A Micronesia Limited Liability Company provides foreigners with a completely tax free business income (see exemptions below) with limited liability protection in an English speaking jurisdiction. Foreigners may own all of the shares in the company.

The Federated States of Micronesia Code – Corporate Laws of 2009 govern all companies and corporations established in the FSM. Public Law 13-70 – Corporate Registry Act of 2005 governs the registration of companies and corporation in the FSM. The Corporate Registry Regulation Title 37 enacted in 2006 provides the regulations for registering corporations and companies in the FSM.

Background

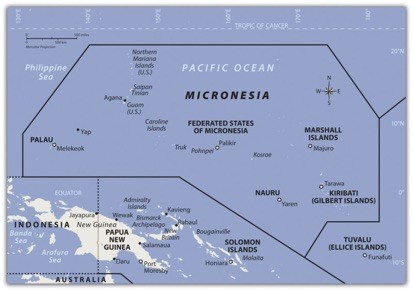

Micronesia is a region located in the Western Pacific Ocean. The region is home to several independent sovereign island countries.

Micronesia often refers to what It is officially known as the “Federated States of Micronesia” (hereinafter “FSM”) which is one of the sovereign countries. FSM consists of nearly 600 islands and islets separated into four states: Yap in the western Caroline Islands; and Kosrae, Pohnpei and Chuuk in the eastern Caroline Islands. Each state elects its own governor and a one house legislature. The federal government consists of an elected one house congress with an elected president. Its political system is described as a “federal parliament republic with a non-partisan democracy”.

The Spanish colonized FSM in the late 19th century. In 1899, they were sold to Germany and ended up under Japanese control after World War I. After WW II, the islands came under the United Nations control. Eventually they became a United States Trust Territory in 1947. In 1986, the U.S. and FSM entered into a “Compact of Free Association”. In 1990, independence was granted by the United Nations.

As a result of the U.S. territorial association, English is the only official language in the FSM.

Benefits

A Micronesia Limited Liability Company offers the following benefits to foreigners:

• 100% Foreign Ownership: Foreigners may own all of the shares.

• Total Tax Exemption: Several ways to obtain total exemption from all taxes exist. Note: U.S. taxpayers must report all world income to their IRS. Everyone subject to global income taxes must report all income to their governments.

• No Minimum Capital: No requirement for a minimum share capital exists.

• Privacy: The shareholders’ names are not part of any public records. Using nominee initial directors and officers protects the privacy of their replacements after incorporation.

• Limited Liability: The shareholders’ liabilities limited to their share capital contributions.

• English: As a former American territory, English is the only official language.

Micronesia Limited Liability Company Name

Company names must never be alike or closely resembling other company names in Micronesia. Name searches and the ability to reserve a company name prior to applying for incorporation are available. A proposed company name may be reserved for up to six months at no charge.

A limited liability company’s name may end with either “Limited”, “Limited Company”, “Corporation”, or “Incorporated” or with the appropriate abbreviation such as “Ltd.”, or “LLC”, or “Corp.”, or “Inc.”.

Incorporation Process

All applications for new companies are made with the Registrar of Companies. The following information must be provided with the application:

• Company name;

• Registered local office address;

• Duration of the company;

• Purposes for the company;

• Powers;

• Capitalization;

• Incorporators’ names;

• Number of officers;

• Number of directors (minimum of three)

• Names of the initial directors and officers;

• Management structure;

• Rules for voting members;

• Rules for shareholders;

• Liquidation provisions;

• Financial surplus dispositions;

• Rules for amending the articles of incorporation; and

• Attach the articles of incorporation and bylaws.

After approval, the Registrar issues a Certificate of Incorporation.

If a business license is required (not required for exclusive offshore business activities) this must be applied from the nearest municipality for after receipt of the Certificate of Incorporation.

Articles of Incorporation and Bylaws

The Articles of Incorporation must include all of the information mentioned above with the application.

The Bylaws provide the rules for governing the corporation.

Both documents must contain notarized signatures of the authorized persons.

Limited Liability

A shareholder’s liability will be limited to his or her contribution to the corporation’s share capital.

Corporate directors and incorporators while normally immune to corporate liability, will be held liable for the debts of the company or corporation if business was conducted without having the required minimum capital. In addition, board of director members will be held liable for knowingly misleading creditors and regulatory officials causing damages or failing to pay debts of the corporation.

Shareholders

No restrictions prevent a citizen of any country residing anywhere in the world from becoming a shareholder.

Directors

A minimum of three directors must be appointed. Directors do not have to be local residents. They can be living anywhere and nationals of any country.

Minimum Share Capital

Limited liability companies are not required to have a minimum share capital.

Taxes

Corporate Tax

The standard corporate income tax rate is 21%. However total exemptions from the corporate income tax exist by satisfying one of these requirements:

• The corporation’s control group equity is less than $10 million USD; or

• The corporation’s equity at the beginning of the fiscal year is less than $1 million USD; or

• The corporation was incorporated in the FSM before January 1, 2005; or

• The corporation’s principal business is a bank in the FSM.

Business Tax

The gross revenue business tax applies to the sale of services and/or tangible personal property. The first $10,000 USD of the annual gross revenue is taxed $80 USD. All revenues above $10,000 USD are taxed at a flat rate of 3%. Businesses only grossing less than $2,000 USD are exempt from this tax.

However, corporations whose gross revenue from business activities are generated outside of the FSM may file for a total exemption because this tax is only imposed on revenues generated within the FSM.

Summary

Corporations registered in the FSM whose equity is less than $1 million USD at the beginning of the fiscal year and all business revenue is generated outside of the FSM pay no corporate or business taxes.

If the corporation’s control group’s equity is less than $10 million USD at the beginning of the fiscal year and no business income is generated within the FSM will be exempt from both the corporate and business taxes.

However, U.S. residents must disclose all global income to the IRS. Anyone subject to worldwide income taxes must report all income to their tax authorities.

Public Records

While the names of the initial directors and officers are filed with the Registrar upon application, nominees may be used who will be replaced after incorporation providing complete privacy for the directors, officers, and shareholders.

Time to Incorporate

Expect the preparation of documents and registration approval to take up to one week.

Conclusion

A Micronesia Limited Liability Company provides foreigners with the following benefits: complete foreign ownership, privacy, limited liability, no minimum share capital, total tax exemptions available, and English is its only official language.