A Puerto Rico Limited Liability Company (LLC) is governed by the Limited Liability Companies chapter, included in the Corporation Law of 1990, which regulates the formation, operation and dissolution of LLCs in Puerto Rico. It combines the best features of partnerships with corporations to create a separate legal entity providing limited liability to its members. Foreigners are permitted to own 100% of the membership shares.

Background

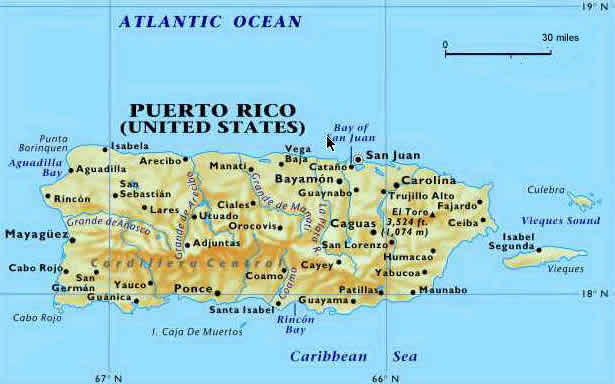

Puerto Rico is a self-governing island U.S. territory with over 3.7 million inhabitants. It is located between the Caribbean Sea and the Atlantic Ocean. Officially it is called the “Commonwealth of Puerto Rico”. Similar to the 50 states of the U.S., Puerto Rico governs its internal affairs. The U.S. federal government maintains jurisdiction over foreign commerce, relations, immigration, customs, citizenship, postal services, currency, and the military. All of the U.S. treaties and federal trade laws apply to Puerto Rico. Its official languages are Spanish and English.

Puerto Rico Limited Liability Company (LLC) Benefits

A Puerto Rico Limited Liability Company (LLC) has the following benefits:

• 100% Foreign Membership: Foreigners can own 100% of a LLC in Puerto Rico.

• Limited Liability: Members’ liabilities are limited to their capital investment.

• One Member: The minimum number of members is one to form a LLC.

• One Manager: A minimum of one manager is required to form a LLC.

• No Minimum Share Capital: There is no required minimum share capital.

• English: As a U.S. Territory, English is the second official language where all documents can be submitted in English.

Puerto Rico LLC Company Name

The LLC must choose a name which will not resemble any other Puerto Rico company name.

At least one corporate designator or its abbreviation must be included at the end of a Puerto Rico LLC name. Either one of these designators, “Compania de Responsabilidad Limitada” or “Limited Liability Company” must be included. Or, one of these abbreviations: “LLC” or “L.L.C.” or “CRL”.

Registration

Registration of a Puerto Rican LLC requires the following to be filed with the Puerto Rican Department of State:

• Filing a Certificate of Formation by an authorized person representing the LLC;

• The Certificate of Formation can be in Spanish or English must include the LLC company name and registered office address, the name of the registered agent and his/her office address, the company’s purpose, length of time for existence, the organizer’s address, and when the LLC will be ready for business and;

• Payment of the current $250 USD filing fee.

Upon filing all required documents with the Secretary of State, it will become a legal entity. Prior to registration, the LLC may operate as a “company in organization” for up to six month with the ability to enter into legally binding contracts.

Limited Liability Company Agreement

The Limited Liability Company Agreement (LLCA) governs the administration and internal affairs of the LLC. The law requires that this document be written. It does not have to be filed or registered, so it remains a private document. But, it is the rules and regulations for the operation of the LLC. It is recommended all members sign the LLCA.

Limited Liability

The LLC is a separate legal entity from its membership. The company is fully liable for all of its contracts, debts and legal obligations & liabilities. Neither the members nor the mangers can be held personally liable for these debts and liabilities. However, the LLCA can make members and managers personally liable under certain conditions and circumstances.

Each member’s liability is limited to his/her company’s contribution.

Perpetual

The LLCA must declare whether the LLC is formed for a specific time period with a date when it ceases to exist or indefinitely (perpetual).

Members

A single member is permitted who can be treated as a domestic corporation for tax purposes or can elect to be treated by the IRS as a partnership.

LLC members can be natural persons and for-profit and nonprofit corporations. Allowing nonprofit corporations to participate in LLC’s encourages joint ventures between individuals and profit earning corporations with tax-exempt nonprofit corporations for charitable and social improvements missions.

Like partnerships, the members can decide how and when profits are distributed amongst its membership. Just like corporations, the members can divide their interests into different classes with differing rights such as voting.

Their “Operating Agreement” also called the Limited Liability Company Agreement (LLCA) has the flexibility to determine all of the above-mentioned options and much more.

Management

The Limited Liability Company Agreement (LLCA) or “Operating Agreement” governs how the LLC will be managed. Just like a corporation’s Articles of Incorporation and Bylaws, this document can specify the company’s purpose, types of business it will engage in, and how the daily operations occur. The Puerto Rico government looks at the LLCA as a legally binding contract between all members governing the management and internal matters of the LLC. This document has great flexibility regarding all operational matters of the company. It can be amended and modified by its members at any time.

Accounting

Annual reports are not required to be filed with the Department of State. However, every LLC must pay an annual fee of $100 USD by April 15th.

The LLCA can specify what accounting systems and bookkeeping records may be maintained.

Registered Office and Agent

LLC’s must have a registered office (physical address and a mailing address) with a registered agent in Puerto Rico.

Minimum Share Capital

The law allows the LLCA to provide its members with the freedom to customize their capital contributions and their percentage of shares of profits and losses. In essence, the law allows members to tailor their income and risks of loss. Thus, there is no minimum share capital requirement.

Annual General Meeting

An annual Members’ Meeting is required under the law. However, this meeting will be conducted in a manner as stated in the LLCA which has discretion and flexibility regarding member’s rights and duties.

Taxes

Puerto Rico’s Internal Revenue Code of 2011 provides that LLC’s will be subject to the same taxes as a corporation. However, the LLC may elect to be treated as a partnership for income tax purposes. Therefore, similar to partnerships, the LLC has a pass through income tax system for profits to be distributed directly to its members according to their percentage of ownership. The same goes for losses which are passed through to their members. So, there are no corporate taxes.

The LLC can apply for IRS recognition for tax exemption pursuant to Section 501(c) (3) of the Internal Revenue Code as a non-profit LLC as long as all of the requirements to meet such tax treatment are met.

An Employee Identification Number (EIN) for the employees and multiple members is required for tax purposes.

Currently, the corporate tax rate is 20% plus a surtax added on starting at 5% for income of $25,000 up to 19% for income over $275,000.

Currently, the income tax for individuals starts at 7% for income over $9,000 up to 33% for income over $81,500.

Public Records

All records filed with the Secretary of State are available for public inspection.

Registration Time

Registering a Puerto Rico LLC can take up to one week for approval.

Shelf Companies

Shelf companies are available for purchase in Puerto Rico for quicker registration.

Conclusion

A Puerto Rico Limited Liability Company (LLC) has these benefits: 100% foreign ownership, limited liability, one member, one manager, no required minimum share capital, and English is the official second language.