Liechtenstein LLC – Limited Liability Company Introduction

A Liechtenstein Limited Liability Company (LLC) can be formed by at least two natural persons and/or legal entities. The legislation governing LLC’s is called the “Law on Persons and Companies of 1926”, known as the “PGR Code”. Foreigners can own all of the shares in a LLC.

Liechtenstein LLC Background

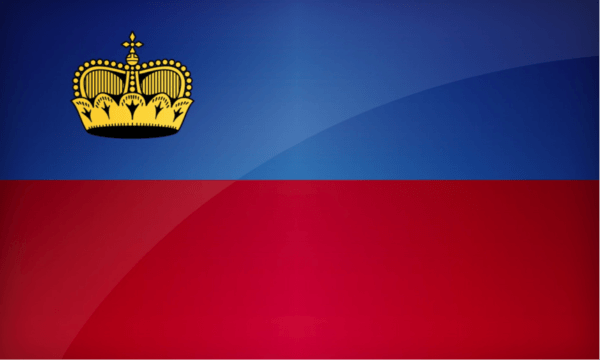

Liechtenstein is a Central European country. Its official name is the “Principality of Liechtenstein”. German is the official language spoken by the majority of its citizens.

Its political system is a unitary parliamentary constitutional monarchy with a Prime Minister and a Legislature. The Monarch is the Prince of Liechtenstein. The Swiss Franc is the official currency and there are no currency controls.

Liechtenstein Limited Liability Company (LLC) Benefits

A Liechtenstein Limited Liability Company (LLC) has these benefits:

- 100% Foreign Ownership: Foreigners can own all of the shares in a LLC.

- Limited Liability: Shareholders are protected from LLC creditors and lawsuits as their only liability is their shares contributions.

- Privacy: Shareholders names are not included in any public records and Bearer Shares can be issued for further privacy.

- Perpetual Life: The LLC can be in existence perpetually.

- Two Shareholders: The minimum number of shareholders is two to form a LLC which is favored by small companies seeking limited liability.

- One Director: The LLC can be managed by only one director or more if the shareholders so choose.

Liechtenstein LLC Name

A limited liability company must select a name different from all other legal entities. A list of Companies in Liechtenstein is available to see if a suggested company name is available. The name must be approved in advance by the Office of Justice, Commercial Register Division.

The company name can be in any language and can use imaginative names. Company names incorporating international or national locations must obtain special permission. Every LLC company name must end with either of these abbreviations: “LLC” or “Ltd.”.

Registration

A Liechtenstein LLC is formed by filing the Articles of Association and a Formation Deed with the Commercial Register.

Duration

The lifetime for a LLC is unlimited.

Limited Liability

Shareholders are only liable up to their contributions to the company.

Shareholders

The LLC can have only two shareholders which is an advantage to small companies seeking limitation of liability. However, large group shareholders are acceptable.

Shares can be issued in different classes and forms including registered, preference, no-par or par value, voting, and bearer shares. All shares must be at par value with the only exception being registered shares which can be issued at below par value.

Shareholders’ voting rights are in accordance to the percentage of the total initial contributions of each shareholder. Typically, one voting right for every 1,000 CHF is acceptable. Shareholders can be represented by a third party or another shareholder. A written Power of Attorney will be required.

Directors

Every LLC must have at least one Director who is elected during the annual Shareholders Meeting. The Director represents and manages the LLC. The Director can be a natural person or a corporation.

Management

The Company Management is the administrative arm for the LLC which can be one or more persons who do not have to be shareholders. The Managers are appointed by the shareholders. At least one of the Company Managers must reside in Liechtenstein. Any appointment can be revoked by the shareholders at any time unless every shareholder is a Manager. Company Managers are authorized to act in the LLC’s name.

Company officers such as a President, Treasurer, and Secretary are not required to be appointed.

Company Management can perform the following duties:

- Acquire, sell, and encumber real estate;

- Appoint an officer for the LLC and issue Power of Attorneys for commercial activities on behalf of the company;

- Open and close branch offices; and

- Form, acquire, and sell other companies and shares in corporations.

Auditors

A LLC must either appoint an auditor or the Articles of Association may assign auditing duties to non-managing shareholders. The auditor must submit audits of annual accounts at the annual General Meetings with appropriate reports. Audited reports must be filed with the tax authorities.

Only standard bookkeeping procedures are acceptable although no set system or method is required for keeping financial and accounting records.

Registered Office and Agent

Unless the Articles of Association state differently, the LLC must maintain its registered office where its main administrative activities occur.

A local professional registered agent must be appointed who can be a natural person or a company.

Nominal Capital

The nominal capital is 30,000 CHF which must be fully paid up when registering.

The minimum share capital amount which can be subscribed to by any one shareholder is 50 CHF.

The company’s share register will contain the shareholder’s name, contribution sum, and every transfer of shares. The pledging or sale of shares requires the written consent of every shareholder. The original shareholder’s rights to the company’s gains and liquidation will not be permitted to transfer to third parties.

The company’s share register remains in the company’s office and is not accessible to the public.

Annual General Meeting

A Shareholders Meeting must formally convene at least once a year. The shareholders are the governing body of the LLC.

Taxes

LLC’s qualifying as Private Wealth Structures (PVS) are subject to taxation at the annual minimum income tax of 1,200 CHF. This minimum tax is normally only granted to PVS companies which are not commercially active. However, commercially active companies are subject to the general corporate tax rate of 12.5%.

There is no capital gains tax or withholding taxes on dividends.

U.S. citizens and taxpayers from countries taxing global income must report all income to their tax agency.

Liquidation

A LLC can initiate the procedures to liquidate the company at any time by resolution at a Shareholders Meeting. Liquidation will be subject to applicable laws and the terms in the Articles of Association. The director will initiate the liquidation process unless another person is appointed at a Shareholders Meeting.

The Commercial Registry will delete the LLC no sooner than six months after the third notice to creditors of the liquidation.

Public Records

All records filed with the Commercial Register are available for public inspection.

Registration Time

It is estimated that registering a LLC can take up to one week for approval.

Shelf Companies

Shelf companies are available for purchase.

Form a Liechtenstein LLC Conclusion

A Liechtenstein Limited Liability Company (LLC) has these benefits: 100% foreign ownership, limited liability, perpetual company life, two shareholders to form the LLC, and only one director.