A Guernsey Foundation combine the benefits of a company with a trust. Foundations are separate legal entities in Guernsey. Foreigners may become the founders, beneficiaries, and protect assets from around the world.

The Guernsey Foundations Law of 2012 (hereinafter “Law”) went into effect in 2013. Several unique options became available for founders to take advantage of which other jurisdictions do not provide. The new law anticipated that family businesses, wealthy individuals, and entrepreneurs from “emerging markets” would find the Guernsey Foundation interesting.

Several Uses for a Private Foundation

• Protecting wealth and managing assets;

• Succession and inheritance planning and avoiding forced heirship laws;

• Holding assets such as properties and funds;

• Pension funds management;

• Charitable and non-charitable purposes; and

• Acting as a trustee as an alternative to a private trust company.

Background

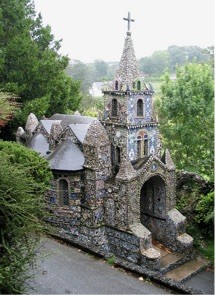

Guernsey Island is a British Crown Dependency. The island is located on the English Channel off the coast of Normandy (a French region).

Guernsey as a dependency is not part of the United Kingdom. However, as a dependency it defers most foreign relations to the British Government who also provides its military defense.

Benefits

A Guernsey Foundation offers the following benefits:

• Total Foreign Participation: Foreigners may be the founder, beneficiaries, council members, and the guardian with assets located anywhere in the world.

• No Taxation: Guernsey down not impose any kind of taxes. However, U.S. taxpayers and everyone paying taxes on global income must report all income to their governments.

• Privacy: The public does not have access to the Registrar of Foundations records protecting the privacy of the founder, council members, guardian, beneficiaries, and location of assets.

• Founder’s Control: The law allows founders to retain powers and become involved with management.

• Fast Formation: The Foundation Charter can be prepared in one day with same day registration with the Registrar.

• Asset Protection: Since all assets are owned by the foundation, the founder and beneficiaries are protected from their future creditors.

• Estate Planning: A private family foundation offers perpetual estate planning benefits for many generation of heirs.

• English: As a British Crown Dependency, Guernsey’s official language is English.

Guernsey Foundation Name

A foundation cannot use a name already in use in Guernsey by a legal entity. The name must end with the word “Foundation” so third parties know what type of legal entity they deal with.

Formation

One or more founders who may be natural persons or corporate bodies from anywhere in the world contribute assets to the private foundation as an initial endowment. Such endowments may include cash, movable or immovable properties, and tangible or intangible assets. Since there is no minimum required initial endowment, a foundation may be formed with little capital.

Foundations may be formed with a specific purpose or to benefit certain beneficiaries or a mixture of both. The purpose may be charitable or non-charitable.

A written instrument (called the “Foundation Charter”) details the purposes, beneficiaries, initial assets, and how they are administered, managed and distributed.

Registration

The Foundation Charter is filed with the government’s Registrar of Foundations. After registering, the foundation becomes a legal entity.

Like a company and a corporation, every foundation must renew its registration every year and pay a renewal fee.

Although the Registrar is normally open to public inspection, the Law specifically prevents the Registrar from allowing public access to the Charter.

Asset Protection

As a separate legal entity, foundations own the endowed assets. The founder relinquishes ownership of the assets and the beneficiaries are not considered their owners.

Therefore, future creditors of the founder and the beneficiaries will not have any legal claims over the assets.

In addition, because the beneficiaries are not the legal owners of the assets they cannot have influence over the assets which appeals to some founders with minor children or heirs who may not agree with the founder regarding how the assets are managed and distributed.

Founder

A founder can be a national of any country and reside anywhere. Founders can either be natural persons or corporate bodies.

Foundation Charter

The written instrument creating a foundation in Guernsey is called the “Constitution” or “Charter”. Similar to a Memorandum and Articles of Association or Incorporation for companies, the Charter sets forth the purpose or names the beneficiaries, initial assets, and the rules regarding appointing the Council, Guardian (if needed), and how they manage and administer and distribute the assets. Basic information like the foundation’s name, duration, acceptance of future endowments, and appointments and removal of councilors and their compensation are also included.

