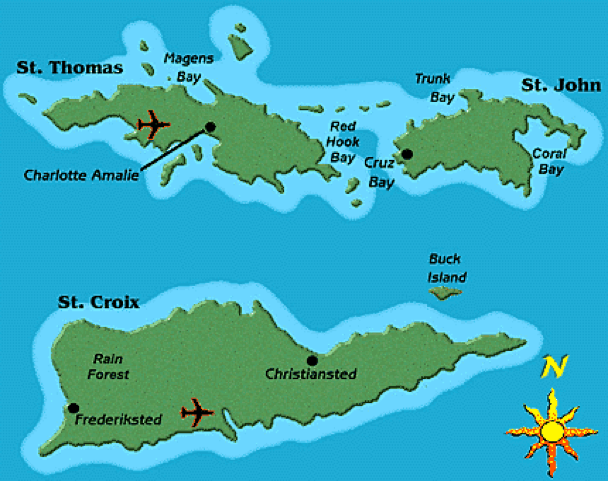

Company formation in the US Virgin Islands (USVI) can give rise to multiple tax and business benefits. USVI is a United States territory. There are tremendous financial incentives allowed by the US government in the USVI, including a tax reduction of up to 90%. For a corporation or LLC US Virgin Islands registered agent is required, which is provided here as well as a certificate of good standing and USVI Secretary of State support.

US Virgin Island Corporation Benefits

Forming a corporation in the US Virgin Islands (USVI) provides many benefits. Some of these benefits include the following:

- The US Virgin Islands offers company owners many tax incentives. Some corporations can receive a tax reduction of up to 90% on personal and corporate income taxes, and an exemption of up to 100% on excise, business property, and gross receipt taxes.

- The minimum authorized capital for corporations in the US Virgin Islands is quite low.

- Only one shareholder, and a total of two individuals, is required to incorporate a company in the US Virgin Islands.

- Meetings of managers and members in the U.S. Virgin Islands is optional.

- There are many tax advantages available in the US Virgin Islands, which are sanctioned by the U.S. government.

- The U.S. Virgin Islands offers a friendly environment for offshore investors.

- The U.S. Virgin Islands has a stable economy and a solid governmental structure.

- The U.S. Virgin Island’s corporate law is similar to corporations formed in Delaware and Nevada.

Corporate Legislation

The U.S. government controls the U.S. Virgin Islands as a U.S. territory. It has sanctioned many tax advantages within the U.S. Virgin Islands. The U.S. Virgin Islands is a part of the U.S. court system, and as such the U.S. Virgin Islands attracts many American investors wanting to incorporate, because often Americans will be more prone to picking a U.S. territory with a familiar court system instead of other offshore centers.

USVI corporations are similar to corporations formed in Delaware and Nevada, and based on a prior version of the Delaware corporate law. The corporate legislation the U.S. Virgin Islands follows is the Uniform Limited Liability Company Act in 1998, which makes it very similar to Delaware legislation.

Corporate Name

You must pick a unique name that is not similar to already existing corporation names. Typically, three versions of the business name are submitted to your agent with the hope that one of them will be approved.

Office Address and Local Agent

US Virgin Islands corporations must have both a local registered agent and a local office address. This address will be used for process service requests. This is provided automatically by the agency (such as this one) filing the company for you.

Shareholders

Corporations in the US Virgin Islands are required to have at least one shareholder.

Directors and Officers

The U.S. Virgin Islands requires company owners to have three directors and three officers (a president, treasurer, and secretary). The U.S. Virgin Islands does not allow corporate directors, so they must be natural persons rather than other business entities.

Thus, at least two people must serve as corporate officers and directors even if there is only one shareholder. Therefore, one person (who can be a shareholder) can serve as director, president, and treasurer), and a second person can serve as secretary, for example.

Authorized Capital

Company and limited company owners incorporating in the U.S. Virgin Islands can expect a minimum authorized capital of US $1000.

Taxes

The US Virgin Islands follows the tax system that is a mirror of the US government, but provides more corporate tax incentives and exemptions. Some corporations can receive a tax reduction of up to 90% on personal and corporate income taxes, and an exemption of up to 100% on excise, business property, and gross receipt taxes.

For most U.S. sourced passive income earned by a U.S. Virgin Islands exempt company, such as dividends, most types of interest, royalties, and the like, the United States would impose a 30% withholding tax at the source.

Annual Fees

Annual government fees for corporation owners incorporated in the US Virgin Islands is US $300, as of this writing, plus a very reasonable registered agent registered address fee.

Public Records

For corporations in the U.S. Virgin Islands, financial statements do not become public record.

Accounting and Audit Requirements

Company owners incorporated in the U.S. Virgin Islands need to file an annual report that includes:

- Identities of officers and directors. Shareholder identities are not required.

- An annual franchise tax return

- Financial statements

- Payment of the annual franchise tax

Exempt companies only need to turn in one report and no financial statements. This information is due by June 30 of each year.

Annual General Meeting

Meetings for USVI corporation shareholders and directors are optional.

Time Required for Incorporation

Those choosing to incorporate in the US Virgin Islands can expect the entire process to take about one week to one month. This completion time depends on the turnaround time with the government, as well as how accurately the company registration documents are completed by your agent.

Shelf Companies

There may be USVI aged/shelf companies available that have already been filed so that you can receive your company faster. This is subject to availability.