A St. Lucia Limited Liability Company (LCC) is actually called a Private Limited Company. There are two types of limitations: limited by shares and limited by guarantee. The most popular is the limited by shares because making guarantees can lead to higher liabilities which defeats the purpose of limiting one’s liabilities.

The Companies Act of 1996 (hereafter the “Act”) governs private limited companies in Saint Lucia (St. Lucia). How they form, what activities are legal, how liabilities are limited, taxation, and dissolution are contained in the Act.

Foreigners are welcome to form LLC’s and to own all their shares as long as no commerce or trade is conducted inside the island.

Background

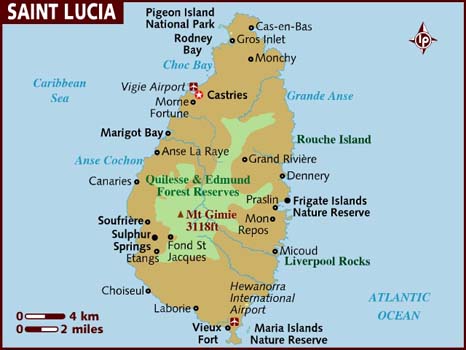

Saint Lucia is a Caribbean island nation with French and British influences as they fought many wars over control of the island. The British prevailed after 150 years of fighting in 1814 and ruled until independence was granted in 1979.

St. Lucia maintained ties with the United Kingdom since its independence with the UK’s Queen Elizabeth II as its official monarch. Politically, it has a democratic two house parliament with a prime minister.

Its judiciary follows English Common Law yet its civil code is based upon French law. This is why English is its official language while French is spoken by many of its residents.

S Benefits

A St. Lucia Limited Liability Company (LCC) enjoys the following benefits:

• 100% Foreign Shareholders: Foreigners may own all the shares in a LLC.

• Tax Exempt: All income earned outside the island is tax exempt. However, U.S. residents and others residing in countries taxing global income must disclose all income to their governments.

• Limited Liability: Shareholders’ liabilities limited to unpaid amount for their shares.

• Privacy: The names of the shareholders and directors are not included in any public records.

• No Minimum Capital: There is no requirement for a minimum authorized capital.

• No Audits: Audits are not required and there are no accounting or financial statements filed with the government.

• English: As a former British territory, English is its official language.

St. Lucia Limited Liability Company (LLC) Name

LLC’s must select a unique company name not similar or resembling any other St. Lucia legal entity’s name.

LLC’s company name must end with either the word “Limited” or its abbreviation of “Ltd.”.

Limited Liability

The liability of its shareholders is limited to the amount not paid for their shares. If a shareholder failed to pay 100% of the value of his or shares in the company and the LLC is sued in a court of law which renders a judgment which the LLC cannot pay because it lack the funds to pay it, the shareholder must pay what is still owed for his or her shares to the plaintiff. Or, when the LLC winds up with liabilities unpaid due to the lack of sufficient assets, the shareholder’s amount still owing for his or her shares must be paid towards the unpaid liabilities.

Registration

An Articles of Association and a Memorandum are filed with the Registrar of Companies. Upon approval, the Registrar issues a Certificate of Incorporation.

Articles of Association

This legal document dictates how the LLC will operate, managed, how profits are distributed, and how it dissolves. The articles may allow the LLC to engage in a wide variety of business activities or limit them.

Shareholders

Some jurisdiction require the LLC to have members and not shareholders. St. Lucia allows shares to be sold in private (not to the general public) instead of membership quotas.

A minimum of two shareholders is required to form a private limited company who can be natural persons or corporate bodies. A natural person can be a citizen of any country and residing anywhere outside of St. Lucia. A corporate body can be registered in any country.

A private company limited by shares can only have a maximum of 50 shareholders.

Its shares are only available for private sales and are not for sale to the general public. In addition, debentures cannot be sold to the public.

Bearer shares are not allowed. LLC’s can issue different types of shares such as: shares with par without par value, redeemable shares, fractional shares, registered shares, and voting shares.

The registered agent must keep records of the names and addresses of the shareholders. However, those records are not available to the public.

Directors

The LLC is required to appoint a minimum of two directors who can be natural persons or corporate bodies. Like its shareholders, a director can be a citizen of any country and reside anywhere. Similarly, a corporate body can be registered in any country.

If only two directors are appointed, the Articles of Association should describe how tie votes can be resolved.

While the names and addresses of the directors are maintained in a register by the registered agent, they are not available for public inspection.

Business Activities

LLC’s can engage in many types of business depending upon any restrictions found in the Articles of Association. No business can be conducted within St. Lucia or any income derived from St. Lucia if the LLC wishes to be exempt from taxes.

Registered Agent and Office

LLC’s must appoint a local registered agent to accept legal notices and process of service. A local office address must be maintained as the official registered office. The registered agent typically provides his or her office address for the LLC.

Minimum Authorized Capital

No minimum authorized capital is required. In addition. There is no requirement for a paid up share capital.

Accounting

Unless the LLC elects to pay a corporate tax, there are no requirements for filing accounting records or statements or conducting audits.

No minimum standard accounting procedures are required by the government.

Taxation

LLC’s have an option to choose between complete tax exemption and paying a 1% corporate (income) tax. Members of the CARICOM Double Tax Agreement countries often choose the 1% taxation option because it prevents paying a higher tax rate their resident country may impose who is a member of the CARICOM.

In addition, there is no capital gains tax or stamp duty.

General Meetings

Shareholders are required to conduct an annual general meeting which can be held in another country.

Public Records

The names of the directors and shareholders are withheld from all public records.

Incorporation Time

LLC formation and registration may take from two to three working days. Keep in mind this does not include shipping time nor the time it takes for you to provide the legally required due diligence (know-your-client) documents.

Shelf Companies

St. Lucia offers shelf companies to speed up the formation process.

Conclusion

A St. Lucia Limited Liability Company (LCC) can utilize the following benefits: foreigners owning all shares, limited liability, privacy, no taxes, no audits, no minimum capital, and English is the official language.