Labuan Company Registration Information

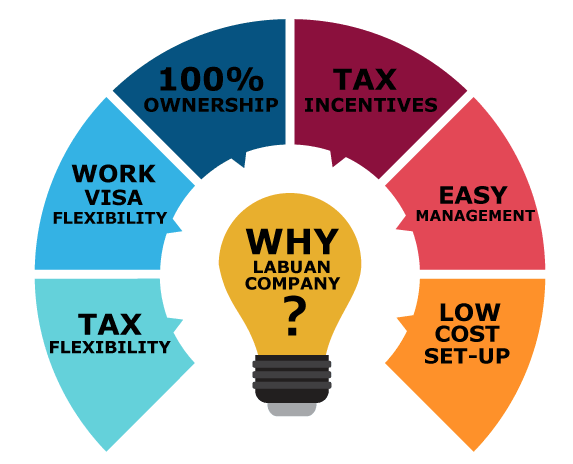

Malaysia has several types of companies and corporations. However, foreigners prefer the Labuan Company. Specifically the formal name is the Labuan International Company. Most foreigners choose this company type because it provides 100% foreign ownership. In addition, it lower taxes more than all of the others.

In 1989, the Malaysian government made Labuan into an International Offshore Finance Center. Then, in 1990, the Offshore Companies Act created its offshore corporate laws. In addition, there are the Offshore Banking Act of 1990 and the Labuan Trust Companies Act of 1990. The Labuan Companies Act of 2010 currently oversees the formation, activities, and taxation of a Labuan International Company. Finally, Labuan Offshore Financial Services Authority (LOFSA) is the sole regulatory agency overseeing these laws.

In the 1980’s, Malaysia wanted to compete against Hong Kong for offshore entity business. While being popular with Asians as a tax haven, it remains under the radar for residents of other countries seeking a tax haven. Non-Malaysian sourced income is tax free. As a result, Air Asia airlines bases its operations in Labuan to avoid paying income taxes. Thus, it allows them to keep their fares low to be competitive with larger airlines. From 2015 to 2017, Labuan offshore legal entities held more than $550 billion USD .

Labuan Background

Labuan is an autonomous federal area of Malaysia, much like an independent state. It is actually a small island off the coast of Borneo, but owned by Malaysia. Its population is only around 85,000.

Malaysia is a member of the British Commonwealth having been a former British Colony until it gained its independence in 1957.

The Malaysian legal system is based on British Common Law. The legislature enacted special laws which created the offshore industry in Labuan. For example, the statutes allos arbitration. Plus, the court hears disputes on camera. Then, if needed, final appeal lies with the Supreme Court.

Labuan Company Formation Benefits

A Malaysia Labuan International Company obtains the following benefits:

- Lower or No Taxes: Offshore non-trading companies do not pay any taxes on income sourced outside of Malaysia. Therefore, no income tax levied on foreigners. Incidentally, the corporate tax rate is only 3% for the other companies. However, U.S. taxpayers and everyone residing in countries who tax worldwide income must declare all income to their tax authority.

- One Shareholder/Director: One can form a company with just one shareholder who can also be its sole director.

- Low Registration Fee: For a very reasonable cost, compared to most jurisdictions, you can form a small company. The price is very reasonable. Please use the phone numbers above or complete the consultation form for more information.

- Confidentiality: The names of directors and shareholders are not part of the public records.

- Low Minimum Capital: The minimum total authorized capital is $10,000 USD.

- International Banks: Over 100 international banks have branches in Labuan. For example, JP Morgan, Bank of America, BNP Paribas, and DBS hold licenses in Labuan and have branches in the region. Unlike many other jurisdictions, foreigners can easily open bank and brokerage accounts.

- Ideal Location: Since Malaysia is a Muslim country in Asia, Labuan offers access to Asian and Middle East markets.

- Asia Monetary Markets: Labuan brokerages have access to every Asian monetary market at a much lower setup costs than Hong Kong or Singapore. Labuan has its stock market called the Labuan Financial Exchange (LFX).

