A New Zealand Family Trust offers foreigners an opportunity to protect their family’s assets for up to 80 years. Trust serve as estate planning tools and asset protection vehicles.

New Zealand has family trusts set up before the outbreak of World War II to protect their family’s properties during a predicted forthcoming war. These trusts still exist. They survived different governments, changes in gift and inheritance tax laws, and remain intact to provide senior family members with rest home subsidies, pensions, and protect them from creditors, ex-spouses, and lawsuits.

Foreigners can set up family trusts where all of the beneficiaries and assets are located outside of New Zealand.

Background

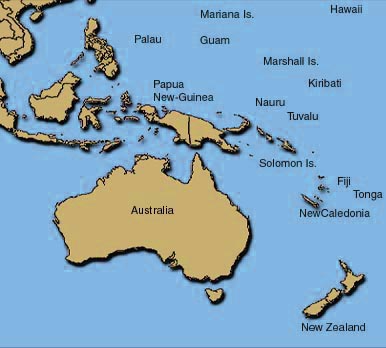

New Zealand is an island nation located in the Southwest Pacific Ocean near Australia. It became a British colony in 1788. In 1907, New Zealand became a Dominion of the British Empire. In 1947, it severed ties with the British Parliament and became self-autonomous. English is its official language.

Benefits

A New Zealand Family Trust can take advantage of the following benefits:

• Complete Foreign Participation: The settlor and the beneficiaries can all be foreigners with assets located outside of New Zealand.

• No Taxes: Non-resident trusts pay no taxes of any kind. However, U.S. residents and others taxed on global income must declare all income to their governments.

• Asset Protection: All of the assets are protected from future creditors of the settlor and the beneficiaries.

• Estate Planning: Trusts offer up to 80 years of estate planning benefits for many generations.

• Fast Formation: A trust deed can be written quickly and no government registration required.

• Privacy: No information regarding trusts become part of any public records.

• English: New Zealand as a former British colony is an English speaking country.

Family Trust Name

Trusts can never use a name exactly alike or resembling a legal entity’s name in New Zealand.

The word “Trust” must be included at the end of its name to provide notice to third parties of the nature of its structure.

Types of Trusts

Various types of trusts have been conceived over the past hundreds of years that trusts existed around the world. These include: constructive trusts, unit trusts, fixed trusts, will trusts, charitable trusts, and discretionary trusts.

The information provided here regards “discretionary trusts” as they are more popular in New Zealand. The term “discretionary” refers to the discretion a trustee has under the terms set forth in the trust deed. Such discretion may include the power to decide which beneficiaries receive payments from the trust properties income. Another discretion can be the power to decide if benefits will be paid during the life of the trust or not. The settlor decides what discretionary powers the trustee can have when preparing the trust deed.

Reasons for a Family Trust

Typical reasons for creating a family trust includes:

• Asset protection from future creditors especially when the settlor engages in risky business ventures which may fail.

• Estate planning such as assuring that a family’s company, ranch, or a farm remain intact when title transfers to the next generation.

• Protecting family members from marital break ups or contested probate of a will.

• Protecting family members from their future creditors.

• Managing assets for a beneficiary who incapable of managing his or her own assets.

• Protection from tax liabilities such as gift, estate, and inheritance taxes.

Formation

The trust is created when a person known as the “settlor” transfers title to properties to an individual or persons or a company known as the “trustee” to hold and administer on behalf of someone else known as the “beneficiary”. The term “settlor” refers to the fact that the properties are “settled on” the trustee.

Since the trust has its own name and hold properties and performs functions described in a legal document (trust deed) may consider a trust to be a separate legal entity like a corporation or a company which is the case in some countries. Actually, under New Zealand law a trust is a relationship between the trustee and the beneficiaries defined in the trust deed imposing certain powers and duties upon the trustee regarding how to deal with the trust’s properties in the best interests of the beneficiaries.

Trust Deed

The trust deed transfers a property’s title to the trustee and sets forth terms and conditions which the trustee must follow. A lawful purpose for the formation of the trust must be stated in the trust deed. Often, the purpose is simply to make payments from the trust properties to the beneficiaries.

The trust deed may limit the rights of individual or all of the beneficiaries which is known as a “discretionary” trust. The settlor may reserve certain rights for him or herself to amend the limits of a discretionary trust or to create limits at a later time.

Trustee

The trustee normally has extensive powers, rights, and duties specified in the trust deed and by law. Therefore, the trustee should be someone (or a company) with the knowledge, experience, and qualifications to manage the assets, make sound investments, maintain proper accounting records, and administer the income and trust assets to benefit the beneficiaries according to the conditions found in the trust deed.

Beneficiaries

Family trusts are established to name family members as the sole beneficiaries. Future family members can be described in the trust deed to include future generations. The words “children” and “grandchildren” suffice to describe future generations.

Beneficiaries for tax purposes must be non-residents of New Zealand. This means that the beneficiaries can be citizens of any country and all reside outside of New Zealand.

Discretionary beneficiaries while having a right to be considered by the trustee to receive payments from the trust’s assets, they do not have an automatic right. Discretionary beneficiaries may include the settlor and his or her spouse along with his or her children and grandchildren.

Residuary (ultimate) beneficiaries are the ones who receive title to the assets when the trust terminates. Since 80 years (if the trust states that time period) passes before the trust terminates, it will be impossible to name which ones consist of the residuary beneficiaries. Best practices dictate the trust deed to provide that the living discretionary beneficiaries become the residuary ones at the time the trust terminates.

Appointer

New Zealand law allows for the appointment in the trust deed for an “appointer” with powers to add or remove beneficiaries. Additional powers may include removing and adding trustees. All actions must be done in the best interests of the beneficiaries.

Appointers can reside and be citizens from any country.

Taxes

According to the New Zealand Inland Revenue website, a “foreign trust” is tax exempt where the settlor and beneficiaries are non-residents and the only distributions to the beneficiaries are either realized capital gains or payments from the trust’s corpus.

Non-resident trusts do not have to file annual tax returns.

Privacy

Since do not register with the government, no information about them are in any public records.

Time for Formation

A trust deed can be written in one day.

Conclusion

A New Zealand Family Trust offers the following benefits: total foreign participation, no taxes, privacy, estate planning, asset protection, fast formation, and English is the official language.