A Montserrat Limited Liability Company (LLC) offers foreigners not only a structure which limits the liabilities of its shareholders, but also excludes personal liabilities for its managers regarding debts, obligations, and liability of the entity. Foreigners are allowed to purchase all of the shares (or quotas) in the LLC.

The Montserrat Limited Liability Company Act was enacted in 2000. However, it failed to require any record keeping practices or standards. An amendment in 2002 corrected this error. This Act governs the formation, types of business activities, and dissolution of all LLC’s.

Background

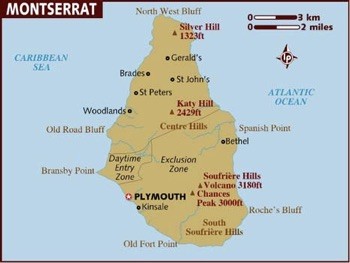

Montserrat is a Caribbean island in the Lesser Antilles. Christopher Columbus discovered the island in 1493. The United Kingdom has controlled the island since 1632. Currently, it is a British Overseas Territory with its official language being English.

Its political structure is defined as a parliamentary dependency under the British Crown. It democratically elects a one house legislature and while being semi-autonomous, it is still subject to the British monarch.

Benefits

A Montserrat Limited Liability Company (LLC) offers foreigners the following benefits:

• Complete Foreign Membership: The LLC’s shares can be owned totally by foreigners.

• No Taxes: LLC’s and their members do not pay any taxes. Note: U.S. taxpayers must report all global income to the IRS like everyone else paying taxes on their global income must disclose all income to their governments.

• One Member: Only one member is required to form the LLC.

• Management: LLC’s have the option for self-management or appointing one natural person as the manager who can be a member.

• Privacy: Only the initial member and manager becomes part of the public records. Privacy exists for subsequent members and managers.

• Limited Liability: Members’ liabilities limited to their share capital contributions. Manager’s personal liability also limited.

• English: Since Montserrat is a British Territory, the official language is English.

Montserrat Limited Liability Company (LLC) Name

Every LLC must select a unique company name which is not similar to other legal entities names in Montserrat.

LLC’s company names must end with the word “Limited”, or words “limited Liability Company” or the suffix “LLC”.

Registration

New companies apply with the Register of Companies. The registration requires the following information:

• Company name;

• Registered office address and name of the registered agent;

• Name of the incorporator; and

• Types of classes of shares and maximum number issued.

In addition, LLC’s must file their Articles of Formation with the Registrar. The application for LLC’s must include this information:

• Company name;

• Purpose for the LLC;

• Duration of the LLC;

• Local registered office address;

• Registered agent’s name and address;

• Members’ names and addresses; and

• Manager’s name and address.

Note: the Act does not require information on the number of members’ shares or the incorporator’s shares or interest in the LLC. The Act does not require subsequent information regarding new members. In addition, beneficial ownership information is not filed with the Registrar, but maintained at the registered office which remains private.

The Register of Companies maintains records of all companies including the above mentioned information. The public can examine these records and filed documents. However, the Registrar does not have to produce any documents which are six years or older from their filing date.

Limited Liability

Members’ liabilities are limited to their contributions towards the company’s capital In addition, LLC managers are also protected from personal liabilities resulting from the LLC’s obligations, debts, and liabilities. This includes protection of liability towards third parties.

Members

Only one member is required to form a LLC. The member may be a citizen of any country and may reside anywhere in the world.

Members may contribute to the LLC with cash, properties, and services. These contributions may be secured with a promissory note to make cash payments, transfer properties, or perform services in the future.

The LLC Agreement dictates how new members join and how existing members may be removed. Unless the LLC Agreement provides otherwise, the Act requires unanimous consent by all members to admit a new member. If there is no unanimous consent, the transfer of interest (assignment) remains valid and must be registered. However, that member (assignee) does not have the right to participate in managing the LLC, but is entitled to share the profits and losses.

Bearer shares are not permitted for LLC’s. Only IBC’s can issue bearer shares.

Management

The Act provides the option to appoint a natural person as the manager. The sole manager may be a member. If that option is not exercised, the Act allow the LLC to self-manage itself where each member votes on all matters proportionally with their percentage in the LLC’s profits.

Registered Office and Registered Agent

Every company must have a local registered office address and appoint a resident registered agent whose office may be the LLC’s registered address.

A register of the members data including their full names and last known address along with the date they became a member or ceased to be one, and the number of shares they hold. This register remains private and is not accessible to the public.

LLC’s must specifically maintain this register for a minimum of five years.

Taxes

As long as the LLC does not conduct business in Montserrat, it will be exempt from all taxes. This includes exemption from the income tax, corporate tax, withholding taxes, and all other taxes based on earned income.

Non-resident members of the LLC also receive exemptions from dividends and other distributions.

However, U.S. residents have to disclose all world income to the Internal Revenue Service. In addition, all others paying taxes on their worldwide income must reveal all income to their tax agencies.

Accounting

LLC’s must file an annual return which includes the names, addresses and number of shares for each member. However, the tax administration does not make this information available to the public.

The annual return must be filed with the Comptroller of Inland Revenue reporting all income generated in Montserrat.

Public Records

Every document filed with the Registrar is open to public inspection in the first 6 years after filing. However, only the initial filing of the names of the members and managers are included in the public records. Subsequent changes in the manager and/or members are not required to be filed with the Registrar. Therefore, the initial application may include one member and no manager which may change at a later time and remain private.

Time for Formation

The preparing of documents and registering may take up to 5 working days.

Conclusion

A Montserrat Limited Liability Company (LLC) has these benefits: complete foreign members, privacy, no taxation, one member who can be the sole manager, English as the official language, and limited liability.