A St. Vincent IBC / International Business Company is regulated by The International Business Companies Act of 2007 (Act). This is a separate law from the St. Vincent Company Act of 1996 where typical corporations and Limited Liability Companies (LLC) are formed. In addition, New International Business Companies Regulations were enacted in 2008.

Background

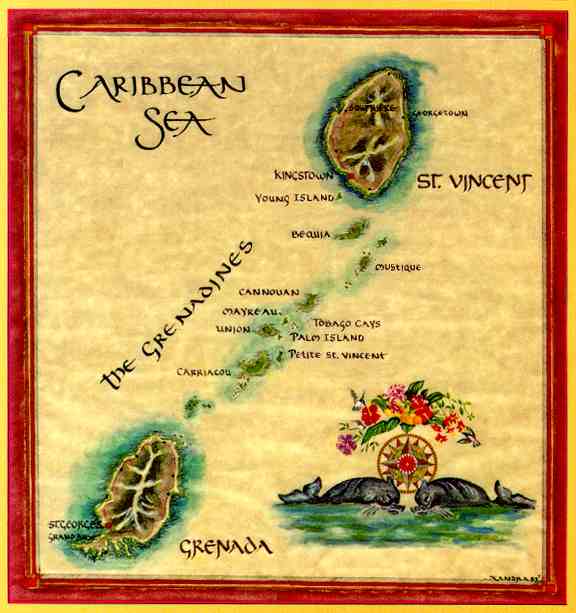

The State of Saint Vincent and the Grenadines (SVG) are a group of islands located in the Caribbean near Barbados Island and Grenada Island. The SVG were a British Territory from 1783 before gaining its independence in 1979. However, SVG remains a member of the British Commonwealth with England’s Queen Elizabeth II as its official Head of State. Their political system is described as an independent parliamentary democracy with an elected parliament and a prime minister. Its official language is English.

St. Vincent IBC Benefits

A St. Vincent IBC / International Business Company obtains these benefits:

• Total Foreign Ownership: Foreigners can create IBC’s and own all the shares.

• Privacy: No public records exist containing the names of beneficial owners, shareholders, directors, or officers. Bearer shares can be issued providing further privacy.

• Limited Liability: IBC’s have the option to incorporate as a LLC limiting their shareholders’ liabilities to their contributions to the share capital.

• No Taxation: IBC’s pay no taxes of any type. Note: U.S. taxpayers and everyone subject to global taxation must disclose all income to their governments.

• Fast Incorporation: IBC’s can be incorporated within two days.

• One Shareholder: Only one shareholder is required.

• One Director: A minimum of one director is required who can be the sole shareholder for grater control.

• No Minimum Capital: There is no requirement for a minimum share capital.

• English: After 200 years of British control, its official language is English.

St. Vincent International Business Company (IBC) Name

An IBC cannot select the same name or very similar to any other SVG legal entity.

Company names can be in any language utilizing the Latin alphabet as long as the name is translated into English at the time of registration with the Registrar of Companies.

The following names requires a license to operate or prior consent: banks. Savings and loans, building societies, assurance, insurance, re-insurance, management of funds, trustee services, trust, university, college, and any government agency.

IBC’s incorporated as a Limited Liability Company (LLC) must include the following words or their abbreviations in its company name: “Limited”, “Ltd”, “Sociedad Anónima” or “S.A.”.

Trading Restrictions

An IBC cannot conduct trade or other commercial activities in the SVG. An IBC cannot undertake insurance or banking activities. IBC’s cannot solicit money from the public or offer to sell company shares to the public.

Incorporation

Prospective new IBC’s must register with the Registrar of Companies.

File the Articles of Incorporation, Bylaws (if any), naming the initial directors and secretary (if any). Provide the local registered office address and name of the registered agent. File the previously obtained company name approval certificate. Provide information regarding the amount of initial authorized capital and describe the types of issued shares. File the registered agent’s certificate of compliance confirming all of the Act’s requirements are complied with.

Registration can be completed within two business days. Then the Registrar can issue two types of Incorporation Certificates: one with the director’s name or another without for privacy.

The government does not require the disclosure of the names of the beneficial owners of an IBC, nor their shareholders, directors, or officers.

Limited Liability

IBC’s can choose to be a Limited Liability Company (LLC). This limits their shareholders’ liabilities to their contributions to the share capital.

Shareholders

Only one shareholder is required.

The shareholders can be residents of and citizens of any country. They may also be natural persons or legal entities.

Shares can be issued as: shares of no par value, registered shares, redeemable shares, and shares having voting rights or no voting rights.

Bearer shares are permitted under the Act. However, the registered agent must maintain a register and take custody of the bearer share certificates. None of this information will be filed with the government or made accessible to the public.

Director

Only one director is required. Directors can be citizens of and reside in any country. Directors can either be natural persons or legal entities (which do not have to be incorporated or registered in the SVG).

The sole shareholder can become the only director for more control.

Secretary

IBC’s have the option to appoint a company secretary, but are not required to do so. Company secretaries can be nationals of and reside in any country. A company secretary may either be a natural person or a corporation (which does not have to be incorporated in or registered in the SVG).

Minimum Share Capital

There are no requirements for a minimum authorized share capital. However, issued shares must have a minimum capital of one share of par value or no par value which can be in any foreign currency.

Registered Agent and Office

IBC’s must appoint a local registered agent and maintain a local registered office address.

Taxes

IBC’s are exempt from all taxes (corporate, income, capital gains, etc.) for the first 25 years.

Note: United States citizens and residents are subject to worldwide taxation as others from countries taxing global income must disclose all income to their government tax agencies.

Accounting

IBC’s must maintain financial records accurately reflecting the IBC’s current financial position. However, there are no filing requirements of financial statements or accounting records with the government and no required audits.

Public Records

The Registrar does not have any records pertaining to beneficial owners, shareholders, directors, or officers of an IBC.

Incorporation Time

IBC’s can expect incorporation to be completed between one to two business days.

Shelf Companies

Shelf companies are available to purchase in SVG for faster incorporation.

Conclusion

A St. Vincent International Business Company (IBC) can take advantage of these benefits: 100% foreign ownership, privacy, no taxes, limited liability option, one shareholder who can be the sole director for more control, no minimum share capital, fast incorporation, official language is English.