A Seychelles Foundation can be a family or a private foundation. The Seychelles Foundation Act of 2009 governs the different types of foundations. Foreigners can form and control their foundations.

A Seychelles foundation provides many of the benefits found in other countries like Panama, but provides increased rights like the ability of the Founder to assign his/her rights. Flexibility of types and usages of foundations makes the Seychelles an ideal jurisdiction to form specialized foundations like charitable, private interests, family, asset protection, and specific purposes.

As a separate legal entity, assets transferred to the foundation becomes the exclusive property of the foundation. This releases the founder from any implied ownership of his/her former assets. In a similar manner, the beneficiaries are not considered owners of the assets or the foundation. In addition, the beneficiaries do not have any legal or beneficial rights to the foundation’s assets or any control of the foundation.

Background

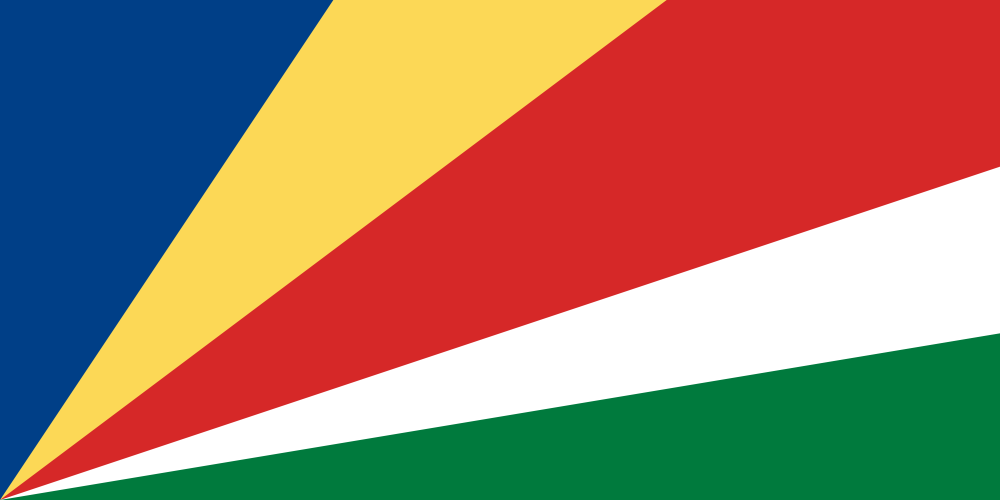

The Republic of Seychelles is a country consisting of 115 islands in the Indian Ocean near Madagascar. It gained independence from the United Kingdom in 1976. Its political structure is described as a unitary presidential republic with an elected national assembly and a president.

Seychelles Foundation Benefits

A Seychelles Foundation has the following benefits:

• Foreign Ownership: Foreigners can form foundations and maintain total control.

• No Taxation: Seychelles does not impose any taxes on foundations. Note, U.S. taxpayers and those from countries taxing global income must reveal all income to their tax authorities.

• Asset Protection: Foundations are separate legal entities owning all of the assets which shields the Founder and the Beneficiaries from the assets.

• Estate Planning: Since the foundation owns all the assets and is directed to distribute them to the Founder’s heirs and to their heirs, this is the perfect estate planning tool. Expensive and timely Probate can be avoided.

• Privacy: The names of the Founder, Beneficiaries, Council members, and Protector can be left out of the public records.

• Flexibility: There are many types and purposes of foundations available.

• Low Registration Fee: Currently, it only costs $200 USD to register a foundation.

• Low Minimum Capital: There minimum capital requirement for foundations is $1 USD.

• Fast Formation: The foundation can be formed and registered in one to three days.

• English: As a former United Kingdom territory, the official language is English.

Seychelles Foundation Name

A foundation’s name must not be the same or resemble any other legal entity in the Seychelles. The name must include the word “Foundation”.

Asset Protection

The Seychelles Foundation Act of 2009 provides strong asset protection for its foundations.

A Seychelles Foundation is a separate legal entity owning all assets transferred to it from the Founder. Neither the Founder nor the Beneficiaries own any of the assets. This insulates all assets from the previous owner(s).

The Founder’s creditors cannot seize any of the foundation’s assets. Any claims brought by creditors must be filed within two years from the date the assets were transferred to the foundation. Only a Seychelles court can order the seizure of foundation assets.

Estate Planning

The Founder can designate when the foundation’s assets can be passed from his/her heirs and the next generation of heirs and onwards. There is no need for a testamentary will or leaving behind a personal estate. Seychelles laws specify that other countries laws forcing heirship do not apply.

Privacy

The following are ways to achieve privacy with foundations:

• The Foundation Charter can be signed by a nominee Founder. As the only documents filed with the Registrar, only the nominee Founder’s name will appear in the public records.

