An Isle of Man New Manx Vehicle (NMV) is governed by The Companies Act of 2006. This Act provides several options for a NMV to be formed as either:

• Company limited by guarantee;

• Company limited by shares;

• Company limited by guarantee and shares;

• Unlimited company with shares; or

• Unlimited company without shares

Foreigners can own all of the shares in a NMV.

Background

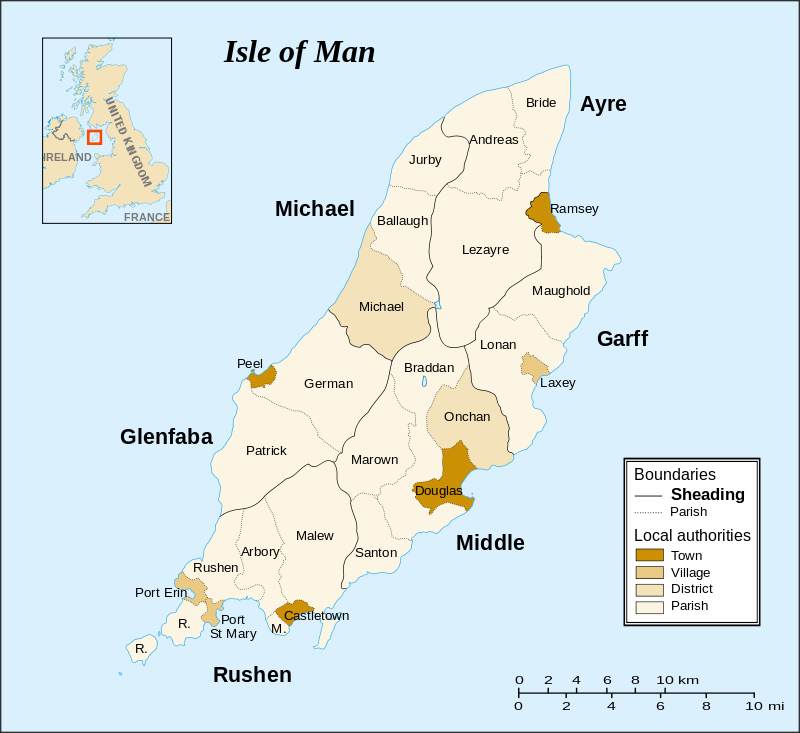

The Isle of Man (commonly called “Mann”) is an island located on the Irish Sea and the British Isles. It is a semi-autonomous (able to govern internal affairs) British dependent territory. The British government provides for its defense and represents it globally. In return, the Isle of Man pays the British government for its services. It has a two house elected Parliament. Her Majesty Queen Elizabeth II is ultimately responsible for the island and must give assent to all legislation passed by its Parliament.

Isle of Man New Manx Vehicle Benefits

An Isle of Man Manx Vehicle (NMV) has these types of benefits:

• 100% Foreigner Ownership: Foreigners can own all the shares in a NMV.

• No Taxes: 100% foreign owned NMV with all income earned outside the Isle of Man pays not taxes.

• Flexibility: NMV’s have many options to choose regarding the type of company including many different types of issued shares.

• One Shareholder/Director: Only one shareholder and one director are required who can be the same person.

• Privacy: Owners names do not appear in any public records.

• English: As a British territory, English is the official language.

Legal Information

Isle of Man New Manx Vehicle (NMV) Name

A NMV Company cannot take a name identical or similar to an existing legal entity. Nor can a NMV

• Use a name implying illegal activities or implies government or royal patronage;

• Use words implying an individual or a company provides trust services without an appropriate license under the Financial Services Act of 2008 (FSA);

• Use the word “Group” unless adequate proof is provided showing the company owns a group of companies;

• Use the word “Holdings” without proof of ownership of a minimum of 51% in at least one company within six months of incorporation; or

• Any name which the Registrar deems inappropriate or offensive.

A company name can be in any foreign language using Latin alphabet lettering. An English translation must be submitted for the Registrar to judge the appropriateness of the name.

In addition, the following name usages requires a license: banks, loans, savings, co-operative, assurance, insurance, reinsurance, building society, council, municipal, Chamber of Commerce, finance, and a trust or such words translated into a foreign language.

NMV Limited Companies must use either “Limited”, “Incorporated”, “Corporation”, “Public Limited Company”, or an abbreviation.

NMV Unlimited Companies may (but not required) end with the word “Unlimited” or its abbreviation “Unltd”.

A protected cell company must use “Protected Cell Company” or its abbreviation “PCC”.

Incorporation Procedure

Submit a Memorandum and the Articles of Association and information regarding the Registered Agent and Registered Office with the Registrar of Companies.

The names of the beneficial owners do not have to be included in the documents filed with the Registrar.

Trade Restrictions

NMV Companies cannot:

• Undergo bank or insurance business without a license;

• Undergo a business offering investments other than investing the company’s own assets without a license; or

• Offer company membership or shares to the public or solicit money from the public without a license.

Shareholders

A minimum of one shareholder is required.

Different classes of shares are permitted by the Act such as:

• Redeemable at the company’s or shareholder’s option;

• Convertible;

• Confers preferential rights;

• Confers limited, special, or conditional rights, including voting rights;

• Only entitles participation in specific assets.

In addition, the Memorandum or the Articles of Association may allow the NMV to:

• Issue shares with or without par value;

• Issue bonus shares;

• Issue shares in any foreign currency (if par value);

• Issue fractional shares; or

• Issue numbered or unnumbered shares.

However, bearer shares are prohibited under the Companies Act of 1931.

Registered Office and Agent

NMV Companies must have a local registered office and a licensed registered agent.

Directors

At least one director is required who can be a citizen of any country and residing anywhere. Normally, directors are natural persons because the Isle of Man requires legal entities to be licensed under the Isle of Man Fiduciary Services Act of 2000.

Officers

No officers are required to be appointed.

Taxes

Private Limited Companies do not pay any taxes. In addition, there is no withholding tax on dividend payments to shareholders.

Companies engaged in banking, insurance, or business inside the Isle of Man pay a corporate tax rate of 10%, as well as, a withholding tax of 10% when paying dividends to their shareholders.

Accounting

There are no requirements for filing audited financial statements with the government. However, the following accounting records must be maintained at the company’s local registered office:

• Accurately explains all NMV transactions;

• Accurately determines the current financial status of the NMV; and

• Allows financial statements to be prepared if needed.

Public Records

While all records filed with the Registrar are open for public inspection, the names of the beneficial owners do not have to be included in any filings with the Registrar.

Time for Incorporation

Typically, a NMV can be incorporated between one to five business days.

Shelf Corporations

Shelf corporations are available.

Conclusion

An Isle of Man Manx Vehicle (NMV) has these types of benefits: 100% foreigner owners, no taxes, privacy, one shareholder who can be the only director, flexibility with choosing the type of company, and English is the official language.