For Egyptian company registration, the Limited Liability Company (LLC) is the most popular type formed by foreigners in Egypt. Foreigners obtain limited liability protection along with a very low required minimum share capital. Foreigners may own 100% of the shares in the LLC.

The Commercial Companies Law 159 of 1981 governs the formation, acceptable activities, and dissolution of LLC’s. The Investment Law 230 of 1989 governs the manner in which foreigners may make investments in Egypt.

Background

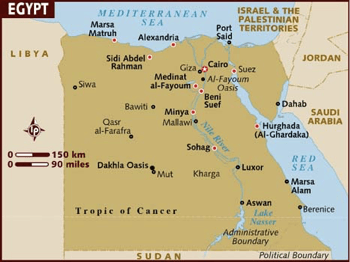

Egypt is officially called the “Arab Republic of Egypt”. Its borders transcend two continents, the southwest corner of Asia and the northeast corner of Africa. It is also a

Mediterranean country bordered by the Red Sea to the south and the Gulf of Aqaba to the east, and Israel and the Gaza Strip to the south with Libya to the west.

Egypt became one of the world’s first nation states in the 10th millennium BC and Ancient Egypt was considered the cradle of civilization.

Egypt was a British Protectorate from 1882 until 1952. However, in 1922 the United Kingdom granted Egypt its independence while maintaining its protectorate role until 1952 when Egypt became a republic. While Arabic is the official language, English is understood and spoken by a large part of its population.

Its political system is described as a “unitary semi-presidential republic” with a one house legislature and a prime minister and a president.

Egyptian Limited Liability Company (LLC) Benefits

An Egyptian Limited Liability Company (LLC) offers these benefits:

• Completely Foreign Owned: Foreigners may own all of the shares in the LLC.

• Limited Liability: A shareholder’s liability is limited to the value of his or her shares.

• Two Shareholders: The minimum requirement is two shareholders.

• One Director: Only one director is required to manage the LLC.

• Low Share Capital: Currently, only 150 Euro require as the minimum share capital.

• English: While not an official language, because Egypt was a British Protectorate for 70 years, English is widely spoken

Egyptian Limited Liability Company (LLC) Name

LLC’s must select a company name completely different than any existing legal entity’s name in Egypt. Proposed company names may be reserved for up to 10 days.

The company name must end with either the words “Limited Liability Company” or its abbreviation of “LLC”. The LLC’s name can also include the type of business or trade engaged in and/or one or more of the beneficial owners’ names.

Words suggesting Egyptian or any other country’s government patronage are prohibited without written authorization.

Limited Liability

LLC’s are private companies where the liability of the shareholders are limited to the value of their shares.

Incorporation

The Commercial Companies Law provides the mandatory terms to be included in the Memorandum of Association.

All documents are filed with the Commercial Register.

Shareholders

At least two shareholders are required to form a LLC. The maximum number of shareholders allowed is 50. No restrictions exist regarding shareholders’ residency location or nationality. Shareholders may be natural persons or corporate bodies.

A Register of Shareholders must be maintained at the registered office. The Register must contain the names of all shareholders, their citizenships, domiciles, and their occupations. In addition, the Register contains the number of shares owned by each shareholder, the sums paid each one, and record any assignments or transfers of shares.

As a private company, the shares of the LLC cannot be sold or traded in a public stock exchange. However, once a shareholder offers his or her shares to the other shareholders who decline the offer (after a one month period), then a shareholder’s shares may be sold to third parties.

In addition, being a private company prevent the LLC from raising capital from the public or issuing negotiable bonds or shares.

Director

Only one director is required to be appointed in order to manage the LLC. Directors can be natural persons or legal entities. Foreign directors may also reside anywhere and be citizens of any country.

At least one director must be a resident of Egypt. In order to avoid tie votes on important matters and to maintain total control of the LLC, it is recommended that two foreign directors be appointed with the local director. A foreign owner desiring to be the sole resident director must obtain a residency visa and maintain a paid up capital of not less than 19,000 Euro.

Nominee directors are also permitted.

The Memorandum of Association must name all of the directors and specify the definite term of appoint length or if an indefinite period.

Directors are presumed to have the full authority to manage the LLC unless the Memorandum of Association specifically limits their authority and powers.

Supervisory Board

If the number of shareholders in the LLC exceeds 10, a supervisory board consisting of at least three shareholders must be created. The supervisory board maintains the right to request access to all accounting records, require reports from the directors, verify all available cash and assets, and review all of the LLC’s financial statements before they are presented to the annual general meeting.

Share Capital

The required minimum share capital is only 1,000 EGP (currently, 150 Euro). The total share capital must be paid in full upon incorporation of the LLC.

If the LLC’s share capital equals or exceeds the minimum share capital of a closed joint stock company (250,000 EGP currently equivalent to 32,000 Euro) at least 10% of the profits must be distributed to the shareholders. The 10% can also be distributed amongst the employees under a profit sharing arrangement as long as no more than 100% of their annual salaries are distributed to them.

Registered Office

Every LLC must maintain a registered office address in Egypt to accept legal notices. The company setting up a foreigner’s LLC usually provides their office address as the official registered address for the LLC.

Taxes

Egyptian resident companies are taxed on their global income. The Corporation Income Tax (CIT) rate is currently 22.5% on the profits.

Note: U.S. taxpayers and all others subject to taxation on their global income must report all income to their tax authorities.

Annual Meeting

An annual general meeting of the shareholders is required along with a meeting of the directors.

Time for Formation

When all necessary documents are filed with the Registrar, it typically takes one week to obtain approval.

Conclusion

An Egyptian Limited Liability Company (LLC) has the following benefits: complete foreign ownership, limited liability, low share capital, two shareholders, one director, and English is widely spoken.