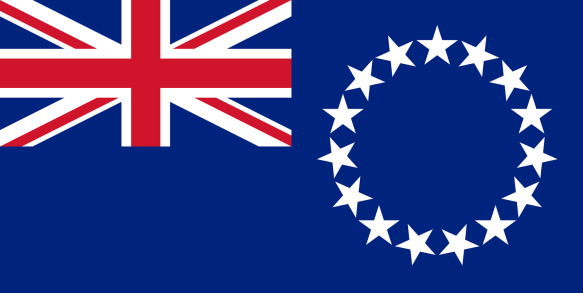

The Cook Islands, while associated with New Zealand, is South Pacific Ocean self-governing island country. There are 15 islands comprising the Cook Islands. The approximate total land area is 92 square miles (240 square kilometers). The Cook Islands have an Exclusive Economic Zone (EEZ) which is attractive to foreign investors.

The 1982 Cook Islands International Companies Act regulates its offshore corporations. Later amendments strengthened its asset protection features which protect foreign investors incorporating in the Cook Islands.

Benefits

Cook Islands corporations receive many benefits including:

• Privacy: A Cook Islands Corporation, known as an International Company (IC) or International Business Company (IBC), provides a high level of privacy and confidentiality for owners, shareholders, and directors.

• Tax Advantages: Cook Islands Corporations have numerous tax advantages and benefits.

• Friendly Government: The Cook Islands government is extremely friendly toward offshore investors. Numerous times the government has upheld its strength as an offshore financial center by protecting its foreign investors from directives and court orders from other countries attempting to force the government to breech its confidentiality agreements with foreign investors.

• Easy and Fast Incorporation: The Cook Islands incorporation process is easy and efficient, typically taking about three days to complete.

• One Shareholder: Only one shareholder and one director are required to form a Cook Islands corporation.

• No Minimum Authorized Capital: The Cook Islands has no minimum share capital requirements for its corporations.

• Minimum Reporting: The Cook Islands government has minimal reporting and regulating restrictions for its corporations.

• Low Renewal Fee: The $200 USD annual renewal fee for a Cook Islands corporation is very low when compared to other jurisdictions.

Corporate Name

Cook Island corporations must select a unique corporate name which is not similar to other corporations. While the corporate name can be in any language, an English translation must accompany it.

Office Address and Local Agent

Cook Islands corporations must have both a local registered agent and a local office address for process service requests and official notices. The main office address of the company can be located anywhere in the world.

Shareholders

Cook Islands corporations must have at least one shareholder.

Directors and Officers

Cook Islands corporations must have at least one director. Directors can be corporations or private individuals. Also, these corporations or persons can reside anywhere and be of any nationality.

A Cook Islands resident must be appointed as the secretary.

Authorized Capital

Cook Islands corporations are not required to have a minimum authorized share capital.

Taxes

Offshore corporations are exempt from taxation.

Annual Fees

The incorporation fee is $300 USD and annual renewals fees are $300 USD.

Public Records The Cook Islands government does not disclose the information of shareholders, directors, or members to the public. The government possesses some of the strongest and best privacy laws found anywhere in the world, guaranteeing privacy for offshore investors incorporating in the Cook Islands or forming an LLC.

Accounting and Audit Requirements

All corporations must file annual returns accompanied by audited accounts; however the audited accounts can be ignored with a corporate resolution.

Annual General Meeting

An annual general meeting is required for Cook Island Corporations.

Time Required for Incorporation

Cook Islands incorporation is estimated to take about three days. The time it takes to incorporate in the Cook Islands depends on how well the applicant files its corporate name request, as well as the accuracy of the applicant’s paperwork submitted for registration.

Shelf Corporations

Cook Islands shelf corporations are available for faster incorporation.

Update

The Cook Islands Legislation Addresses EU Concerns

The Cook Islands passed a suite of legislation on 17 December 2019 to comply with the European Union’s international tax good governance standards, thus avoiding being listed as a non-cooperative tax jurisdiction. Agreed in December 2017, the EU list is a common tool for member states to tackle risks of tax abuse and unfair tax competition.

Cook Islands Corporation Law Update Summary:

• The removal of Cook Islands tax exemptions for companies incorporated or registered under the International Companies Act 1981-82, subjecting those companies to the domestic company tax regime and a tax on company profit of 20%. International companies existing on or before 17 December 2019 will not be subject to the new law until 2022. International companies incorporated after 17 December 2019 will be subject to the taxation provisions with immediate effect. This includes international companies carrying on international banking business from within the Cook Islands under the Banking Act 2011 and international companies licensed to carry on captive insurance business under the Captive Insurance Act 2013.

• The abolition of Category C insurance licences issued under the Insurance Act 2008.

• The removal of specific tax concessions on investment in the Cook Islands offered under the Development Investment Act 1995-96 and a tax exemption on revenue from certain public works offered under the Income Tax Act 1997.

The Deputy Prime Minister and Minister of Finance of the Cook Islands, the Hon. Mark Brown, has also announced that in 2020 the Cook Islands will be undertaking a thorough review of its taxation system, including the taxation of company income, and will explore the introduction of a territorial tax system.

Conclusion

The Cook Islands government is friendly towards foreign investors by offering several benefits to its corporations including: privacy for the owners, shareholders, and directors; tax advantages, fast and low cost incorporation, minimum of one shareholder, no minimum authorized capital, minimum records requirements, and low renewal fees.