A Cayman Islands Non-Resident Company is also known as an “Ordinary” Non-Resident Company. They are governed by the Cayman Islands Companies Law (last revised 2013). Any foreigner can own a Non-Resident Company.

These companies are prohibited from conducting trade inside the Cayman Islands. However, they may execute contracts on the islands in order to do business outside of the islands. For instance, contracting with local service providers in order to maintain an office in the islands. Or, to contract with tourists regarding formation of legal entities for them.

A Certificate of Non-Residency will be issued by the Financial Secretary upon satisfaction that the company will not engage in trade activities within the islands.

At any time, a Non-Resident Company can apply for conversion into an Exempted Company.

Background

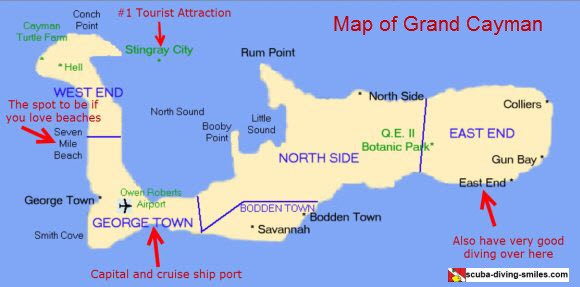

The Cayman Islands are a British Overseas Territory in the Caribbean. Its political structure may be describes as a parliamentary dependency under constitutional monarchy with England’s Queen Elizabeth II as its official monarch.

Non-Resident Company Benefits

A Cayman Islands Non-Resident Company enjoys the following benefits:

• Complete Foreign Ownership: Foreigners can own the entire company.

• No Taxes: The Cayman Islands do not impose any type of taxes on its citizens, resident, or foreign owned companies. Note: United States taxpayers are subject to global income taxation along with those from other countries taxing global income. They are required to disclose all income to their governments.

• Limited Liability: Shareholders have limited liability up to their unpaid shares amount.

• Privacy: The public records do not contain shareholders and directors names. Nominee shareholders are permitted.

• No Minimum Authorized Capital: There is no requirement to have a minimum authorized capital.

• One Shareholder: Only a minimum of one shareholder is required.

• One Director: Only one director is required. The sole shareholder can be its only director for more control.

• No Reporting: No requirements to file annual accounting, tax returns, or perform audits.

• English: Being a British Overseas Territory means that English is the official language in the Cayman Islands.

Non-Resident Company Name

Non-Resident Companies may not choose the same or a similar company name than those of other registered legal entities in the islands.

The company name must include the word “Limited” or its abbreviation “Ltd” at the end of its name.

Registration

The registration of a Non-Resident Company is a fairly simple process. The Registrar of Companies requires the filing of a Memorandum and an Articles of Association.

The Memorandum of Association sets forth the purpose for the company, the company name, type of company (exempted or non-resident), types of shares, authorized capital, registered office address, subscribers’ names and addresses, and Memorandum’s date of execution.

The Articles of Association provides the company’s rules and regulations regarding the daily operations, meetings, and powers of the directors and officers, and the rights of the shareholders.

Limit of Liability

Shareholders’ liability is limited to the unpaid amount of their shares. This means that if the company is sued in a court of law and a creditor obtains a court judgment against the company; the shareholders’ liability is either what funds they put into purchasing their shares or if they have not fully paid, what is still owed.

Shareholders

The minimum number of shareholders is one. There are no maximum limits on the number of shareholders. No restrictions on the nationality or residency of shareholders exists. Shareholders can be natural persons or legal entities.

Nominee shareholders are permitted.

The share capital can be in any currency.

Bearer shares are prohibited. The law permits shares to be issued at par value or at a premium. A capital duty of $50 CI is required when issuing shares.

Directors

The minimum number of directors is one. A single shareholder can be the sole director. There are no restrictions on the residency or nationality of directors. In addition, directors may be natural persons or legal entities.

Minimum Capital

There is no requirement for a minimum authorized capital.

Registered Agent and Office

Every company must appoint a local registered agent and have a local registered office address.

Accounting

Non-Resident Companies are not required to file any financial statements or perform audits with the government.

Accounting records must be maintained, but the government does not require any minimum accounting standards or practices. Accounting records may be kept outside of the islands and in any currency.

There is no requirement to file annual tax returns with the Tax Authorities.

Taxes

The Cayman Islands do not impose any types of taxes on their companies.

There are no income taxes, no corporate taxes, no capital gains tax, no estate or inheritance taxes in the Cayman Islands. This includes citizens and residents, as well as, foreign owned companies.

In addition, there are no sales taxes or VAT. However, they do levy a stamp duty.

Note: U.S. taxpayers are subject to world income taxation along with those from other countries taxing worldwide income. They are required to disclose all income to their governments.

Annual General Meetings

An annual general meeting of shareholders is required. All meetings must be held in the islands.

Public Records

The names of beneficial owners, directors, and registered shareholders are not included in any public records.

Time for Incorporation

Normally, an applicant can expect the incorporation process to be completed in 3 to 4 business days.

Shelf Companies

Shelf companies are not available in the Caymans.

Form a Cayman Islands Non-Resident Company Conclusion

A Cayman Islands Non-Resident Company enjoys the following benefits: Total foreign ownership; no taxes; limited liability, privacy; one shareholder, one director, no minimum capital, no reporting requirements, and English is its official language.