A Niue Offshore Trust offers a complete tax free international trust

The Trusts Act of 1994 and the Trustee Companies Act of 1994 governs the formation of trusts and the responsibilities of trustees in Niue.

Foreigners can be the settlors (creators) and beneficiaries of an offshore trust.

Background

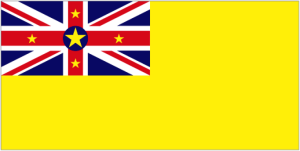

The Island nation of Niue located in the South Pacific Ocean near New Zealand is a self-governing country and a member of the British Commonwealth. In 1901, Niue became colonized by New Zealand which granted its independence in 1974.

Its political system is described as a “unitary parliamentary constitutional monarchy” under protection by the British Crown and New Zealand.

Benefits

A Niue Offshore Trust offers the following benefits:

• Complete Foreign Participation: Offshore trusts consist of settlors and beneficiaries who are foreigners.

• No Taxation: Offshore trusts and their beneficiaries pay no taxes of any kind. However, U.S. taxpayers and al others paying taxes on global income must declare all income to their governments.

• Private: Offshore trusts do not register with the government so all of their information remains private.

• Estate Planning: Offshore trusts provide ideal estate planning structures for families seeking numerous generations of succession and benefits from the assets legally avoiding the many taxes which estates face around the world.

• Asset Protection: The settlor’s assets held by a trust are protected against all future creditors.

• Quick Formation: A deed of trust can be prepared in one day.

• English: As a member of the British Commonwealth, English is one of its official languages.

Niue Offshore Trust Name

Trusts cannot use the same name or similar ones which are used by Niue legal entities.

A trust’s name must end with the word “Trust” to prevent confusion over what type of legal entity is being used.

Types of Trusts

Niue allows several different types of trusts to be formed like: beneficiary trusts and discretionary trusts, onshore trusts and offshore trusts.

Settlor

The person or legal entity creating a trust is known as the “settlor”. Settlors may be from any country and in order to create an “offshore” trust, must reside outside of Niue.

Settlors can be natural persons or legal entities registered in any country.

Settlors transfer their assets (funds, properties, etc.) to the trustee to hold them for the benefit of the beneficiaries.

Settlors can maintain indirect control over the trust by the manner in which the deed of trust is written.

Deed of Trust

The deed of trust is the legal trust document containing all the terms and conditions of the trust and what powers, duties, and responsibilities the trustee has.

Trust Property

The settlor transfers real properties, personal properties, and funds to the trustee or the trust to hold. These are often referred to as the “assets”. The deed of trust can identify the initial assets or not. Best practices dictate that all of the assets be specified and identified for clarity in case a third party attempts to seize assets to pay off the settlor’s or beneficiaries dates in the future.

Trustee

The individual or company named to accept the settlor’s assets to hold for the benefit of the beneficiaries. The trust deed specifies what powers and discretion the trustee has in regards to managing and investing the assets along with making distributions from the income or the capital to the beneficiaries.

The Trustee Companies Act of 1994 established a licensing process for companies to become trustee services providers. The Act provides for the education, qualifications, and experience for trustee companies to obtain in order to become licensed before they provide trustee services. As a result, every trust must appoint a local, licensed trust services company to act as their trustee.

Beneficiary

The individual or persons whom the settlor names in the trust deed to benefit from the trust are called the “beneficiaries”. The beneficiaries can be citizens in any country and reside anywhere outside of Niue. Some trust deeds do no specifically name who the beneficiaries are but rather the settlor provides a private document listing the beneficiaries for the trustee.

Protector

One way for the settlor to maintain influence over the trust and the trustee is to appoint a person called the “protector” who protects the interests of the beneficiaries. The trust deed provides the powers, duties, and responsibilities that t a protector has over the trust and the trustee. In some instances, the protector may have veto power over decisions off the trustee or must provide prior consent before the trustee can act. Sometimes the protector has the power to remove and appoint trustees.

Protectors can live anywhere and be citizens of any country.

Letter of Wishes

Settlors have the option to prepare a letter detailing his or her wishes regarding how the trustee can act which is called a “letter of wishes”. This is a private document between the settlor and the trustee. Because of its private nature, the letter of wishes may not be legally binding, but more of a guide than a directive.

Taxes

Offshore trusts are completely exempt from all taxes. No corporate tax, no income tax, no capital gains tax, no wealth tax, no gift tax, and no inheritance tax are imposed upon offshore trusts. When beneficiaries receive income generated by the assets and the capital, no income taxes are imposed.

Note: U.S. residents and others subject to taxation of world income must report all income to their tax authorities.

Public Records

No public records exist containing the names of the settlor, beneficiaries, or the identity and location of trust assets since offshore trusts do not register with the government.

Time for Formation

A Deed of Trust could be written in one day.

Shelf Trusts

Since trusts are unique depending upon the wishes of the settlor and the type of assets being held, no shelf trusts are available to purchase ion Niue.

Conclusion

A Niue Offshore Trust has the following benefits: total foreign participation, no taxes, privacy, estate planning, asset protection, fast formation, and English as one of the official languages.