A Curacao Trust law was enacted in 2011 to provide similar trusts seen in other jurisdictions allowing for asset protection and estate planning for wealthy families. The 2011 law added a new paragraph 3 to section 231 of Book 3 of the Curacao Civil Code. Prior to 2011, Curacao did not have any laws establishing trusts.

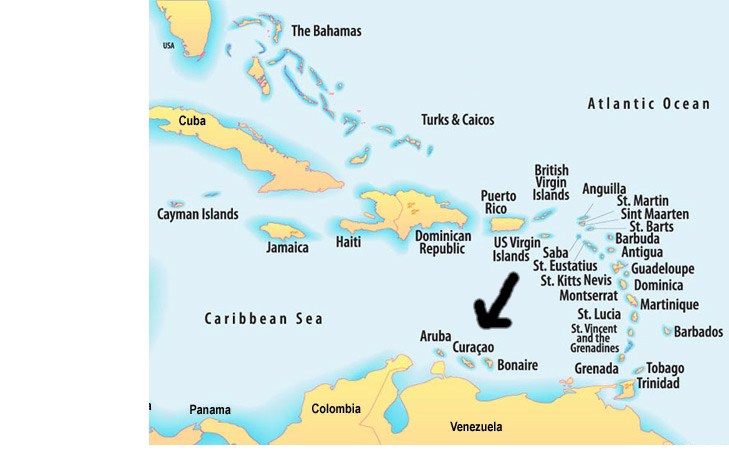

Foreigners can set up trusts in Curacao offering complete corporate and income tax exemptions as long as they do not carry out commercial business activities. English is spoken by many citizens as most tourists come from English speaking countries.

Benefits

A Curacao Trust obtains the following benefits:

• Total Foreign Participation: The settlor and beneficiaries can be foreigners.

• No Taxation: Passive income is tax free. However, U.S. citizens and others paying taxes on global income must reveal all income to their governments.

• Privacy: The settlor and beneficiaries names remain private.

• Estate Planning: Trusts can be perpetual offering many generations of a family long term estate planning.

• Asset Protection: Assets held in trust are protected from creditors of the settlor and beneficiaries.

• Fast Formation: A trust can be formed in one day.

• English: Most tourists come from English speaking countries making English a popular language in Curacao.

Trust Name

A trust must pick a name not resembling any other legal entity’s name in Curacao.

The word “Trust” or its Dutch translation must appear at the end of its name to prevent confusion with other legal entities.

Types of Trusts

Two types of trusts can be formed in Curacao:

• Beneficial Trust – this type of trust contains the names of specific persons or legal entities (or future ones) who benefit from the trust (beneficiaries) in the trust deed.

• Purpose Trust – this type of trust has no names beneficiaries. Instead, the trust deed states a specific purpose for the trust. Any non-charitable purpose is acceptable. Most jurisdictions consider purpose trusts to be invalid for failing to assist humans or charitable causes and for not having a beneficiary who can enforce the trust. Event occurrence (like erecting a monument or the coming apocalypse) or benefitting animals are invalid in most countries.

Duration

There is no “Rule against Perpetuity” limiting the lifespan of a Curacao trust. They can have a non-ending lifespan (perpetuity). However, the trust deed can limit the trust’s lifespan to a specific number of years.

Formation

The settlor (founder) executes a trust deed in front of a Curacao civil law notary which describes the assets (properties) to be held in trust by a named trustee for the benefit of named beneficiaries.

The government does not require registration or filing the trust deed or any other legal documents for a trust to become legally valid.

Trust Deed

As mentioned above, this is a written legal document establishing a trust and signed by the founder (settlor) in front of a Curacao civil law notary.

A trust deed must include the following information:

• A description of the trust assets including their locations;

• The name of the trust which includes the word “trust”;

• Details regarding the beneficiaries or a specific purpose if no beneficiaries exist;

• Appointment of one local trustee who accepts the position;

• Assurance that a local trustee will exist at all times; and

• Duration for the existence of the trust.

Settlor

The person creating a trust is known as the “settlor”. The settlor can have citizenship in any country and may reside outside of Curacao.

The settlor’s assets (properties) are held by a third party called a “trustee” for the benefit of named person called the “beneficiaries”.

Beneficiaries

The persons receiving the benefits from a trust are the “beneficiaries”. They can be citizens of any country and reside anywhere outside of Curacao. Being non-residents allow them to take advantage of the tax exemptions when receiving income and/or the assets from the trust.

A beneficiary may be a natural person (living or unborn) or an existing legal entity (or one to be formed) as long as present and future beneficiaries can be sufficiently described. Beneficiaries can benefit from the trust’s income and capital.

Beneficiaries under the law have the right to access all information regarding the trust. However, the trust deed may limit those rights.

Trustee

A local resident must be appointed as a trustee. If more than one trustee are appointed, at least one of them must be a local resident.

The trustee owes a fiduciary duty towards the trust and the beneficiaries. Therefore, the assets of the trust must be separated from the trustee’s personal assets. Otherwise, a trust deed can tailor make whatever powers the trustee can assume in managing the assets and administering the trust and making distributions of the income and assets to the beneficiaries.

Protector

The trust deed may appoint one or more protectors. A protector cannot be a trustee or a beneficiary. Trustees are prohibited by law from appointing protectors.

The powers of the protector(s) can be tailor made in the deed. For instance, the protector can oversee the actions of the trustees and overrule their decisions. A protector may be granted the power to take actions against the trustees for the benefit of the beneficiaries or purpose of the trust.

Termination

The trust terminates upon:

• Expiration of a definite time period stated in the trust deed;

• The trust no longer has assets;

• The purpose has been accomplished or the trust no longer has beneficiaries; or

• Court ordered dissolution.

Taxes

Trusts not engaging in trade, commercial or other business activities are completely exempt from all taxes like corporate tax, income tax, capital gains tax, gift tax, and inheritance tax. In addition, the beneficiaries receiving dividends or other payments from the trust’s income are not subject to a dividends or capital gains tax. Also, distributions of assets to non-resident beneficiaries will not subject them to a gift tax or income taxes.

Note: U.S. taxpayers and everyone paying taxes on worldwide income must declare all income to their tax authorities.

If a trust actively participates in a trade, business, or other commercial enterprise, it will be subject to the current corporate tax rate of 22%. But, just like a Curacao private foundation, a trust can apply for corporate tax reduction of 10% for the first three years of conducting business.

Public Records

Since trusts do not have to register with the government, no public records exist naming the settlor or the beneficiaries.

Formation Time

A trust can be formed in one day.

Conclusion

A Curacao Trust enjoys these benefits: complete foreign participation, no taxes, privacy, estate planning, asset protection, fast formation, and English is popular.