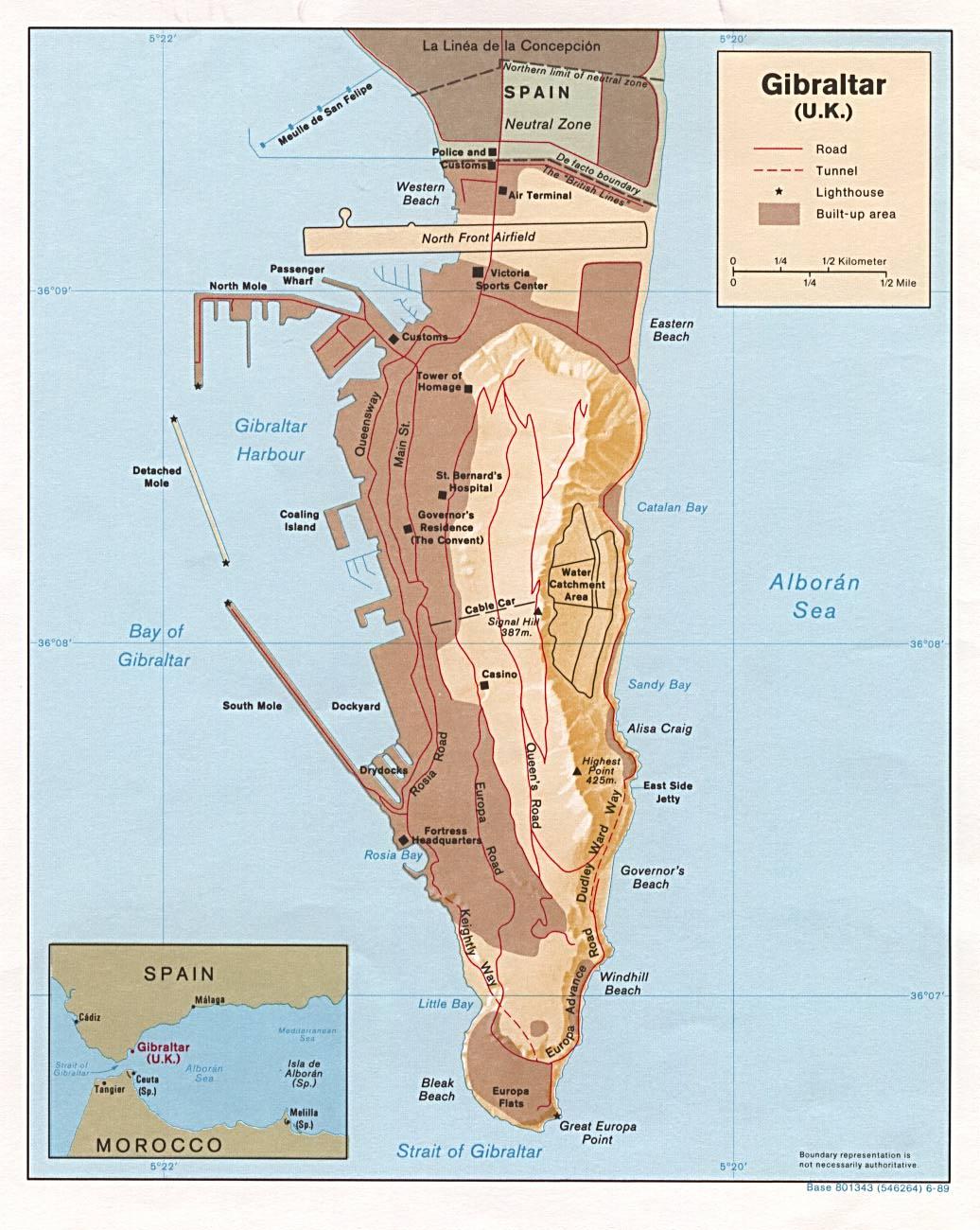

The British Overseas Territory of Gibraltar is located on the southern end of the Iberian Peninsula south of Spain. Its land area is only 2.6 square miles (6.6 square kilometers). Its densely populated city has an estimated population of over 30,000 citizens and resident from other countries. Its major famous landmark is The Rock of Gibraltar.