- Corporate Infrastructure: Labuan offers an infrastructure for corporations to set up including a qualified workforce.

- Free Port: Labuan is a free port where no sales tax, import and export duties, surtax, or excise taxes are levied.

- English: While not being its official language, English is widely spoken.

Malaysia Labuan Company Name

Naturally, the company cannot have a name resembling any other company’s name in Malaysia. Its company name can be in any foreign language using the Latin alphabet. The company name must end with one of the following words or abbreviations: “Labuan”, “Limited”, “Co,Ltd”, “Inc.”, “Ltd”, or “LLC”.

Registration of Company

Registration of this offshore company involves submitting to the Registry the following documents: Memorandum and Articles of Association, a consent form from the company director, a Statutory Declaration of Compliance and the required fee.

The Labuan company must register with following four Malaysian government agencies, which is part of our incorporation process:

- Labuan Company Formation Authority

- Malaysia Immigration Department

- Inland Revenue Authority

- Central Bank of Malaysia

Shareholders

Shareholders can be from anywhere in the world.

The statutes permit the following classes of shares: preference shares, registered shares with par value, shares with no voting rights and redeemable shares. The regulations do not permit bearer shares.

Directors and Officers

A minimum of one director is required which can be a natural person or a corporation. Corporate directors can reside in and be citizens from any country. There is no requirement for local directors.

While there is no requirement for a president or a treasurer, the company must appoint a secretary, who can reside anywhere in the world. However, if there is more than one secretary, at least one must be a local resident.

Registered Office and Secretary

All companies must maintain a local registered office address and hire a company secretary.

Authorized Capital

The minimum standard authorized capital is $10,000 USD divided into 10,000 shares whose value is $1 USD per share. The minimum issued capital is one share ($1 USD).

Accounting

The government requires you to file an annual report with a statement of your accounts. All financial records must be kept in Labuan.

Taxes

There are four tax options for a Labuan International Company to choose:

- Investment Holding Company: No taxes paid and no required audits.

- Trading, Exporting and Importing Company: Only a 3% tax on the net profits with a required audit report.

- Trading Company: Instead of the 3% tax on profits, this type of company can choose to pay a lump sum tax of 20,000 RM ($5,000 USD) with no required audit.

- Non-Trading Company: No taxes owed and no required audit for non-trading companies whose sole source of income is from outside of Malaysia.

In comparison, the normal Malaysian Sdn Bhd Company does not have these tax options. An audit is required and corporate tax starts at 19% up to 24% as follows:

- Up to 500,000 RM has a fixed tax rate of 19%; and

- All profits over 500,000 RM pays a fixed tax rate of 24%.

The tax reductions also include foreigners earning fees, salaries, and bonuses in Malaysia. Comparing these taxes as follows:

Malaysian Sdn Bhd Company: the income tax rate is 28% for all foreigners residing in Malaysia.

Labuan International Company: no income tax for all director’s fees and only 14% for all expatriate employee salaries.

However, U.S. taxpayers and everyone residing in countries who tax worldwide income must declare all income to their tax authority.

More Labuan Company Information

Public Records

The names of directors and shareholders are not part of the public records.

Registration Time

Getting a Labuan International Company registered usually only takes one to two days. So, be sure to give us advanced notification so that we can meet your needs. Naturally, we cannot promise an exact timeframe. This is because we need you to send the legally required know-your-client due diligence documents. Plus, we have no control over government filing times. In addition, you will need to account for shipping times.

Labuan Shelf Company

Labuan shelf companies are not permitted. Therefore, if you wish to own a Labuan company you will need to establish a new one.

Conclusion

A Malaysia Labuan International Company obtains the following benefits:

- Low or no taxes

- Only one shareholder and director are required

- Low registration fee

- Confidentiality

- Low minimum capital

- Access to numerous international banks

- Ideal location to Asian and Middle East markets

- Easier access to Asian money markets

- Good corporate infrastructure

- Free port benefits

- Finally, English is widely spoken.