A Luxembourg International Trust offers foreigners a global reputable financial center along with an asset protection vehicle utilizing estate planning benefits. Foreigners may become the settlors, trustees, and beneficiaries. In addition, foreigners may establish international trusts to protect their worldwide assets.

The Trust Law of 2003 (hereinafter the “Law”) established International Trusts just for foreigners. The Law allows the establishment of simple to sophisticated trusts for asset protection, efficient successions, tax efficiency, privacy, and family governance. A new tax law was enacted in 2016, but does not affect trusts.

Background

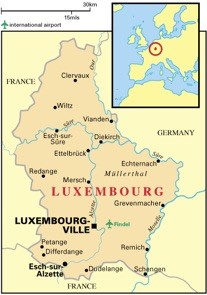

Luxembourg is considered the “Gateway to Europe” as it has the second largest funds center in the world and as one of the founders of the European Union. With a high business oriented infrastructure combining with solid banking and political stability it attracts large foreign investors.

The Luxembourg Civil Code maintains a two tier judicial system depending on the types of activities. The judicial courts try contract disputes where the lower courts try contract and commercial claims up to a maximum 10,000 Euro. The district courts try contractual and commercial claims in excess of 10,000 Euro.

Administrative courts deal with non-litigation disputes by mediating or initiating arbitration procedures to settle claims.

Luxembourg is on the OECD “white list” making it a very reliable and transparent jurisdiction.

Its political structure may be described as a “unified constitutional parliamentary monarchy” with an elected one house legislature, a prime minister and the Grand Duke Henri as their monarch.

International Trust Benefits

A Luxembourg International Trust offers the following benefits:

• Full Foreign Participation: The Law was created for international trusts so foreigners may become the sole settlor, trustees, beneficiaries, administrators and all of the assets can be located in other countries.

• Tax Exemptions: Non-resident beneficiaries with all of the trust’s assets located outside of Luxembourg are exempt from all taxation. However, U.S. taxpayers and all others paying taxes on global income must report all income to their governments.

• Privacy: Trusts do not register with the government assuring all information will not be made available to the public.

• Fast Formation: A trust deed may be prepared in one business day.

• No Capital: There is no minimum capital requirement. So, international trusts can be formed without any initial assets.

Luxembourg International Trust Name

Every trust must select a name not being used by any other legal entities in Luxembourg.

The name must end with the word “Trust” so third parties won’t get confused with other types of legal entities.

Registration

International trusts are not required to register with the government.

Settlor

The person creating the trust is called the “settlor”. Settlors may be citizens of any country and may reside anywhere.

Trustee

The trustee is the person who can be an individual or a company who agrees to manage the assets on the settlor’s behalf for the benefit of the beneficiaries. The Law creates an immediate fiduciary relationship between the trustee and the settlor and beneficiaries.

Companies in Luxembourg acting as fiduciaries for settlors must be licensed by the government’s Financial Regulator. This provides greater protections for appointing local trustees rather than one from another country.

Beneficiary

The person(s) benefiting from the creation of a foundation is called the “beneficiary”. Beneficiaries may be nationals of any country and can reside outside of Luxembourg in any other country.

Trust Deed

The private agreement between the settlor and the trustee creating a trust is called the “Trust Deed”. This agreement sets forth the types of assets in which the trustee will administer for the settlor on behalf of the beneficiaries. The Trust Deed must be signed by both parties in front of a Luxembourg public notary.

Minimum Capital

There are no requirement for a minimum capital.

Taxes

International trust non-resident beneficiaries are exempt from all taxes as long as the trust assets are located outside of Luxembourg. Some exceptions exist regarding certain taxes in relation to non-residents where they can be subject to taxation.

The following is a summary of those situations:

• Income taxes for non-residents are only imposed upon income earned within Luxembourg and on their property located in Luxembourg. Residents are taxed on their worldwide income.

• Capital gains tax is only imposed on non-residents who dispose of shares or other assets subject to capital gains taxation within 6 months of acquisition.

• Inheritance tax is not imposed upon non-residents receiving assets from an international trust by way of direr bloodline from the settlor.

• In 2016, a new law changed the corporate income tax rate on profits which was reduced from 21% to 19% for 2017 and 18% for 2018. However, the corporate tax does not affect income generated by international trusts.

Note: U.S. taxpayers and everyone subject to taxes on their world income must disclose all income to their country’s tax authorities.

Public Records

International trusts do not have to register with the government. Therefore, there are no public records regarding trusts, their settlors, beneficiaries, or assets.

Time to Form

A trust deed can be prepared in one business day.

Conclusion

A Luxembourg International Trust has these types of benefits: international trusts created especially for total foreign participation, no taxation, privacy, no minimum required capital, and fast formation.