An Antigua International Trust is also called an “Antigua Offshore Trust” because the law makes it easier for foreigners to create a trust. An ideal legal structure for asset protection and estate planning for families residing outside of Antigua.

The Antigua Trust Act of 2004 governs the formation, activities, and dissolution of their trusts. The law applies to charitable and non-charitable (private) trusts. Private trusts can last up to 200 years or less if specified in the trust deed.

Foreigners can create international trusts to protect their family’s wealth and to pass on assets to their heirs for many generations for the next 200 years.

According to the U.S. State Department, the government of Antigua and Barbuda encourages direct foreign investments and is one of the most prosperous countries in the Eastern Caribbean. The main industries are tourism, offshore education, and medical tourism. Financial services is a fast growing sector. Their government treats foreign investors equally with their local investors under the law. Major U.S. investors include: Chevron, American Airlines, Texaco, Western Union, Federal Express, Ace Hardware, Burger King, Subway, and Kentucky Fried Chicken.

Background

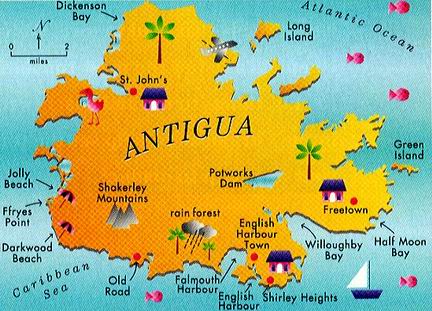

Antigua and Barbuda are a country of islands situated in the Caribbean Sea. They gained their independence from Great Britain after nearly 350 years of British rule and joined the British Commonwealth in 1981. Politically, it is described as “a unitary, parliamentary, representative democratic monarchy”. Queen Elizabeth II of England is the Head of State who appoints the Governor General as her representative. Two chambers of their legislature (parliament) with a democratically elected House of Representative and an appointed Senate.

International Trust Benefits

An Antigua International Trust obtains the following benefits:

• Foreign Control: Foreigners create trusts for the benefits of other foreigners.

• Tax Free: Trusts and their beneficiaries pay no taxes. However, U.S. residents and everyone paying income taxes on global income must report all income to their governments.

• Confidential: It is a crime for anyone to reveal trust information to unauthorized persons.

• Privacy: The names of the settlor and beneficiaries are not included in public records. Descriptions of assets and their locations are not in any public records.

• Estate Planning: The settlor’s heirs and their heirs can enjoy 200 years of estate planning benefits.

• Asset Protection: Since the assets are owned by the trustee, the creditors of the settlor and beneficiaries cannot seize the assets.

• Settlor’s Control: The settlor maintains control with the trust deed, letter of wishes, and appointing a protector.

• Business Flexibility: Unlike most countries, Antigua allows trusts to engage in all types of business activities.

• English: After nearly 350 years of British rule, Antigua remains part of the British Commonwealth with English as its official language.

Antigua International Trust Name

Trusts cannot select names the same as or closely resembling the names of other legal entities in Antigua.

Trusts must use the word “Trust” at the end of its name so third parties know it is a trust.

Uses

Trusts can be used in many ways, such as:

• Preserving a family’s wealth;

• Legally avoiding taxes like income, corporate, gift, inheritance, and estate taxes;

• Continuation of ownership and management of assets as the trust survives the settlor;

• Avoiding probate as the settlor’s heirs succession structure takes place upon the settlor’s death.

• Providing for aged parents, infant children, or persons of unsound mind;

• Estate planning as the assets are preserved for future generations of the beneficiaries heirs; and

• Pension plans for retired beneficiaries and their dependents.

Confidential

Antigua laws guarantees confidentiality by making it a criminal offense for anyone associated with a trust to divulge any information without express consent from the trust’s settlor. The only exception is by an Antigua court order when the trust is accused of involvement in illegal or criminal acts.

Privacy

The names of the settlor and beneficiaries are never included in any public records. Descriptions and locations of trust assets are also not included in public records.

Business Flexibility

Many countries do not allow their trusts to engage in any type of active business practices. Antigua permits all types of commercial and trade activities by their trusts as long as none of them occur in the Caribbean region.

Assets

An international trust may hold properties and other assets located anywhere in the world. While most trusts in other countries prohibits the inclusion of assets located in their countries, Antigua may permit the holding of assets located in Antigua by obtaining government approval.

Settlor

A trust is a legally binding relationship created by a “settlor” who transfers assets (properties) to a third party called a “trustee” to hold for the benefit of named persons (or to be named in the future) called “beneficiaries”. The main principle of the trust is a clear separation of legal ownership of properties (assets) from the original owner (settlor) and the new owner (trustee) and the beneficial owners (beneficiaries) who obtain distributions of trust income and the assets as the trust deed dictates.

Settlors can be natural persons or legal entities located anywhere in the world.

A “letter of wishes” may be executed by the settlor to provide instructions and guidance for the trustee. The letter may be amended during the settlor’s lifetime.

Trust Deed

The trust deed is like a corporation’s Articles of Incorporation or a Limited Liability Company’s Articles of Organization (or Association). The trust deed provides the rules and procedures as to how the trust operates. Trust deeds must be in writing.

Many legal experts look upon a trust deed as a contractual agreement between the settlor and the trustee setting out the details of the assets to be deeded to the trust or trustee, the powers and duties of the trustee, identity of the beneficiaries and how they benefit. The settlor will not be paid any income from the trust and the assets will not be returned to the settlor. The trustee holds title and manages the assets for their profitability while administrating the trust to benefit the beneficiaries in a tax free environment.

Trustee

The law requires the appointment of a trustee to manage the trust’s assets. The trustee represents the trust in all matters including administrative functions.

The law allows a minimum of one trustee up to a maximum of four.

Beneficiaries

Beneficiaries are the ones benefitting from the trust. They may be natural persons citizens of and residing in any country.

The trust deed determines what benefits each beneficiary is entitled to and when he or she is entitled to them.

The heirs of the beneficiaries typically assume the rights of the beneficiary upon that person’s death.

Protector

The settlor has the option to appoint a protector in the trust deed. The protector normally protects the interests of the beneficiaries and ensures that the trustee acts in their best interests and fulfills the purpose of the trust. The trust deed may allow specific powers for the protector such as overruling actions and decisions made by the trustee. Or, requiring prior approval before the trustee can act.

Taxes

International trusts pay no corporate tax, or income taxes, or gift tax, estate tax, inheritance tax, or stamp duty.

Note: U.S. residents and everyone subject to worldwide income taxes must report all income to their tax authorities.

Public Records

The trust deed and letter of wishes are never filed with the government. Neither the names of the settlor nor the beneficiaries are part of any public records. Descriptions of the assets and their location are not included in the public records.

Time for Formation

Trusts can be formed very quickly depending how fast the professional takes to write the trust deed.

Conclusion

An Antigua International Trust enjoys the following benefits: foreign control, tax free, confidential, privacy, asset protection, estate planning, business flexibility, settlor’s control, and English as the official language.