A Montserrat International Business Company (IBC) was designed for foreigners. Their IBC’s offer tax free income and profits, controlled by one shareholder who can be the only director for total foreign control.

In 1985, the Montserrat International Business Companies Act was enacted which mirrored the British Virgin Islands (BVI) IBC law. In order to qualify as an international company, no local residents can be shareholders and no local real estate may be owned. Leases for an office are allowed, but not ownership. However, an IBC may own shares, debts obligations, or securities in another IBC.

The Montserrat Financial Services Commission oversees all companies and their Registrar handles all applications for establishing new companies.

Background

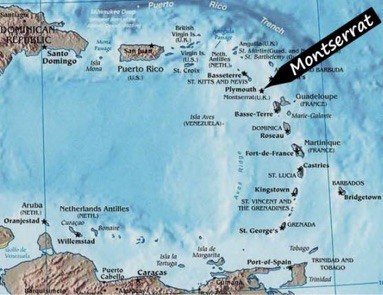

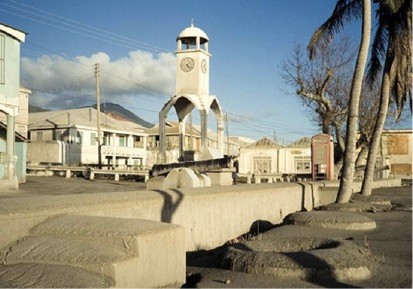

Montserrat is a British West Indies island located in the Caribbean Sea near Puerto Rico. It forms part of the Leeward Islands which are part of a chain of islands known as the Lesser Antilles.

It was discovered by Christopher Columbus in 1493 who named the island “Santa María de Montserra”. The British took control of the island in 1632 where they raised sugar cane and distilled rum.

Montserrat has been a British Overseas Territory (BOT) since 1667 who took control of the island after the Irish settled there in 1632. The United Kingdom provides it with military defense. English is its official language.

Politically, it is described as a parliament dependency with a constitution under a monarchy which is the English Queen Elizabeth II. It has an elected one house parliament with a British governor and a premier.

Montserrat is fast becoming an international finance center offering different forms of offshore companies and other legal entities.

International Business Company (IBC) Benefits

A Montserrat International Business Company (IBC) provides foreigners with these kinds of benefits:

• All Foreign Shareholders: The entire shares in an IBC can be owned by foreigners.

• Tax Exemption: All taxes for the IBC and the shareholders are exempt for the first 25 years. Note: U.S. taxpayers must report total global income to the IRS. Anyone residing in a country which taxes global income must report total income to their governments.

• One Shareholder and One Director: Only one shareholder is required to form the IBC and he or she can be the sole director for total control of the company.

• Low Share Capital: The minimum authorized share capital is $10,000 USD.

• Privacy: The names of the beneficial owners, shareholders, and directors never appear in any public records.

• Bearer Shares: For further privacy, bearer shares are permitted.

• No Reporting: IBC’s do not have to file annual financial statements or returns.

• English: As a British territory for over 385 years, the official language is English.

Montserrat International Business Company (IBC) Name

The IBC must choose a unique name not resembling any other legal entity’s name in Montserrat.

The company name must end with either “Corporation”, “Incorporated”, or International Business Company” or their abbreviations of “Corp.”, Inc.”, or “IBC”.

Registration

A Memorandum and Articles of Association must be filed with the Montserrat Financial Services Commission’s Registrar. The following information is also required:

• Precise nature of the types of business the IBC will engage;

• Countries in which the business will be conducted;

• Names, addresses and occupations of the directors and shareholders;

• Written declaration by the beneficial owners that the IBC will not engage in any criminal activities; and

• Written statement indemnifying the registered agent and office from liability for their acts on behalf of the IBC.

Note: the above information will only be used internally by the Commission and will not be made available to the public.

The only information available to the public concerning the IBC are: IBC’s name, incorporation date, and name of the subscriber (local registered agent).

Shareholder

Only one shareholder who can be living in any country and a foreign national is required to form an IBC.

Bearer shares are allowed but must be held by a legal custodian like a solicitor or a bank. Shares may be issued at no-par value.

Director

Only one director is required to manage the IBC. The director can be of any nationality living anywhere. The sole shareholder may appoint him or herself as the only director to maintain complete control over the IBC.

Minimum Authorized Share Capital

IBC’s must have an initial minimum authorized share capital of $10,000 USD.

Registered Agent and Office

IBC’s must appoint a local registered agent whose office may be the registered office for the IBC.

The registered office typically maintains the books, records and meeting minutes of the IBC. However, the director can keep those records at another location.

Taxes

IBC’s are exempt from all corporate taxes, income taxes, and stamp duty for the first 25 years from formation. Non-resident shareholders are likewise exempt from income tax, dividend tax, and withholding taxes for the first 25 years. This includes all forms of compensation paid by the IBC to the shareholder such as royalties and interest.

There are no taxes of any kind in Montserrat on income sourced outside of the island. Therefore all IBC profits are completely tax free.

But, U.S. residents must pay taxes on all world income and therefore report total income to their IRS. Similarly, everyone subject to taxes on global income must declare all income to their country’s tax authorities.

There is a resident income tax in Montserrat which is on a sliding scale rate reaching 40% for income above 120,000 XCD (currently, this East Caribbean Dollar amount equals $44,444 USD).

Accounting

While IBC’s must meet international accounting standards regarding their record keeping, they are not required to file any audited accounts with the government.

Accounts can be maintained in any foreign currency.

Annual Meetings

At least two shareholders must hold an annual meeting. However, the meeting may be held anywhere in the world.

Since shareholder IBC’s do not have to hold any meetings.

Public Records

All of the documents filed with the Registrar’s office are not available to the public.

Time to Form

Expect the preparation of documents and the registration process and approval to take up to five business days.

Conclusion

A Montserrat International Business Company (IBC) offers these benefits: complete foreign shareholders, no taxes, privacy, low share capital, bearer shares, one shareholder who can be the only director, no reporting, and English as the official language.