The Nicaragua Limited Liability Company (SCRL) provides foreigners with a totally tax free limited liability protected company. Foreigners may own all of the shares (contributions) in the SCRL.

The Spanish name for the SCRL is “Sociedades Colectivas de Responsabilidad Limitada”. The Nicaraguan Code of Commerce governs the formation, acceptable activities, and dissolution of the SCRL.

Background

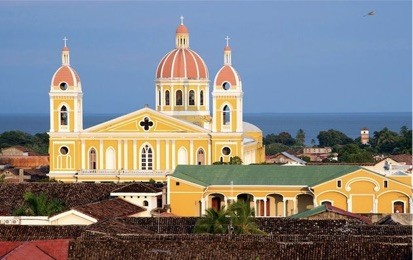

Nicaragua is the largest country in Central America. It borders the Pacific Ocean to the west, the Caribbean Sea to its east, Honduras to its north, and Costa Rica to its south.

Officially called the “Republic of Nicaragua”, its political system can be described as a “constitutional unitary system where the Political Constitution of Nicaragua prevails over all laws. Its president is democratically elected along with the members of its one house National Assembly in a multi-political party system.

Its legal system is based upon civil law along with codes, rules, and regulations created by the president and the legislature.

Benefits

A Nicaragua Limited Liability Company (SCRL) offers foreigners the following benefits:

• Full Foreign Ownership: The law permits all the shares (contributions) in the SCRL to be owned by foreigners.

• Totally Tax Free: As long as all income is earned outside of Nicaragua, no taxes are imposed. Note: U.S. taxpayers must report all global income to their IRS as everyone paying taxes on their worldwide income must report all income to their governments.

• Limited Liability: A participant’s liability is limited to his or her contribution to the SCRL.

• Two Participants: The law requires at least two participants to form the SCRL.

• Self-Management: The law allows the participants to manage the company themselves or they can choose to appoint outsiders as administrators.

• No Minimum Capital: The law does not require any minimum share capital.

• Privacy: The public records do not contain the names of the participants.

Nicaragua Limited Liability Company (SCRL) Name

Every SCRL must choose a company name totally different from all of the registered legal entities in Nicaragua.

The name of the SCRL must contain at least one of the participant’s name. In addition, the words “y compañía limitada” (translates to “and limited company”) at the end of its company name.

Limited Liability

The liability of each participant is limited to the actual contribution made to the company.

Formation and Registration

Formation of the SCRL occurs with the execution of a Public Deed (Articles of Incorporation) signed in front of a Public Notary. The Public Deed is then filed with the government’s Mercantile Registry. In addition, copies are filed with the Municipal Authority nearest to the registered office address and with the national Tax Authority.

Participants

Nicaragua does not like the usage of the words “shares” or “shareholders” regarding their companies and corporation. Instead, they use “partners” who “participate” or are in a “participation” business relationship. The word “contribution” is used in place of “shares” in a corporation.

A minimum of two participants can form a SCRL. Participants may be citizens in any other country and reside anywhere. Natural persons or legal entities may become participants.

Contributions can be made with cash or in-kind consideration which must be verified by an accountant at the current market value.

The rights of the participants in relation to their contributions are not set by law other than the Nicaraguan Code of Commerce providing equal rights for all participants unless the company’s Articles of Incorporation states otherwise. Therefore, the company’s Article of Incorporation and/or Bylaws describe their rights.

Management

The highest authority in the SCRL can be found in the participants’ meeting. The administration of the policies, rules, regulations, and resolutions adopted at the participants’ meetings are handled by the Board of Directors who must be participants.

SCRL’s may appoint administrators who are not participants who act on behalf of the company and as legal representative to outsiders.

The laws do not restrict foreigners from being on the Board of Directors or appointed ad administrators.

Liability of the directors and administrators are limited by the Nicaraguan Code of Commerce. Administrators and directors are not personally or jointly or severally liable for the company’s obligations. However, they can be liable to third parties when they:

• Fail to properly execute the company’s administrative mandates; or

• Breach the laws; or

• Breach the company’s Articles of Incorporation or Bylaws.

Criminal sanctions exist under the Nicaraguan Criminal Code when directors or administrators:

• Participate in decision making or agree to follow decisions which benefit them while harming the company; or

• Consent to breaching the company’s Articles of Incorporation or its Bylaws which harms the company or the public.

Legal Representative

The law requires every legal entity to appoint a legal representative (similar to a registered agent in other countries). The legal representative must either be a:

• Nicaraguan citizen; or a

• Foreign national with legal residency living in Nicaragua.

Minimum Share Capital

The law does not require any minimum authorized share capital in order to form the SCRL.

Currency Control

Law 732 “Organic Law of the Central Bank of Nicaragua” (hereinafter “Law 732”) requires all payments within the country to be made in its official currency the Córdoba (NIO). However, no restrictions prevent legal entities from maintaining local or foreign bank accounts in other currencies. Law 732 allows legal entities to keep their accounting records in foreign currencies. However, once payments are made within the country, the foreign currency must be converted into the NIO at the currently exchange rate.

Taxation

The typical corporate tax rate is 30%, but only applies to income earned in Nicaragua. In addition, municipalities’ levy a 1% of gross income (paid monthly) based on business conducted inside Nicaragua. Therefore, if a company only earns its income from sources outside of Nicaragua, no taxes are due.

However, U.S. residents are required to report all world income to the IRS. Everyone subject to taxation of worldwide income must report all income to their tax authorities.

Tax Incentives

The government has tax incentives for both national and foreign investors who invest in the following sectors:

• Free Zones;

• Exports;

• Foreign Investments;

• Coffee;

• Fishing;

• Energy; and

• Tourism.

Accounting

International standards for properly keeping books and accounting records must be followed.

The following are the required reporting information:

• National Tax Authority –

(i) Monthly tax return for the Value Added Tax (VAT);

(ii) Income tax payment;

(iii) Withholding tax payments; and

(iv) Minimum definitive payment.

• Municipal Authority –

(i) Tax return;

(ii) Municipal tax payment (monthly); and

(iii) Real estate municipal tax (annually).

Note: the tax returns and payments are made to the Municipal Authority and not to the National Tax Authority.

Public Records

The names of the shareholders (participants) do not appear in any public records.

Time for Formation and Registration

Preparing the Public Deed (Articles of Incorporation) and registering with the three above-mentioned government agencies and obtaining approval from the Mercantile Registrar should take up to one month.

Conclusion

A Nicaragua Limited Liability Company (SCRL) provides foreigners with these benefits: complete ownership of the SCRL, privacy, no taxes, two shareholders (participants), self-management, no required share capital, and limited liability.