An Ireland Limited Liability Company (LLC) is also called a “Private Company Limited by Shares” (LTD). Foreigners can own 100% of the LLC. This is a popular Irish legal entity because it protects the foreign owners from liability, allows easy formation, and there are options for income taxation.

Ireland’s Companies Act of 2014 is the law overseeing the formation, activities, and dissolution of a LLC.

Background

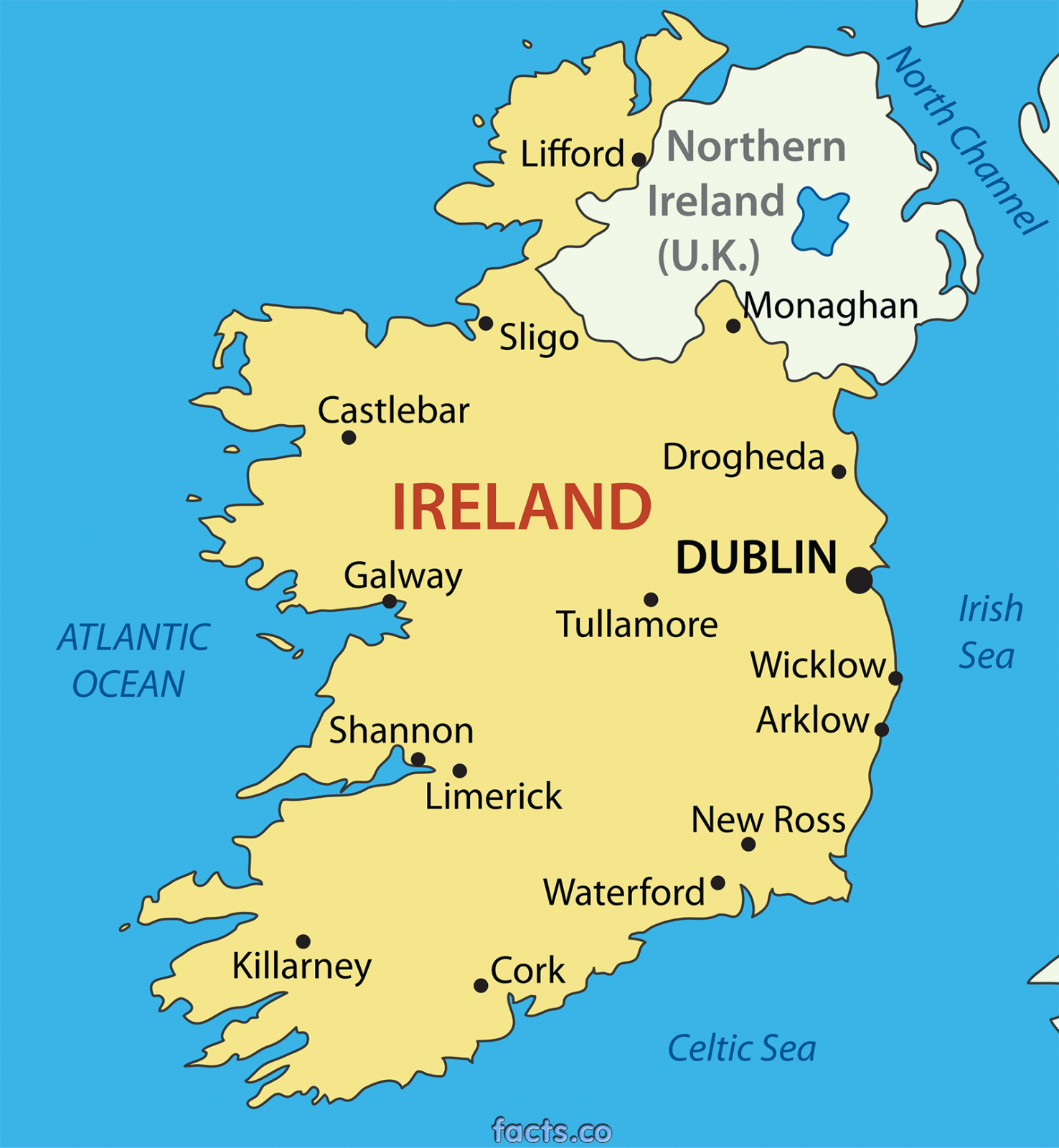

Ireland is a sovereign state in north-western Europe. Its official name is the “Republic of Ireland”. Its political system is a unitary parliamentary republic with a President and a Legislature.

Benefits

An Ireland Limited Liability Company (LLC) obtains these benefits:

• 100% Foreign Ownership: Foreigners can own all the shares of an Irish LLC.

• Limited Liability: The shareholders are responsible up to the amount of share capital they contributed including any unpaid capital.

• Low Corporate Tax and Exemptions: The corporate tax rate is one of the lowest in Europe. In addition, an exemption and tax relief are available. However, U.S. taxpayers along with everyone subject to global income taxation must report all income to their tax authorities.