The Charter is the only document filed with the government Registrar. Therefore, in order to maintain privacy, the Charter often only provides general information without specifically naming the beneficiaries, or the location of the assets. Other written private documents provide those details for the Council. However, the founder’s name is mentioned in the Charter. Many founders initially form a corporation with an anonymous beneficial owner to act as the founder in order to protect the identity of the true founder.

Retention of Powers

The founder can retain certain powers in the Charter. Including the power to determine the purpose, appoint council members and the guardian. In addition, the founder may retain the powers to amend or revoke certain provisions in the Charter and terminate the foundation. Using a corporation as the founder avoids the problems when the founder passes away or is incapacitated and otherwise unable to exercise his or her powers.

The founder can also become a councilor or the guardian, or a beneficiary. This often occurs with a family foundation or a foundation owning a family business.

The Law allows founders the ability to become involved with the management of the foundation. However, the Law also limits the powers in scope and duration in order to provide a balance between valid foundations which are not just a founder’s sham with the ability for the founder to have some say.

Beneficiaries

There are no restrictions regarding the nationality or place of residence of the beneficiaries.

Information regarding the trust is normally available to the beneficiaries. However, the Law created a special class called the “disenfranchised” beneficiaries who are not entitled to all information and have less rights than the normal beneficiaries. This allows the founder to separate the beneficiaries in order to limit some of their rights and access to information.

Management

A foundation council is appointed which acts like a corporation’s board of directors. Under the Law, at least two “councilors” must be appointed. However, the Charter may specify that only a single councilor be appointed as the founder wishes.

Councilors can be natural persons or corporate bodies. Councilors are required to act in good faith while exercising their duties just like a corporate director. Good faith requires not personally profiting from decisions, providing accurate information, a duty to preserve the assets, act impartially, and to maintain standard records. A councilor’s duties are owed to the foundation and not the beneficiaries similar to a corporate director to the corporation.

The Law requires the appointment of a guardian for purpose foundations or when one or more beneficiaries become disenfranchised. The guardian acts as an “enforcer” ensuring that the purposes and/or benefits are being enforced alleviating a risk of a foundation ending up having no purpose or the means to enforce its purpose. The guardian owns a duty of good faith to the founder and the beneficiaries to enforce the Charter. The founder may be appointed as the guardian. However, a councilor cannot become the guardian while remaining a councilor.

Confidentiality

The private foundation provides certain information in its Charter which is filed with the Registrar such as the founder’s name, the names and addresses of the councilors and the guardian and location of the registered office. However, the Law states that the Registrar may not allow public access to this information. The only exception is for criminal investigations.

Registered Agent and Registered Office

Every foundation must appoint a local registered agent who maintains the foundation’s records. An exception exists when either a councilor or the guardian is a licensed Guernsey fiduciary which is regulated by the Guernsey Financial Services Commission.

Foundations must also have a registered office. Usually, the registered agent or the licensed fiduciary allows his or her office to be the registered office for the foundation.

Taxes

Guernsey does not impose any types of taxes on their private foundations. No corporate tax, no income tax, no gift tax, no inheritance tax, and no stamp duty.

Note: U.S. residents pay taxes on all worldwide income and must report all income to their IRS. Similarly, anyone who pays taxes on global income must declare all income to their tax agencies.

Public Records

The records of the Registrar of Foundations are not accessible to public inspection. Therefore, neither the founder’s, beneficiaries, council members, nor guardian’s names are part of any public records.

Time for Formation

I can take one day to prepare the Foundation Charter with same day registration with the Registrar of Foundations.

Conclusion

A Guernsey Foundation has these benefits: 100% foreign participation, no taxation, fast formation, privacy, estate planning, asset protection, and English is Guernsey’s official language.