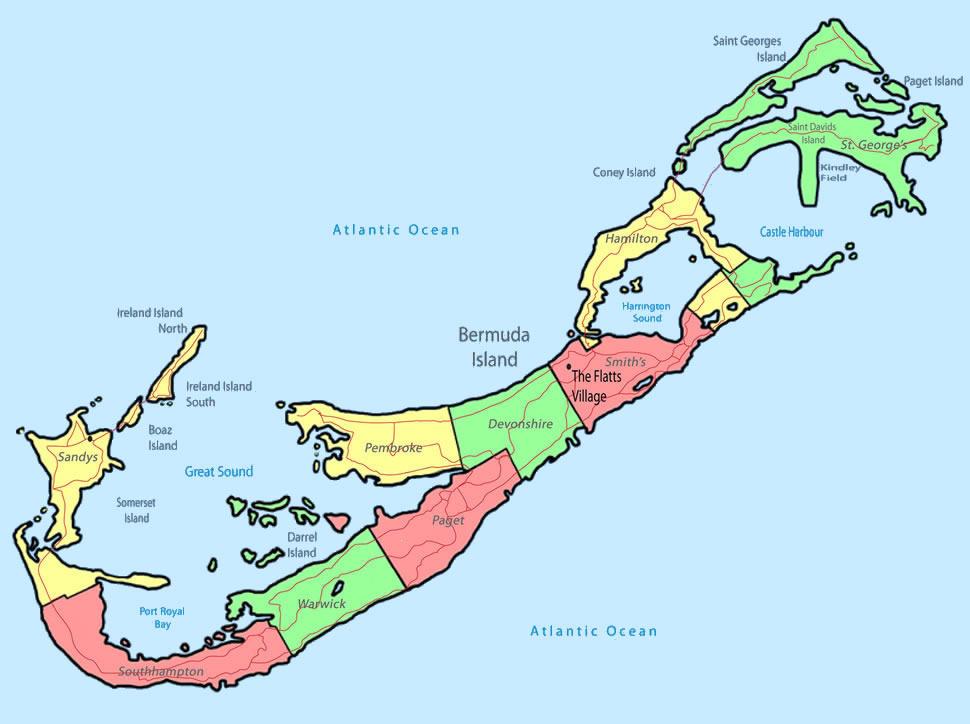

Bermuda Island is a British Overseas Territory in the North Atlantic Ocean. It is located approximately 660 miles (1,000 kilometers) from Cape Hatteras, North Carolina. Its land area is 20.5 square miles (53.2 kilometers) with a population of around 66,000 consisting mainly of people from European and African origins. English is the primary language. The capitol is Hamilton city. Bermuda is an associate member of CARICOM.

The principal law regulating Bermuda corporations is The Companies Act of 1981. Bermuda corporations have all the powers of natural persons. The official language of legislation and corporate documents is English.

The type of Corporation used for international trade and investment is an Exempt Company. All other Bermuda corporations must be at least 60% owned by Bermudan residents.

Benefits

Bermuda is popular with Americans because of its close proximity to the United States. Bermuda corporations offer several benefits including:

• No Taxes: Bermuda does not have corporate or income taxes. However, U.S. citizens and those from countries taxing worldwide income are required to report all income to their tax authorities.

• Privacy: Bermuda corporations’ information about its officers, directors, owners, or shareholders is not filed with the government Register so they are not part of any public records.

• One Shareholder: A minimum of one shareholder is required to incorporate in Bermuda.

Corporate Name

Bermuda corporations must select a unique name that is not similar to already existing corporation names. It is recommended that three versions of the corporate name be submitted for faster approval.

Office Address and Local Agent

Bermuda corporations must have a local registered agent and a local office address. This address will be used for process service requests and official notices.

Shareholders

Bermuda corporations are required to have at least one shareholder. The shareholders may be private individuals or corporations. Nominee shareholders are permitted for privacy.

Directors and Officers

Bermuda corporations are required to have at least two directors (or one director & one secretary), who must be natural persons. The directors must appoint three officers (President, Treasurer, and Secretary).

Authorized Capital

The standard authorized share capital of a Bermudan exempt corporation is US$ 12,000; divided into 12,000 common voting shares of $1USD which is the minimum issued capital per share.

The following classes of shares are permitted: registered shares, redeemable shares, and shares with or without voting rights, and preference shares. Bearer shares are not permitted.

Taxes

Bermuda corporations are exempt from corporate or income taxes as long as they do not conduct business in Bermuda or own Bermuda real estate.

Annual Fees

A Bermuda corporation with an authorized capital of up to $12,000 USD pays an annual registration fee of $1,780 USD. Thereafter, there is an advancing scale up to a maximum of $27,825 USD on an authorized capital of more than $500 million USD.

Public Records Bermuda corporations are not required to register the names of their shareholders and directors which make them private as they are not part of any public records.

The only corporation records that are made available to the public are the Articles of Association and Memorandum.

Accounting and Audit Requirements

Bermuda corporations are not required to keep annual records.

Annual General Meeting

There is no requirement for annual general meetings to be held locally as they can be held anywhere in the world.

Time Required for Incorporation

Bermuda corporations can expect the entire process to take about three weeks. This completion time depends on the turnaround with the corporate name registration, as well as, how accurately the corporation completes its registration documents.

Shelf Corporations

Shelf corporations are not available in Bermuda.

Conclusion

Bermuda corporations enjoy the benefits of not paying corporate or income taxes, incorporating with only on shareholder, and privacy.