• Fast Registration: A simple application for along with the Company Constitution can be filed online in one business day.

• One Shareholder/Director: Only one shareholder (who can be a foreigner) is required to form a LLC who can be the sole director.

• No Minimum Share Capital: There is no required minimum authorized share capital for private limited liability companies in Ireland.

• EU Member: Ireland is a member of the European Union (EU) opening opportunities to engage in business with other member nations.

• English: Since Ireland was part of the United Kingdom, English is spoken by most citizens and is the official second language behind Irish.

Company Name

The LLC must choose a name not used by any other Ireland legal entity. Applicants can review the government’s website to see what company names are available. A reservation of a company name can be accomplished by paying a fee which will be in effect for up to 28 days.

Registering the LLC

Since 2015, Ireland has made it easier to register LLC’s. Much of the previous red tape was abolished for new companies. Irish LLC’s can be registered online in one business day with a simple application form along with only one document (Company Constitution).

Basically, a new Irish company must:

• Reserve the company name with the Irish Trade Register;

• Establish the registered office address;

• Prepare the Articles of Association (Company Constitution); and

• Appoint the directors and company secretary.

All of these are filed with the Companies Register Office (CRO) whose functions are: incorporate companies and register business names, receive and record incorporation documents, enforce the Companies Act’s regulations regarding filing the annual accounts, and provide information regarding Irish companies to the public.

Limited Liability

Liability is limited for the shareholders to the funds invested in the company up to any remaining unpaid shares. Since the LLC is a separate legal entity, shareholders’ personal assets are protected when the company dissolves or is sued in a court of law.

Shareholders

Only one shareholder is required for formation of a LLC who can be from any country.

The maximum number of shareholders is 50. The LLC does not have to declare business objectives giving them the freedom to engage in any type of business.

LLC’s are incorporated with an authorized and issued share capital. These shares can only be traded privately and not sold to the public.

Directors

Only one director is required who can be the sole shareholder.

The Companies Act requires the following duties upon every director:

• Honesty and responsibility;

• Acting in good faith;

• Avoiding conflicts of interests

• Abiding by the company’s Constitution; and

• Acting in the best interests of the employees and company.

Company Secretary

Every LLC is required to appoint a Company Secretary. The Companies Act of 2014 set forth the following main duties for every company secretary who can be a natural person or legal entity:

• Submitting his/her name as company secretary to the Irish Trade Register;

• Certifying financial statements;

• Signing the annual return;

• Signing tax registration applications and tax returns;

• Signing the application when the company re-registers; and

• Drafting the company’s statement of affairs if liquidating.

In addition, the following administrative duties for the company secretary include:

• Keeping company records;

• Recording and maintaining the minutes of general and board meetings;

• Filing all required documents with the Trade Register in a timely manner;

• Providing administrative and legal assistance to the directors;

• Acting as a communications office between members of the company; and

• Manage share transfers within the company.

Minimum Authorized Share Capital

No minimum authorized and issued share capital is required. If the LLC chooses to have a minimum share capital it must be declared in the Company Constitution.

Registered Office and Agent

Every LLC must have a registered office address in Ireland along with a local registered agent.

Taxes

An Irish LLC is taxed as a separate entity from its shareholders.

The corporate tax rate is 12.5% which is the same rate applied to dividends paid which is one of Europe’s lowest rates.

The LLC is considered a tax resident if it is registered and managed in Ireland. The corporate tax also applies to foreign companies branches earning income in Ireland.

Exemption: According to the Deloitte Touche accounting firm, a 3 year corporate tax exemption exists for start-up companies engaging in trade which commences before the year 2018. The value of the exemption is based on the amount of the employer’s “social charge” (social security system payments) subject to a maximum of 5,000 Euro per employee and a total of 40,000 Euro for all employees.

In addition, corporate tax relief is available for:

• Investments in renewable energy and film projects;

• Interests and royalties;

• Investments in research and development (R&D) sectors; and

• Interests on money borrowed for reinvestments.

However, U.S. taxpayers along with everyone subject to global income taxation must report all income to their tax authorities.

Accounting and Auditing

Financial statements and reports are required to be prepared by the company secretary and approved by the shareholders at a general meeting. Said financial statements and reports are still required to be prepared and approved in a single shareholder company.

Annual General Meeting

An annual general meeting of shareholders is required. However, sole shareholder LLC’s can choose not to hold general meetings.

Public Records

The Companies Register Office (CRO) records are available to the public.

Time for Registration

It is estimated that online registration and approval of the LLC will take one business day.

Shelf Companies

Shelf Companies are available for purchase to quicken the registration process.

Conclusion

An Ireland Limited Liability Company (LLC) obtains these benefits: 100% foreign ownership, limited liability, only one shareholder (who can be a foreigner) is required who can also be its sole director, no minimum share capital, EU membership, and English is widely spoken.