A Madeira SGPS Company is a holding company established as a private limited liability company. Foreigners may own all of the shares in the SGPS. A holding company holds and manages shares in other companies around the world.

In Portuguese the company is known as a “Sociedade Gestora de Participações Sociais” with its abbreviation of “SGPS”.

Foreigners may own all of the shares in a SGPS company.

Background

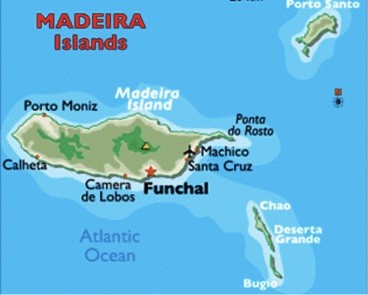

Madeira is an autonomous state of Portugal located in the North Atlantic on the Portuguese archipelago close to the Spanish Canary Islands. It is officially called an “Autonomous Region of Madeira” because it has been an autonomous state under Portuguese administration since 1976.

Its political structure has an elected legislative assembly with a president. Because it is under Portuguese control, it is a member of the European Union.

Benefits

A Madeira SGPS Company offers these types of benefits:

• Full Participation by Foreigners: All of the shares in a SGPS company may be owned by foreigners.

• Tax Exemptions: As a holding company, the SGPS pays no taxes on the dividends it receives. However, U.S. residents and all other subject to taxes on their global income must report all income to their governments.

• One Shareholder: One foreign shareholder may form the SGPS.

• One Director: Only one director is required to manage the SGPS who can be the sole shareholder for complete management control.

• European Union Member: As part of Portugal, Madeira is a member of the European Union (EU) which offers opportunities to engage commercially with other EU members.

• Lower Operating Costs: Foreigners establishing active offices in Madeira will find the costs for operating a company are much lower in Madeira than in other EU countries and jurisdictions. These include lower prices for purchasing and leasing real properties, electricity, telecommunications, and wages paid to local employees.

Madeira SGPS Company Name

The SGPS must select a company name not resembling any other legal entity’s name in Madeira.

Every SGPS must either contain the words “Sociedade Gestora de Participações Sociais” or its abbreviation “SGPS” at the end of its name.

Requirements

In order to qualify and obtain the favorable tax exemptions, the SGPS must only hold shares in other companies and not engage in active business enterprises. The SGPS must hold the shares for at least one year as not to be an “occasional” holding company. In addition, at least 10% of the other companies’ shares with the right to vote must be held either by the SGPS or in conjunction with other companies controlled by the SGPS. There are exceptions allowing the holding of less than 10% of the subsidiary’s shares, however, they are too complicated to explain here.

The SGPS are permitted to provide management services to its subsidiaries under a written contract with compensation.

Holding companies cannot:

• Own real estate except as their offices or for a company in which they hold at least 10% of the share capital.

• Encumber or sell equity interests within one year of acquiring them.

• Provide loans to non-subsidiary companies. They can provide loans to companies in which they hold equity interests or other companies controlled by them.

Formation

The SGPS must first be incorporated either as Private Limited Company (Lda.) or a Shares Company (S.A.). Then it registers as a SGPS Holding Company.

The Private Limited Company (Lda.) may be formed with just one shareholder. Directors are not required. The minimum capital is 1 Euro per shareholder. A minimum of one manager must be appointed who undertakes managing the company.

The Shares Company (S.A.) can be incorporated with only one shareholder with a minimum capital of 50,000 Euro. A Board of Directors must be appointed to manage the company. The company Bylaws determines how many members (shareholders) makes up the Board of Directors. Only one director is required if the share capital is not more than 200,000 Euro.

Taxes

The SGPS source of income is generally dividends paid from the companies in which they hold shares. The following types of dividends are totally exempt from taxation:

1. Dividends received from EU subsidiaries are treated in the same way as a Portuguese SGPS being entitled to a 100% tax reduction resulting in a 0% tax rate;

2. Dividends received from non-EU subsidiaries;

3. Dividends paid to Portuguese non-residents are not subject to withholding tax;

4. Capital gains related to EU subsidiaries are subject to typical Portuguese taxation unless they are re-invested. Capital gains taxes are paid in five equal annual installments;

5. Capital gains related to non-EU subsidiaries are exempt from taxation; and

6. Capital gains related to subsidiaries domiciled as Madeira IBC’s (International Business Center) are exempt from taxation.

Note: U.S. taxpayers must report all world income ot their IRS. Residents of other countries requiring taxation on all global income must report all income to their governments.

Accounting and Audits

SGPS’s must appoint an official certified auditor or auditing company upon incorporation. The auditor will be required to report any inefficiencies to the General Tax Inspectorate.

SGPS’s must provide the General Tax Inspectorate a list of all shares held including financial investments every year prior to June 30. .

General Meetings

Annual general meetings are mandatory for the shareholder which may be held anywhere in the world.

Public Records

Everything filed with the Madeira Registry are public records accessible to the public.

Time for Formation

Formation may take up to one month for preparation of documents and government approval.

Shelf Companies

A shelf SGPS company can be purchases in Madeira for faster formation and registration.

Conclusion

A Madeira SGPS Company provides these benefits: complete ownership by foreigners, the sole foreign shareholder may become the only required director for better control, no taxes, EU membership, and lower operating costs than most EU countries.