Form a Luxembourg Corporation Introduction

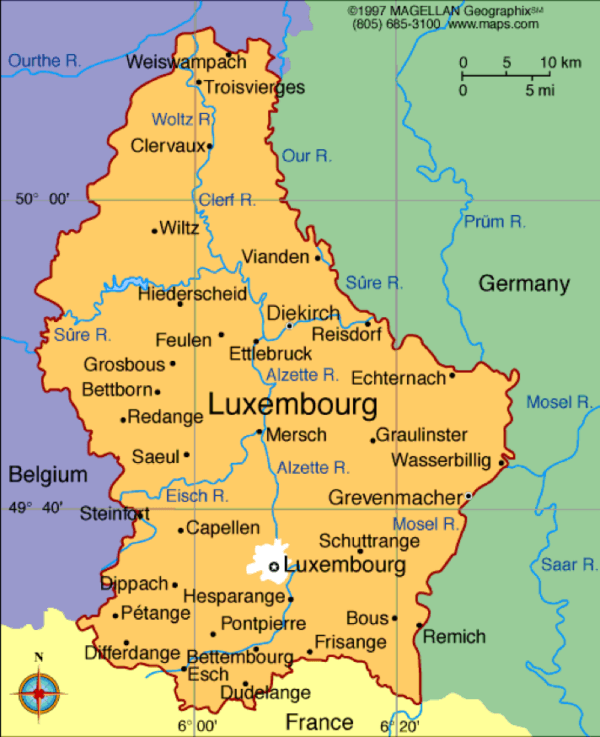

Luxembourg is officially known as the “Grand Duchy of Luxembourg” which is a completely landlocked country located in Western Europe. It is bordered by Germany to its east, Belgium to its west, and France to its south.

Luxembourg corporations are best known for their holding functions rather than being corporations actively engaging in business and commerce. A typical Luxembourg “Holding Company” is a legal corporation in regards to its tax status which is attractive to foreign investors. The Luxembourg SARL is similar to a limited liability company in other regions. The SARL has the legal liability protection of the corporation and the non-transferability of the company shares of a partnership. It can have between two and 100 partners. There is also the one person SARL, called the SARL unipersonnelle.

Cost of Setting up a Company in Luxembourg

The cost of setting up a Luxembourg company / corporation varies depending on the type of company and the capitalization requirements. You can get a better idea by using the number or form on this page to discuss it with a real human.

Benefits

There are many benefits for owning a Luxembourg corporation which include:

- Security: Luxembourg has for many years been looked upon as a very secure political and economic country with a long history of allowing different legal entities to prosper, such as corporations, trusts, and private family wealth entities.

- History as an Investment Center: In spite of being a very small country in terms of land area and population, Luxembourg is the world’s second largest investment funds center managing assets over 2.5 trillion Euros. More than 40% of all incoming and outgoing EU investments go through Luxembourg.

- Territorial Tax: Non-resident Luxembourg corporations are only levied income taxes and corporate taxes on their Luxembourg source income. However, U.S. residents and citizens of countries which levy income taxes on their worldwide income will be subject to their own country’s taxes.

- Bearer Shares: Shareholders are afforded privacy by choosing to obtain share certificates made out to “bearer” rather in one’s name like registered shares.

- Holding Company: Luxembourg corporations choosing to be established as a SOPARFI (French acronym for Society of Participating Financiers) can hold and manage funds and assets while being able to lend and borrow money and collect royalty income. There are several tax benefits for this type of legal entity such as

(a) Income tax exemption from dividends (including upon liquidation);

(b) Capital gains tax exemption on qualifying participations; and

(c) Pay dividends to qualified recipients exempt from withholding tax.

- Family Wealth: Luxembourg corporations can be formed as a Family Wealth Management Company (SPF) where individuals can manage their private wealth preserving assets which can pass onto their heirs. While being exempt from most government taxes, the SPF must pay a yearly subscription tax based on share premiums and share capital at a rate of 0.25%.

- Specialized Investment Fund (SIF): Luxembourg corporations can be formed as a special investment fund where institutional, professional, and savvy investors can invest in a variety of securities including hedge funds, private equity, and real estate. The SIF is only subject to yearly subscription tax based on the value of its net assets at a rate of 0.01%. In addition, VAT (sales tax) will only apply on services and purchases not related to the funds management.

Corporate Name

A newly formed Luxembourg corporation must select a unique corporate name which is not similar to other corporations. The corporate name must also end with the initials “AG” or “SA” to designate the particular type of corporation that it is. Also, the corporation’s name cannot be similar to a corporate shareholder. Once formed the Luxembourg certificate of incorporation will bear the company name.

Office Address and Local Agent

Luxembourg corporations must have both a local office and local registered agent in order to receive process server requests and official notices. The corporation is allowed to have a main address anywhere in the world.

Shareholders

At least one shareholder is required. The shareholder can reside in any country and be a private person or corporate entity.

In Luxembourg, a corporation is permitted to issue registered shares. Corporate shares may be issued with or without voting rights, depending on the company’s discretion. Corporate registered shares must be logged in the corporation’s log book. Registered shares can only be transferred by issuing a transfer statement which is authorized by both the transferor and transferee.

Luxembourg corporations can also issue bearer shares which are usually transferred by delivery of bearer certificates. Whoever is in possession of a bearer share certificate is the owner.

The corporation’s founder can be a private person or legal entity, and names can be kept confidential as long as that individual or entity is represented on paper by a founder in trust.

Directors and Officers

At least one director must be appointed. The director can reside in any country and be a private person or corporate entity.

Minimum Share Capital for a Luxembourg SARL

The minimum required authorized capital in Luxembourg is 31,000 EUR, which must be paid in full in order for the incorporation to occur. In addition, at least 25% of the nominal value of each share must be secured. Until the corporation finalizes its payment of authorized capital, the corporation can only issue registered shares. Once the authorized capital payment is paid, then the company can issue bearer shares.

Luxembourg Company Tax Rate

Luxembourg does not levy corporate or income taxes on non-resident corporations not doing business within its territory.

Annual Fees

The required annual fee for a company in Luxembourg is 6400 CHF, plus the registered agent/office fees.

Public Records

The only corporations entered into the public records are those conducting trade or commerce in Luxembourg.

There is no public disclosure of shareholders. The founder (owner) is publicly represented by nominees appointed as founders in trust.

Accounting and Audit Requirements

Accounting is mandatory for corporations. Records must be kept of the corporation’s finances and business transactions, and maintained so they are always up-to-date.

Annual General Meeting

An annual general meeting is mandatory for corporations.

Time Required for Incorporation

The estimated time required for the incorporation in Luxembourg is one week.

Shelf Corporations

Shelf companies are available in Luxembourg for faster incorporation.

Conclusion

A Luxembourg corporation offers many benefits, especially if foreigners want to use them as holding companies to manage assets and earn passive income for its beneficiaries. In addition, foreigners can establish family wealth entities and specialized investment funds which pay few taxes. Privacy to corporate owners and shareholders are offered by not having their names recorded in public records. In addition, bearer shares provide complete anonymity to shareholders. Nominee owners can be appointed as founders in trust to protect an owner’s privacy.

Luxembourg is a territorial tax country exempting non-resident corporations from corporate and income taxes for conducting business outside its borders.

Luxembourg also offers security with its political and economic structures which makes foreign investors comfortable.