Introduction

In 2000, Anguilla enacted The International Business Companies Act (IBC Act). This Act provides flexible company structures and efficient incorporation procedures. Shareholders privacy is guaranteed under the Act. Its legal system is based on British Common Law.

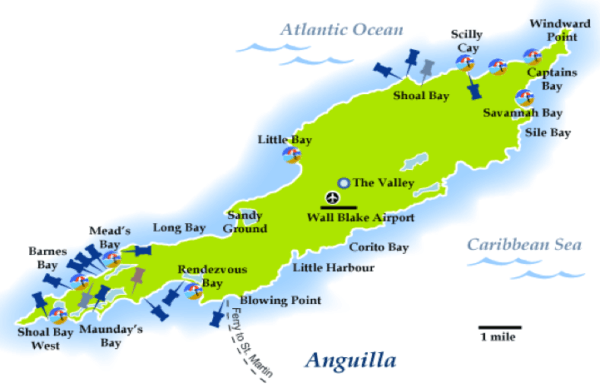

Anguilla in an island nation located in the Caribbean in the Lesser Antilles region. The nearest islands are Saint Martin to the south, and the Virgin Islands and Puerto Rico to the west. Anguilla Island is around 16 miles (26 kilometers) long and 3 miles (5 kilometers) wide. Anguilla’s capital is The Valley which is the island’s main “town” located in the middle of the island near its highest point with a population of approximately 2,000 persons.

Anguilla is a British Overseas Territory. However, it has self-governance under the auspices of the United Kingdom. This means that Anguilla enjoys a democratic parliamentary representative government with its Chief Minister as the head of executive branch of the government and a multi-political parties system. Anguilla adopted a constitution in 1982 called the “Anguilla Constitutional Order”. It has a House of Assembly as its parliament and an independent judiciary.

In addition, the UK provides military defense to Anguilla with no military bases or garrisons or even armed forces present on the island. Anguilla maintains a small national police force of around 35 police persons with one fast patrol boat.

Anguilla is included on the United Nations list of Non-Self-Governing Territories.

Anguilla is a popular tax haven with no direct taxation on either corporations or individuals.

Anguilla IBC Benefits

There are several benefits for an Anguilla IBC including the following:

- No Taxes: Anguilla IBC’s do not pay corporate tax or capital gains tax. However, U.S. citizens and others who reside in countries who tax worldwide income are required to declare all income to their tax authorities.

- One Shareholder: Only one shareholder is required to incorporate.

- One Director: Only one director is required to incorporate which can be the shareholder.

- Fast Incorporation: Upon completion of registration forms and payment of registration funds, an Anguilla IBC Company can be incorporated within 24 hours.

- Low Incorporation Fee: To incorporate in Anguilla and renewal fees cost $250 USD.

- Privacy: Under the IBC Act, it is a crime for anyone to reveal any information about an Anguilla company. Records at the government’s Registered Office are not available to the public.

- No Minimum Authorized Share Capital: There is no minimum Authorized Share Capital requirement for Anguillan IBC companies.

- Flexibility with Issuance of Shares: Shares can be issued in a variety of forms including bearer or registered, par or no par value, common or preferential, and voting or nonvoting.

- English: As a British Overseas Territory, English is the official language.

Legal and Tax Information

Anguilla Company Name

An Anguilla IBC Company must select a unique name which does not resemble other companies or corporation names.

The IBC Company name must end with a phrase or word indicating that it is a “corporation” or use abbreviations like “Corp.” or “Société Anonyme”, and “S.A.”.

In addition, unless the IBC Company has a license or special permission, its name cannot use any of the following words: Assurance, Bank, Building Society, Trust, or Foundation.

Office Address and Local Agent

Anguillan IBC Companies must have local a registered office and hire a local licensed company as its registered agent, which is automatically provided by your agent (such as this one) when your company is formed.

Shareholders

A minimum of one shareholder is required to incorporate. Shareholders can be from any country and reside anywhere in the world. Shareholders can be individuals or corporations.

Shares can be issued in a variety of forms including bearer or registered, par or no par value, common or preferential, and voting or nonvoting. They can also be issued in any currency.

Directors and Officers

One director is required who can be from any country residing anywhere. In addition, a shareholder can be a director. Directors can be individuals or corporations. Directors can also be nominees.

There are no requirements for Anguilla IBC Companies to have officers. If they do appoint officers, they may be from any country and can be individuals or corporations not having to reside in Anguilla.

Authorized Capital

There is no minimum Authorized Share Capital requirement for Anguillan IBC Companies.

Taxes

Anguilla IBC Companies are exempt from corporate taxes and capital gains taxes. These exemptions remain in place as long as the offshore corporation does not do business with Anguilla residents or own real property in Anguilla. In addition, they cannot provide company or corporate management or provide registered offices for other Anguillan offshore corporations or IBC Companies.

Annual Fees

The initial incorporation fee and subsequent annual renewal fees cost $250 USD.

Public Records

Copies of the following documents must be filed with the Registered Office: Articles of Incorporation, Certificate of Incorporation, By-laws, and Register of shareholders and directors.

Under the IBC Act, it is a crime for anyone to reveal any information about an Anguilla corporation. The only exception is pursuant to a court order issued by an Anguilla court only relating to investigations of crimes. The Register is not available to the public.

Accounting and Audit Requirements

There are no requirements to file accounting or financial statements or to appoint an auditor. Records and books must be maintained and be available for inspection if required.

Annual General Meeting

Anguilla IBC Companies are not required to hold annual general meetings. However, if they decide to, they can hold meetings anywhere in the world.

Time Required for Incorporation

Upon completion of registration forms and payment of registration funds, an Anguilla IBC Company can be incorporated within 24 hours.

Shelf Companies

Shelf companies are available for convenience and instant registration.

Conclusion

There are several benefits for Anguilla IBC Companies including: no corporate or capital gains taxes, only one shareholder required to incorporate, fast incorporation, low incorporation and renewal fees of only $250 USD, privacy as no public access to the government’s registry office, no minimum authorized share capital, flexibility with issuance of shares, and English is the official language.