Gibraltar offers a variety of unique options for those wanting to form an offshore corporation. Gibraltar also offers several benefits such as tax breaks and a strong economy which foreigners like.

Foreigners normally choose to form a Non-resident company in Gibraltar which was specifically created to be owned by foreigners living outside of Gibraltar. This type of corporation is regulated by the Gibraltar Companies Ordinance law, which is based on the British Companies Act of 1929.

Gibraltar has become an impressive financial center by adopting the Gibraltar Companies Ordinance and the Companies Act of 1929. Non-resident companies incorporating in Gibraltar are not subject to the local corporate tax. Basically, the law can be interpreted as a tax break for those corporations with local bank accounts, since they will not be taxed.

In addition, non-resident corporations are not required to pay any annual duty or most of the other necessary fees local resident companies incur.

Benefits Gibraltar offers several benefits to its offshore corporations:

• History of Tax Exemption: The system of tax-exempt offshore corporations was introduced to Europe by Gibraltar.

• EU Membership: Gibraltar is a member of the European Union (EU) giving it instant credibility in regards to stability and solid legal practices.

• Political & Economic Stability: Gibraltar’s solid government standing and stable financial economy also contribute to making it a primary jurisdiction for offshore corporations. Over 60,000 offshore corporations are registered in Gibraltar with most of them holding tax exempt status.

• Freedom to Conduct Business Globally: Non-resident Gibraltar corporations can be managed and controlled from anywhere in the world as corporate meetings are not required to be held in Gibraltar. No physical presence is required in Gibraltar.

• Tax Free: Gibraltar’s Companies Taxation and Concessions Ordinance provide every offshore corporation tax exempt status. This means they do not pay corporate or income taxes as long as the corporation is owned by non-residents and does not conduct business in Gibraltar.

• Low renewal Fee: Normally, non-resident corporations only pay annual renewal fees of G£200.

Corporate Name

Gibraltar corporations must select a unique name. The government publishes a legal notice listing all names that could be similar to other corporations. New corporations cannot use the names on the list or that are similar to the names of a corporations already in existence. In addition, a name that is offensive decided by the Registrar, names that relate to government or royal patronage, or a name that could imply relationships to banking activity are prohibited. Certain words used in company names require special permission of the government such as: “Association “, “Assurance,” “Bank”, “Royal”, “Imperial”, International”, “Trust”, etc.

Registered Agent and Office

The corporation must maintain a local office address and appoint a local registered agent as well as a local corporate secretary.

The corporation’s registered agent can provide nominee services for forming the corporation and for shareholders and directors.

Annual Reports

The corporation must prepare an annual report each year to be filed with the government’s registered office. Offshore corporations must complete annual audited accounts and file them with the Financial Service Commission at least four months prior to their fiscal year end date.

Licenses

Offshore corporations operating outside of Gibraltar must apply for a license if their business includes: insurance, banking, investment management, or trust and company management. Other business activities may require a license which the resident agent can explain.

Advertising

All advertising and correspondence by the corporation must include the corporation’s license number on them. These types of communications are under the jurisdiction of the Financial Service Commission ensuring that all offshore corporations are following the laws of the Financial Service Ordinances.

Taxes

Small Gibraltar offshore corporations pay a corporate tax rate of 20%, while the standard offshore corporation tax rate is 30%.

Guaranteed Share Capital

Every Gibraltar offshore corporation must provide a share capital guarantee by depositing that share capital into a bank account.

Resident Employees

Gibraltar offshore corporations having local management offices, as well as, resident employees (typically known as qualifying corporations) must apply with the Employment and Training Board, as well as the Tax Office, prior to incorporation.

Conclusion

Gibraltar offers its offshore corporations several benefits including: EU membership, political and economic stability, tax free income, freedom to conduct business globally, and a low annual renewal fee.