A Cook Islands Trust provides one of the most effective and powerful forms of asset protection globally. For instance, if you are involved in a lawsuit and lose and have your assets secured in a properly established Cook Islands Trust, the individual suing you would not be able access them using your local courts. Your local judge does not have jurisdiction over the Cook Islands trustee.

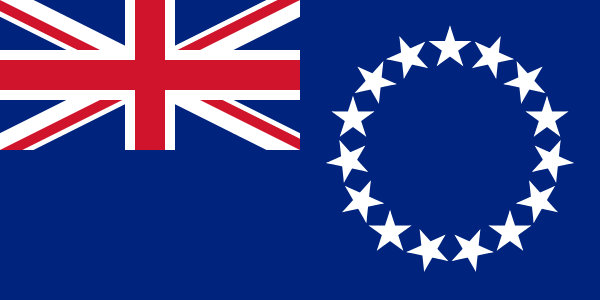

The Cook Islands were first sighted in 1770 by the famous British explorer, Captain Cook, and are named after him. The 15 islands in the Cooks are located in the heart of the Pacific, halfway between Hawaii and New Zealand. The total land area is 91 square miles (236 square kilometers) about 1.3 times the size of Washington, D.C. The estimated population is 12,000. Over 86% of the inhabitants speak English.

The Cook Islands became a British protectorate in 1888. Eventually, New Zealand obtained administrative control of the Cook Islands. The island’s residents chose self-government in free association with New Zealand in 1965. This means that New Zealand retains responsibility for external affairs and military defense of the Cook Islands. The government of the Cook Islands is a self-governing parliamentary democracy (Parliament of the Cook Islands) and the country’s legal system is based on the English Common Law similar to New Zealand’s.

Laws regarding Trusts

Cook Island trusts are known locally as International Trusts and are regulated by the International Trusts Act 1984 (The Act).

The Act provides for the licensing of trustees and trust management companies. Every International Trust must appoint a resident licensed trustee to manage the trust (unless they come within the “custodian trustee” exception mentioned below). In essence, the International Trust is required to use one of the several registered trust companies which operate out of the Islands. The trust must be registered by the licensed trustee company within 45 days of its creation.

Benefits

A Cook Islands International Trust has a number of distinct advantageous including:

• No Taxes: Trusts are exempt from Cook Islands taxation, except for the payment a small fixed Stamp Duty. U.S. citizens and those residing in other countries that tax worldwide income are required to report all earnings to their respective tax authorities.

• Strict Confidentiality: The Act requires strict confidentiality from trustees and employees of licensed trustee companies.

• No Rule against Perpetuity: The Cook Islands allow trusts established under the Act to exist in perpetuity. Most other countries do not allow Trusts to remain forever (perpetuity) and require them to cease existence after an established maximum number of years.

• Privacy: The identity of the settlor (Trust founder or grantor) and the beneficiaries are not registered with the government. Only the name of the Trust and the trustee are named. Cook Islands government records regarding to Trusts are not available to the public. Only persons able to show the government Registrar good and cogent reasons for getting access to public records can be granted an exception. One good reason is fraud.

• No Inheritance Laws: The Cook Islands do not recognize or enforce foreign inheritance laws. Even foreign court judgments regarding inheritance laws will not be enforced in the Cook Islands. Therefore, a foreign court order in favor of an “heir” will have no effect regarding the terms of the Cook Island Trust.

• Only New Zealand Court Judgments Enforced: Cook Islands will only recognize New Zealand court judgments whose laws favor settlers, beneficiaries, and trustees of the Cook Island International Trusts.

• Fraudulent Conveyances: Many countries have laws prohibiting fraudulent conveyances where the settlor aware of a future or pending claim against assets attempts to hide the assets by depositing them with another person or entity, such as a Trust. Cook Islands will only hear the case if the settlor transferred assets within two years from the action a creditor seeks to challenge the transfer. If a suit was filed in the requisite time, then the plaintiff would have to prove that the reason the funds were moved into the trust were to keep them from that particular creditor; not any creditor, mind you, but that particular creditor. The plaintiff would not win by mere preponderance of the evidence (51% vs 49%, for example), the normal legal hurdle in a civil case. The plaintiff would be required to prove its case beyond the shadow of a reasonable doubt (95% vs 3%, for example), a very high legal hurdle.

