A Vanuatu Discretionary Trust provides foreigners a completely tax free structure with an 80 year lifespan for asset protection and estate planning. In addition, local trustees are available who under the law must pass a special test in order to be licensed as a trustee services provider for the protection of settlors, assets, and the beneficiaries of a trust.

The Trustee Act of 2010 along with Companies and Trust Services Providers Act of 2010 regulates the local trustee service providers. In addition regulations were enacted such as the Company and Trust Services Providers Regulation of 2013.

Background

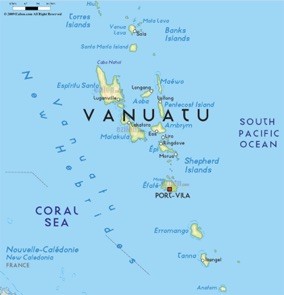

Vanuatu is a small island country located in the South Pacific Ocean. It is officially called the “Republic of Vanuatu”. It was colonized by both France and the United Kingdom gaining its independence in 1980.

Its political system is described as a “unitary parliament republic”. It has an elected one house parliament with a prime minister and a president.

Benefits

A Vanuatu Discretionary Trust offers the following benefits:

• Total Foreigner Involvement: Foreigners can establish trusts with foreign beneficiaries and assets located worldwide.

• Privacy: Trusts do not register with the government allowing for complete privacy.

• No Taxation: Vanuatu imposes no taxes on their trusts. However, U.S. taxpayers must disclose all world income to their IRS. Anyone subject to taxation of global income must report all income to his or her government.

• Fast Formation: The trust deed can be prepared in one day.

• No Reporting: Trust do not file any accounting records or tax returns.

• Estate Planning: Trust can exist for up to 80 years providing many generations of the settlor’s family with estate planning benefits.

• Asset Protection: Discretionary trusts provide stronger asset protection than common trusts against claims made by the settlor’s and/or beneficiaries future creditors because the trustee has total discretion over distribution of the assets and income.

• English: The three official languages are English, French, and the local native Bislama.

Vanuatu Discretionary Trust Name

Every trust must choose a unique name to avoid public confusion with other legal entities in Vanuatu.

The word “Trust” must appear at the end of its name in order for the public to understand they are dealing with a trust.

Discretionary Trust

A discretionary trust is defined as a trust allowing the trustee total discretion with distribution of the income and assets to the beneficiaries. The trust provides asset protection by granting power solely to an impartial third party rather rather than the settlor. Why? In most jurisdictions, laws invalidate asset protection trusts when their courts determine that the settlor exercised too much power and control. This is because a court court could order the settlor to turn over trust funds. When a third-party trustee steps in to protect trust funds, settlors are unable to turn over funds to the courts.

Distribution of the income and assets of a Discretionary Trust remain at the discretion of the Trustee.

Features of a Discretionary Trust

A discretionary trust has the following features:

• Settlors do not have to be physically in Vanuatu in order to create a trust. However, the trust deed must be signed where the settlor may appoint a nominee in order to protect his or her privacy.

• The trust deed can be executed anywhere in the world.

• Trusts do not have to register with the government.

• No restrictions exist preventing unlimited transfers of assets or accumulating income.

• The duration of a trust is for 80 years.

• Trustees can borrow funds using the trust assets as security.

Formation

The trust deed is the only legal instrument in which a settlor must execute (or using a nominee) to form a discretionary trust in Vanuatu. The reason the term “deed” is used is to infer transfer of custody of the assets to a third party (trustee) to manage and administer income and assets for the benefit of other persons (beneficiaries).

Settlor

The person creating the trust is known as the “settlor”. Settlors can be citizens of any country and may reside anywhere.

Trustees

Trustees can be appointed with citizenship in any country residing anywhere in the world.

International companies are prohibited from performing trust management services. Therefore, they need to incorporate as a “local” company. However, they can hold the shares of a local company licensed to provide trust management services.

Local trustees are available who must be licensed by the government to provide trustee services. The licensing process includes courses, understanding the trustee and corporate laws, as well as, passing a written examination demonstrating being “fit and proper” to manage trusts.

Local individuals cannot act as trustees. Only Trust management companies can be hired to perform trustee services. The Trust Companies Act in Chapter 69 sets forth the licensing process which applies to executors, trustees, and trust administrators regulated by the government’s Financial Services Commission. To qualify for a license, the trust management company must have:

• A minimum paid up capital of 15.5 million VUV (currently $147,400 USD) for its Vanuatu head office. If the head office is in another country then it must be 50 million VUV (currently $475,400 USD);

• Either a Vanuatu head or principal office; and

• A minimum of two local resident corporate officers.

Currently, the annual license renewal fee for a trust management company is 200,000 VUV (currently $1,901 USD).

Beneficiaries

The trust deed usually identifies specific persons (or groups of people) as the ones who benefit from the trust known as the “beneficiaries”.

A discretionary trust limits the rights of the beneficiaries who typically have the right to receive income and/or the assets in a normal trust. A discretionary trust provides the trustee with the power of total discretion as to which beneficiaries will receive the income generated by the assets and eventually the assets themselves, the amounts distributed, and when. However, settlors can prepare trust deeds which provide “guidelines” for such distributions which trustees usually follow.

Taxes

Vanuatu has no income tax, no corporate tax, no capital gains tax, no withholding tax, no sales tax, and no VAT tax.

However, they do have a stamp duty assessed on every legal document of settlement. The rate is up to a maximum of 1% or a minimum of 2,500 VUV (currently $23.77 USD). Since a typical initial settlement is under $15,000 USD, the minimum stamp duty usually applies. Only transfers of assets with a legal instrument are assessed the stamp duty. This means that cash and bank wire transfers are not subject to the stamp duty. In addition, foreign assets transferred by legal instruments not subject to the jurisdiction of Vanuatu do not pay a stamp duty.

Note: U.S. residents must report all world income to their IRS. Everyone else paying taxes on worldly income must also report all income to their tax authorities.

Accounting

Trusts do not file any financial statements or accounting records with the government. No audits are required.

Public Records

Since trusts do not register with the government there are no public records regarding trusts enabling the settlor and the beneficiaries the utmost in privacy.

Time to Form

A trust deed can be prepared in one business day.

Conclusion

A Vanuatu Discretionary Trust provides these benefits: complete foreign participation, no taxes, privacy, asset protection, estate planning, fast formation, and English is one of the three official languages.