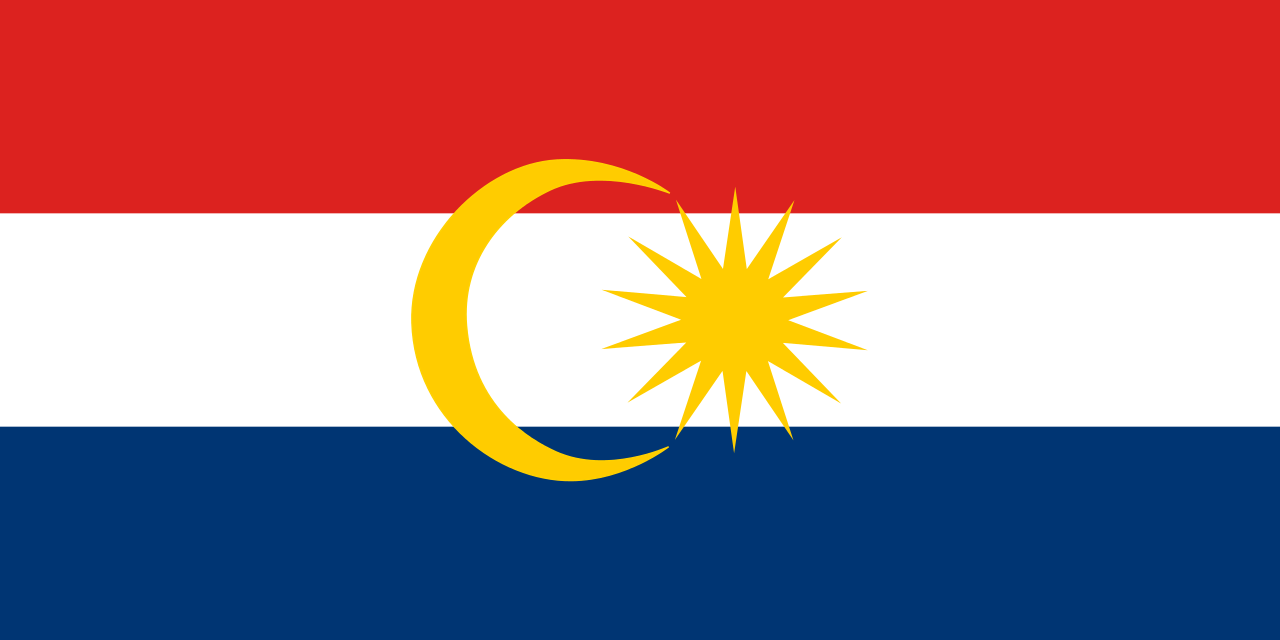

Labuan and is located off the coast of the state of Sabah in East Malaysia. It is officially called the “Federal Territory of Labuan.” It is a territory of Malaysia made up of Labuan Island and six smaller islands. Victoria is Labuan’s capital. It is a popular tourist destination for scuba divers. Since 1990, Labuan is best known for providing international financial and business services (IBFC). It is also known for providing IBFC services to ocean oil and gas companies in the region.

Corporate Legislation

Labuan’s legal system follows English common law. Labuan has enacted laws to help assist offshore corporations and to make an investment in Labuan more attractive.

The most significant corporate legislation in Labuan was signed into law in 2010. The primary goals behind these new laws were to help make Labuan a more attractive choice for offshore investors. Many of these new laws allowed Labuan to create more opportunity for foreign investment in the region, including financial products and services, both Islamic and conventional. Furthermore, the legislation also helps with keeping the status of the Labuan IBFC as a beneficial and credible region with business transactions that follow internationally accepted standards and best practices.

The corporate legislation regulating financial transactions in Labuan includes:

- Labuan Business Activity Tax Act of 1990

- Labuan Companies Act of 1990

- Labuan Financial Services Authority Act of 1996

- Labuan Trusts Act of 1996

- Labuan Limited Partnership and Limited Liability Partnership Act of 2010

- Labuan Financial Services And Securities Act of 2010

- Labuan Foundations Act of 2010

- Labuan Islamic Financial Securities and Services Act of 2010

Benefits

Labuan corporations enjoy many benefits including:

• One Shareholder: Only one shareholder is required to incorporate.

• Easy Banking for Foreigners: it is easy for any foreigner to open a bank account in Labuan. Globally recognized international bank like Bank of America, JP Morgan and BNP Paribas have branches in Labuan.

• In the Heart of Asian and Islamic culture: Labuan is one of the premier Asian and Islamic finance centers in the world connecting both cultures to foreign investors.

• English Common Law: A legal system familiar to current and former British Colony and Commonwealth countries.

Corporate Name

Labuan corporations must choose unique corporate names not used by other corporations. They are not permitted to use the words or implication they are “Royal” or of government patronage, or any names the Registrar deems unacceptable.

Special licenses are required for certain types of names in Labuan. Corporate name words requiring licensing include: assurance, bank, building society, insurance, reinsurance, investment fund, fund management, trustees, trust, Chamber of Commerce, university, municipal or their foreign language equivalents.

Offshore corporation names can use any language that utilizes the Latin alphabet.

Office Address and Local Agent

In Labuan, corporations are required to have a local registered agent and local office for process service requests and official notices. The corporation’s main address can be located anywhere in the world.

Shareholders

One shareholder is required for incorporation in Labuan.

Directors and Officers

At least one director is required for incorporation in Labuan. Labuan does allow directors to be corporations. Directors do not need to reside in Labuan.

Labuan corporations must have a resident secretary. This secretary must also either be a Trust Officer of a trust company.

Authorized Capital

The required authorized capital is $10,000 USD; divided into 10,000 shares of $1 USD. The minimum issued capital is one share, which may be fully or partly paid.

Taxes

Labuan corporations that trade with the public can either choose between a flat tax of 3%; or a yearly tax of 20,000 Malaysian ringgit [RM] (around $6,600 USD). Even better, unlike in the United States where you have to decide upon a tax election and then be stuck with that choice, Labuan lets corporations pick the best tax choice for themselves yearly.

Annual Fees

Like any other offshore jurisdiction, the government does require you to pay an annual renewal fee of around $750. The government also requires filing an annual report with a statement of accounts.

Public Records

The identities of directors and shareholders of Labuan corporations must be disclosed to the Authorities for internal records, but not identities of beneficial owners.

Accounting and Audit Requirements

Labuan requires corporations keep accounting records. Also, trading companies that decide to pay the flat tax of 3% must hire an auditor and have their financial statements audited yearly. For those deciding to pay the tax of RM 20,000 are not required to file financial statements. However, if the corporation is licensed, then an auditor needs to be appointed. A non-trading corporation is not required to file audited financial statements or appoint an auditor.

Annual General Meeting

An annual general meeting is required.

Time Required for Incorporation

The estimated time required for incorporation is 4 to 8 days.

Shelf Corporations

Shelf corporations are not available in Labuan.

Conclusion

Labuan corporations enjoy many benefits including: only one shareholder is required, opening bank accounts by foreigners is easy, its legal system follows English Common Law, and Labuan is in the heart of Asian and Islamic culture.