• Custodian Trustee: An exception exists to the rule that requires the trustee of a Cook Islands trust to be licensed and a resident. By appointing a resident licensed Cook Islands Trustee solely as a “custodian”, the settlor can then hire a managing trustee from his/her own country. Because a judge local to the settlor would have jurisdiction to issue court orders to the local trustee, this may be less than practical for long-term asset protection purposes.

• Different Jurisdictions: Cook Islands laws allow the trust deed to determine which country has jurisdiction over different clauses (sections). In addition, the trust deed can state that a governing jurisdiction can change upon the happening of a specific event (known as the “flee clause”).

The Need for Trusts

The biggest motivator for individuals seeking out a Cooks trust is protection from litigation, otherwise, known as “Lawsuit Protection”. If a Cook Islands Trust is established and funded well before an event occurs which creates legal liability (an accident or a wrongful act), the assets of the Trust will be immune to any civil court lawsuit judgment in another country.

For example, let’s suppose that after a Trust is set up and funded the settlor or a beneficiary is involved in a car accident. If the courts hold that person liable for monetary damages, the assets in the Trust are protected. Even if the “bad thing” (the car accident) happens the day after funds are placed in the trust, the plaintiff would, understandably, find it nearly impossible to prove beyond a doubt that the funds were moved for the purpose of keeping it away from that particular creditor. After all, the movement of assets were made before one could have known the auto accident would occur.

Assets of a Trust

Settlors can deposit cash, title to real estate, investment accounts, and businesses into a Cook Islands Trust. Even better, no assets registered in a Cook Islands Trust has to be located in the Cook Islands, and most individuals with these types of trusts can manage them over the Internet with relative ease and less complexity.

Why Trusts are So Successful

One of the reasons why Cook Island Trusts are so popular has to do with the fact Americans were considered from the start when the idea was formed. The idea for Cook trusts came from a Denver attorney, Barry Engel, who created and published his ideas for asset protection. This notion, published in The Economist, was spotted by a Cook official trying to find a way to bolster the economy of the island. After that, a partnership formed, and Engel was asked to help compose the new Cook Islands law which came about in 1989.

While Engel admits many attorneys have become critics of Cook Island Trusts and what they protect, Engel makes sure to assist his clients through the process of the Cook Islands Trust with their needs in mind regardless. Engel feels his creation of the Cook Islands Trust idea is a response to the over usage and excessive monetary punishment often found in litigation in the United States legal system.

Trusts and the American Legal System

On the other hand, lawyers that support Cook Islands Trusts feel they can not only protect their clients, but be used as a strategy in court to come to an agreement. Realistically, if a client is sued and possesses a Cook Islands Trust, most creditors or individuals pushing a lawsuit will settle rather than have to chase assets to a far away country and go to court there.

Therefore, those that are sued and own a Cook Islands Trust do not usually get off completely Scott free from a lawsuit but are typically able to settle out of court for much less than what they might have had to pay if they did not own such a trust. Furthermore, these types of settlements usually remain off-record and add the extra benefit of secrecy to the entire process.

The Success of Trusts

Since Cook Islands Trusts have been so popular with Americans, the Cook Islands plan to continue to push their trust concept by increasing marketing to businesses in places like China and Asia. Cook Islands officials feel that their trusts have much to offer corporations located in Asia, and can use their success with American corporations and individuals to further push their idea.

As Cook Islands Trusts begin to spill out into other countries and continue to become more popular with American businesses, their success and security seem relatively steadfast for those looking for powerful asset protection benefits. As such, a Cook Islands Trust is certainly an option any corporation or individual worried about future litigation should consider.

As with any new trust plan, it is always wise to seek advice from an asset protection specialist before making any sudden moves or plans. However, if you are in any industry that could cause you to lose your assets through litigation, then a Cook Islands Trust is worth your time in research, consideration, and planning.

Conclusion

A Cook Islands Trust has many benefits including: No income taxes, privacy and strict confidentiality, no limits on a trust’s perpetuity, lawsuit protection (as long as no Fraudulent Conveyances occurred), no affect from other countries inheritance laws or court judgments, flexibility to choose managing trustees from own country, and choosing which country’s laws have jurisdiction over individual clauses.