A St. Vincent International Trust is formed under the provisions of the International Trust Act of 1996. Different from domestic trusts, international trusts were established so foreigners can create them to hold global assets for non-resident foreigners.

Background

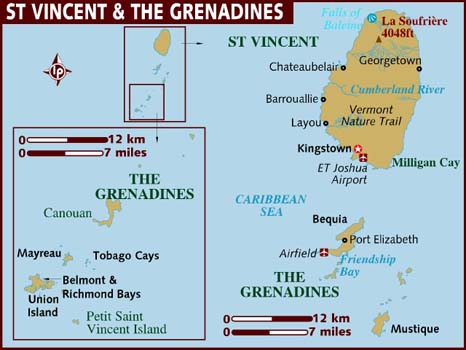

St. Vincent and the Grenadines are a multi-islands nation located in the Caribbean which were a British Colony for over 200 years before gaining independence in 1979.

It legal system follows traditional English Common Law with Magisterial District courts acting as the lower courts and the court of final appeals being Her Majesty’s Judicial Committee of the Privy Council in London, England.

While English law is their basic law, they developed their own statutory laws such as the International Trust Act of 1996 (Act) governing international trusts formed in St, Vincent and the Grenadines (hereafter, SVG).

Trust Benefits

A St. Vincent International Trust can take advantage of the following benefits:

• Foreign Control: International trusts were created especially for foreigners to create and benefit foreign beneficiaries and hold assets held in other countries.

• No Taxes: International trusts pay no taxes. Note: U.S. residents are subject to global income tax along with persons from other countries taxing worldwide income who must report all income to their governments.

• Privacy: No public records exist naming the settlor, beneficiaries, protector, or trust assets.

• Settlor’s Control: SVG allows settlors the power to manage trust investments, assets, trustees, protectors, and beneficiaries without jeopardizing the validity of the trust.

• No Foreign Interference: SVG’s laws prevent other countries’ laws, courts, and claimants from accessing trust assets,

• Asset Protection: Fraudulent conveyance laws are not enforced. Claims against assets have heavy burden of proof. Forced heirship laws not recognized.

• Perpetuity: No rule against perpetuity exists in the SVG allowing no limits on the existence of a trust.

• Estate Planning: A trust with unlimited lifespan and favorable asset protection laws makes for an excellent platform for estate planning.

• English: SVG was a British Colony for over 200 years adopting English as its official language.

• Fast Formation: The trust deed can be prepared in one day and registration takes another day.

St. Vincent International Trust Name

Trust names cannot be exactly alike or closely resemble any SVG legal entities name.

Trust must identify themselves by including the word “Trust” at the end of its name.

Qualifications

Qualifying as an international trust under the Act requires:

• Neither the settlor nor any of the beneficiaries are residents of the SVG;

• One of the trustees must be licensed pursuant to the SVG Registered Agents and Trustees Licensing Act;

• None of the assets held by the trust are located inside the SVG; and

• The trust deed is registered in the government’s Trust Registry

Registration

Trust deeds are registered with the Trust Registry established by the government as a confidential register of trusts which are not accessible to the public. Upon registering, a Certificate of Registration is issued to the settlor.

Trust deeds transfer title to the trust of all assets and describes how the trust will be administered, how assets will be managed, and how income and assets will be distributed to the beneficiaries.

Validity

An international trust which is duly registered will not become invalid because the settlor’s country of citizenship or residency declares if unlawful under their laws. In addition, forced heirship and community property laws of other countries will not be recognized by any SVG court.

The Act determines all conflicts of law and choice of law issues regarding international trusts.

Asset Protection

Foreign fraudulent conveyance laws will not be enforced against a registered international trust.

Foreign court judgments against a SVG registered international trust and/or against the beneficiaries or its settlor are not enforceable if the judgment was based on foreign laws not in conformance with the Act.

A statute of limitations exists barring all claims against an international trust which were not commenced within two years from the date the international trust was created.

The only manner in which a debt creditor can satisfy his or her claim on a particular trust property is by posting a $25,000 USD bond with a SVG court and proving that the settlor intended to defraud the specific creditor and the transference of the property (asset) to the trust rendered the settlor insolvent. These are very difficult things to prove.

Foreign laws regarding the insolvency or bankruptcy of the settlor will not affect a registered international trust.

International Business Companies

An international trust can own as many SVG International Business Companies (IBC) it wishes.

Different Types of Trusts

The Act allows for the creation of different types of trusts such as:

• Purpose Trust – A trust created for specific purposes without naming beneficiaries are permitted. The purpose for such trusts can have a broad range including charities, events, social or political agendas, and religious. Purpose trusts can be charitable or non-charitable. A family business can be the sole asset of a purpose trust.

• Discretionary Trust – This type of trust allows for the trustee to have discretion whether to disperse income and assets to a specific beneficiary or to remove the beneficiary completely.

• Spendthrift Trusts – A spendthrift trust is established to place restrictions on one or more beneficiaries from spending the trusts income or disposing of assets received from the trust. This type of trust protects minors, mentally incapacitated, or beneficiaries that the settlor does not have confidence or trust in the beneficiary to spend income or sell assets in a responsible manner.

• Reserved Power Trusts – Also known as a “settlor-controlled trust” where the settlor can retain powers to control the management of the trust’s assets. This is a very popular trust with foreigners establishing Limited Liability Companies (LLC) or an International Business Company (IBC) and having their shares held by one of these trusts. This allows the settlor to run the companies in the background through the trust. Here are some of the powers which may be reserved by the settlor to retain, possess or acquire the power to:

(a) Revoke the trust;

(b) Amend the trust:

(c) Remove or appoint a protector or trustee;

(d) Direct a protector or trustee to act in certain ways;

(e) Obtain benefits or interest from the trust;

(f) Direct distribution of the trust capital or income to persons other than him or herself;

(g) Become a beneficiary; and

(h) Writes a letter of wishes delivered to the trustee directing his or her activities.

Duration

The Rule Against Perpetuity does not exist in the SVG meaning that trusts can be eternal.

Settlor

The settlor can be from any country (other than the SVG) and can be either a natural person or legal entity.

Trustee

The Registered Agent and Trustee Licensing Act of 1996 sets fort the qualifications and licensing of registered agents and trustees in the SVG.

The Financial Services Authority supervises registered agents and trustees in the SVG to assure their compliance with the laws.

Beneficiaries

Beneficiaries must not be SVG residents. They can reside and be citizens of any country.

Protector

The settlor can appoint a protector in the trust deed who oversees the actions of the trustee to ensure the rights of the beneficiaries are protected. The protector does not have to be a SVG resident and can reside and be a citizen in any country. The trust deed may confer many powers upon the protector including the right to add or remove trustees or overrule actions taken by the trustee. Settlors often appoint trusted financial advisors as their protectors.

Taxes

SVG does not impose any taxes on their international trusts.

However, United States citizens and residents must pay taxes on all world income like residents in some other countries requiring them to report all income to their tax agencies.

Public Records

None of the records of the Registrar are available to the public ensuring privacy for the settlor, beneficiaries, protector, and trust assets.

Time for Formation

Trusts can be prepared in one day with another day for registration.

Conclusion

A St. Vincent International Trust has the following benefits: total foreign participation, privacy, no taxation, fast formation, eternal duration, asset protection, estate planning, settlor’s control, no foreign interference, and English as the official language.