• The Foundation’s Regulations do not have to be filed with the Registrar or any government agency. This document may contain the names of the Founder, Council Members, Protector, and Beneficiaries whose names are not required to be filed with the government.

Foundation Charter

The Charter can be written in English or French or another language (if filed with a translation). This is a publicly filed document which contains the Founder’s name, purpose, and objects of the foundation. However, a nominee Founder’s name may replace the original Founder in the Charter for privacy.

Foundation Regulations

The Foundation’s Regulations are also known as its Bylaws. This is an optional private document which does not have to be filed in any public records. Normally, the Regulations provide the designation and identity of the council members, beneficiaries, distribution of the assets, beneficiary entitlements, etc.

Registration

The licensed International Foundation Services Provider will file the foundation’s Charter and its Regulations (as an option) with the Seychelles Financial Services Authority (FSA) which registers the documents and issues a certificate verifying the official incorporation.

The current registration fee is $200 USD and the same for annual renewals to be paid on the anniversary date of the foundation’s registration.

Foundation Founder

This is the person who creates the foundation and contributes assets to it. The founder can retain power over the foundation after its formation. Such powers may include the right to direct foundation investments, or to remove and replace beneficiaries. Similar powers over a trust could lead to legal challenges. However, because a foundation is a separate legal entity the amount of control exerted by its founder can withstand legal challenges as a “sham” where a trust might not.

The following are the rights pertaining to a founder:

• Founders may be natural persons or legal entities (trusts, corporations, companies, another foundation, etc.) and may be a “nominee” (often used for privacy because the Charter is filed with the public records and names the founder).

• May consist of two or more co-founders.

• Can reserve certain rights for him/herself or another individual in the Charter or Regulations. Such rights can include appointing or removing Beneficiaries, Council members, and Protectors. In addition, the Founder may reserve the right for directing investments, dissolving the foundation, etc.

• Can assign his or her rights to a third party with full powers assigned.

• Can be a beneficiary, but not the only beneficiary.

Foundation Council

Seychelles foundations are managed by the Foundation Council which is typically a licensed Seychelles International Foundation Services Provider. Appointing such a provider ensures professional, experienced administration and control and avoids “tax residency” challenges.

Here are some of the powers that a Foundation Council possess:

• A minimum of one council member is required.

• Members can be individuals or legal entities.

• Manages the foundation’s affairs and business.

• Founder can be a council member, but not the sole member.

• The Charter or the Regulations can name the council members. Because the Regulations do not have to be publicly filed, this is a good way to protect the privacy of the council members.

Foundation Protector

A viable option for Seychelles foundations is to appoint a “Protector” who oversees all of the foundation’s activities and can remove council members and beneficiaries and replace them.

The Charter or the Regulations can name the appointment of a specific Protector. The Founder, council member, or a beneficiary may be appointed as the Protector. However, a sole beneficiary or a sole council membership cannot be appointed as the Protector.

Assets

The following are the types of assets and rules regarding them:

• The foundation must have a minimum of $1 USD as its initial assets.

• Origin of the assets may be from any country and lawful sources including future assets of any nature.

• The types of assets may include: corporate shares, real properties, securities, commodities, mutual funds, vehicles, vessels, bank accounts, brokerage accounts, or any interests or entitlements as a beneficiary in another foundation.

Registered Agent

The International Corporate Services Provider Act of 2003 requires the appointment by every foundation of a licensed International Foundation Services Provider as the registered agent.

Minimum Capital

The total value of the foundation’s assets must only be $1 USD at the time of registration.

Registered Office

Foundations must maintain a registered office address in the Seychelles which may be the address of an appointed registered agent.

Annual Meeting

Annual meetings are not required.

Accounting

The foundation must maintain internationally acceptable accounting practices account books and records showing the true financial position. This includes records showing funds received, expenditures, and distribution. The books and records will be maintained and stored at the registered office or another location if the council members decree. The registered agent will always be informed where the books and records are being kept.

There are no required audits. No annual returns need to be filed. No annual accounts need to be filed.

Taxes

The Seychelles does not impose any taxes on their foundations. No income taxes, no capital gains taxes, no corporate taxes, no withholding taxes on any distributions, no stamp duties, no inheritance tax, no gift tax, and no estate taxes for its foundations.

Public Records

The foundation’s Charter must be filed with the Registrar which will contain the Founder’s name. Sine this is the only document with the Founder’s name filed in the public records, may foundations use a nominee Founder’s name in the Charter for privacy of the original Founder. The names of the Beneficiaries, Protector, and Council members do not have to be filed in any public records.

Time for Establishment

Expect for the formation and registration of a foundation to take from one to three business days.

Shelf Foundations

Shelf foundations are not available for purchase as they are unique.

Conclusion

A Seychelles Foundation has the following benefits: foreign ownership and control, flexibility with types of foundations, no taxes, asset protection, estate planning, privacy, low minimum capital, low registration fee, fast formation, and English is the official language.