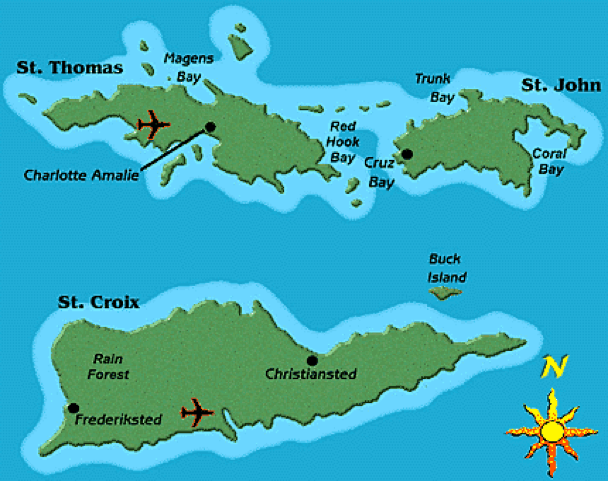

Forming an LLC in the US Virgin Islands (USVI) offers multiple tax savings, business and asset protection benefits. The USVI LLC has become the most popular tool to own real estate on the islands. The main inhabited islands are St. Thomas, St. John and St. Croix. In order to stimulate the economy and maintain the region as a US territory, the US government allows for multiple tax benefits for operating a business in the USVI, including a possible tax reduction of up to 90%, when structured properly.

If you want to form an LLC or need a US Virgin Islands registered agent, on are looking for a USVI business license, then use the number or form on this page. USVI certificate of good standing acquisition and a name availability search is also available.

US Virgin Island LLC Benefits

Filing an LLC in the US Virgin Islands or USVI LLC formation offers business owners many benefits. These benefits include the following:

- Only one member is required for forming an LLC in the USVI. Members and managers can be private persons or corporate bodies when forming a US Virgin Islands LLC.

- Meetings of managers and members in the U.S. Virgin Islands is optional.

- There are many tax advantages available in the US Virgin Islands, which are sanctioned by the U.S. government.

USVI LLC Legislation

Legislation for US Virgin Islands LLCs, that regulates both the formation and management of the LLC falls under the Limited Liability Company Act. Furthermore, this Act regulates what can appear in the company’s operating agreement, and does not allow a company to unjustly limit rights to information or records, dispose of the loyalty that members owe the LLC, or unfairly reduce the care that members owe the LLC by discarding of the concepts of good faith and fair dealing.

The legislation for the US Virgin Islands LLC entities somewhat mimics the formation of nonprofit limited liability companies like those available in two states, Tennessee and Kentucky. These types of LLCs are exempt under Section 501(c)(3) if it elects to be treated as a separate legal entity for tax purposes and its operating agreement includes the language mandated for the operating agreement while it also meets numerous requirements largely designed to guard against inurement and private benefit.

LLC Name

Those wanting to form LLCs in the USVI must pick unique names that are not similar to existing LLC names. Typically, three versions of the business name are submitted to your agent (such as this one) with the hope that one of them will be approved.

The name of an LLC must contain the words “limited liability company” or “limited company” (it may abbreviate the word “limited” to “ltd.” and the word “company” to “co.”) or the abbreviation “L.L.C”, “LLC”, “L.C.” or “LC.”

Office Address and Local Agent

Those looking to form LLCs in the US Virgin Islands must have both a local registered agent and a local office address. This address will be used for process service requests. Your agent who forms the company for you (such as this one) should automatically include this for you in the initial filing.

Shareholders

LLCs in the USVI only need to have one member.

Both natural persons and legal entities can be members.

Directors and Officers

USVI LLCs are required to have at least two managers. One of the managers can be a nominee with a contractual arrangement that the nominee is listed in name only without control of the company.

Both natural persons and legal entities can serve as managers.

Authorized Capital

Company and limited company owners forming LLCS in the U.S. Virgin Islands can expect a minimum authorized capital of US $1000 as stated in the articles.

Taxes

US Virgin Islands LLCs are not required to pay corporate taxes under the U.S. Internal Revenue “mirror code.” The one exception to this rule is if the corporation decides to be considered, for federal and state tax reasons, as a regular corporation. US Virgin Islands LLCs are required to file yearly informational returns.

The “mirror code” can be defined as the U.S. Internal Revenue Service’s code ensuring that taxes are paid to the U.S. Virgin Islands instead of the U.S. government.

Also, unless a company member is exempt from income taxes, its distributive share of membership income and loss is treated as income or loss to the member and reported on his, her or its return, regardless of whether or not the member actually received the income.

If a US Virgin Islands LLC has only one owner, then the owner is considered the same as the entity he or she owns for tax reasons. This does not effect the protection that the LLC provides the owners from lawsuits when the business, itself, is sued.

Annual Fees

Annual fees for company and limited company owners incorporating in the US Virgin Islands is US $300, as of this writing, plus registered agent/office and nominee fees, if required.

Public Records

While there is no public record keeping expected of US Virgin Islands LLCs, companies are expected to allow access to records they do keep.

Accounting and Audit Requirements

There are no specified recording requirements imposed on US Virgin Islands LLCs by the Virgin Islands Limited Liability Company Act. Still, the company is expected to allow for access to its record if requested.

US Virgin Islands LLCs must file annual reports and also pay the annual report fee by June 30th of each year. The annual report fee is equal to .15% of the capital used by the LLC in conducting business during the prior calendar year, with a minimum fee of $300 paid to the government.

Annual General Meeting

For limited liability companies formed in the Virgin Islands, meetings of managers or members is optional.

Time Required for Incorporation

Business owners choosing to for LLCs in the US Virgin Islands can expect the entire process to take about one week to one month. This completion time depends on the turnaround at the government filing office and the accuracy of the documents that are submitted.

Shelf Companies

Business owners who want to organize LLCs in the USVI can acquire existing shelf companies to receive their entities faster.