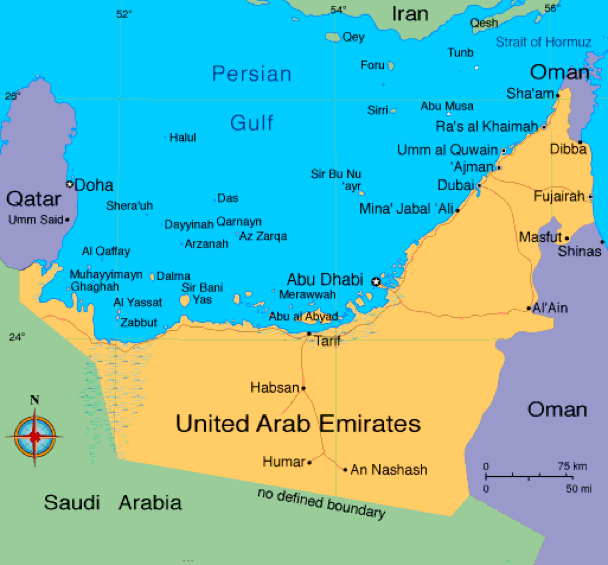

UAE company and Dubai Free Trade Zone company registration are becoming increasingly popular. The United Arab Emirates (UAE) is a prosperous region with ready access to Middle East oil rich markets. Dubai is a city within the UAE that offers special incentives to foreign investors. Filing a civil company under UAE law and the types of companies in the UAE are discussed here. The categories under UAE commercial companies law include businesses that that must have a local citizen as an owner and ones that can be 100% foreign owned. A popular co-venture choice is the UAE LLC.

UAE Company Benefits

Forming a company in the UAE offers multiple benefits. These benefits include:

- There is not a capital gains tax in the UAE.

- English is widely spoken in the UAE, making investment opportunities easier for many foreign investors.

- Owners who have incorporated in the UAE only need to pay income tax if they are in the foreign banking or oil and gas industry. Otherwise, corporations are exempt from taxation in the UAE.

- The paid-in minimum capital requirement for owners choosing to incorporate in the UAE is AED 0. So, there is not a capitalization requirement.

- There is no value-added tax or sales tax in the UAE.

- The UAE houses a diverse, growing economy that continues to expand and offer new business opportunities for corporations.

- The UAE offers a close access point to other Gulf countries, and can work as an entry point to other Gulf Cooperation Council (GCC) countries.

- The market in the UAE offers the opportunity to re-export goods into other countries.

- The World Bank’s “Ease of Doing Business” Report ranked the UAE 31st in the world, and first in the Middle East and North Africa.

- The incorporation process in the UAE is relatively easy and efficient, typically taking 8-20 days.

- The UAE’s market offers a strong opportunity to foreign investors because of its strategic geographical location, since Dubai is a local hub of business for the Middle East and North Africa.

- The UAE is the UK’s biggest export market.

- The UAE offers a large population of skilled labor that would provide an excellent potential workforce for any company choosing to incorporate here.

- The UAE is one of the most liberal trade regimes in the Gulf attracting capital from across the region.

- The UAE’s gas and oil reserves rank it as tenth largest on the globe.

- The UAE offers a strong, stable infrastructure to foreign investors.

- There is a strong banking system and a stable political system present in the UAE

- The UAE offers a number of free trade zones that can allow 100% foreign ownership and a nil taxation regime.

UAE Company Legislation

The UAE’s legal system follows both civil code and the Islamic Shari’a Law. The sources of law for civil matters include federal laws and regulations, the Constitution, Emirate laws and regulations, and Islamic Shari’a.

Corporate legislation in the UAE follows the UAE Commercial Agencies Law (Federal Law No.18 of 1981) This law oversees the appointment of registered distributors, commercial agents and sales representatives. The definition of a commercial agency is “any arrangement whereby a foreign company is represented by an agent to distribute, sell, offer or provide goods or services within the UAE for a commission or profit.”

Dubai Free Zone Company Registration

Dubai is a city in the United Arab Emirates. It has designated areas in the city that offer tax and business incentives, especially to foreign investors.

Dubai Free Zone benefits include the following.

• A foreigner can have 100% Ownership

• It can be formed by only one individual

• You can use it to open bank account in Dubai

• Privacy of ownership is maintained

• There is 0% Tax in Dubai or UAE on such a company

• Reasonable set up and renewal costs.

• Can be liquidated at anytime

• Can conduct international business

• It can do perform multiple business activities

• It can own real estate

Corporate Name

Prospective limited company owners incorporating in the UAE must pick a unique name that is not similar to previously existing corporation names. Typically, three versions of the business name are submitted with the hope that one of them will be approved.

Registering a company name requires a company to get preliminary approvals from the Licensing Section of the Dubai Department of Economic Development (DED) on the company’s activities, trade name, and various partner identities. Once this is completed, your agent can check the availability of the name, reserve the name, and even make payment to reserve the name.

Office Address and Local Agent

People who are looking to incorporate in the UAE must have both a local registered agent and a local office address. This address will be used for process service requests. This will be provided for your by the agent who files the company for you (such as this one).

Shareholders

Businesspeople incorporating in the UAE must have at least one shareholder.

Directors and Officers

Those incorporating in the UAE must have at least two officers, one executive director and one secretary. They can have a maximum of fifty members. One of the two main members must be a foreign partner, and that individual’s power should be outlined in the Memorandum and Articles of Association.

Authorized Capital

The minimum capital requirements vary from Emirate to Emirate (e.g. Dubai is AED 300,000, whereas Abu Dhabi requires AED150,000).

Taxes

Those incorporating in the UAE only need to pay income tax if their industry is foreign banking, or oil and gas. Otherwise, corporations are exempt from taxes. Also, there is no capital gains tax.

Direct personal taxation does not exist in the UAE. However, most Emirates do levy municipal taxes, or taxes through various fees.

Annual Fees

Business owners incorporating in the UAE can expect to pay yearly fees of AED 2,000 as of this writing in addition to reasonable registered agent address and local director fees, if required.

Public Records

Company owners who have formed corporations in the UAE are able to use nominee directors and shareholders for increased privacy.

Annual financial and taxation statements are filed with the Securities and Commodities Authority and published on their website.

Accounting and Audit Requirements

Auditors must be appointed if a company is joint stock or limited liability. UAE corporate entities all must file their audited financial statements with the Ministry of Economy, and have their trade licenses renewed.

The UAE does not allow for any exceptions as far as the appointment of auditors is concerned, nor are there restrictions for most businesses. However, certain companies, especially banks, need to be audited by one of the Big Four accounting forms.

Corporations must prepare accounts once a year, and banks must prepare their accounts and follow the requirements of the Central Bank of the UAE.

All publicly traded companies must file both quarterly reviewed and audited financial statements in English and Arabic with the Securities and Commodities Authority, which publishes these annual statements on its website.

Annual General Meeting

An annual general meeting is required of UAE corporations, but these meetings do not need to be held in the UAE. Meetings for UAE corporations can be held anywhere in the world.

Time Required for Incorporation

Company owners choosing to incorporate in the UAE can expect the entire process to take about 8-20 days, or so. This completion time depends on the turnaround time with the government registry office.

Shelf Companies

This organization has UAE shelf companies (pre-filed, aged corporations) to receive your company faster.