What is a BVI Company? A BVI company is a corporation formed in the British Virgin Islands under the BVI Business Companies Act of 2004, which regulates all corporations. In spite of having the same features as a corporation, the BVI calls the types of businesses they permit to interact financially with non-residents of the BVI “business companies.”

BVI Company Bank Account

Many people seek to establish a BVI company bank account for their IBCs in the British Virgin Islands. A corporation established in the BVI can hold a bank account. Many people seek this arrangement for financial privacy, tax savings or asset protection. Whereas there are income tax exemptions on such entities in the islands you may be subject to taxation in your home country. Many people want to form companies in the BVI and open the corporate bank accounts in other jurisdictions such as Singapore or Hong Kong.

About BVI

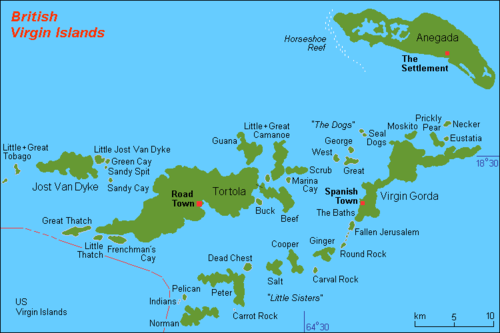

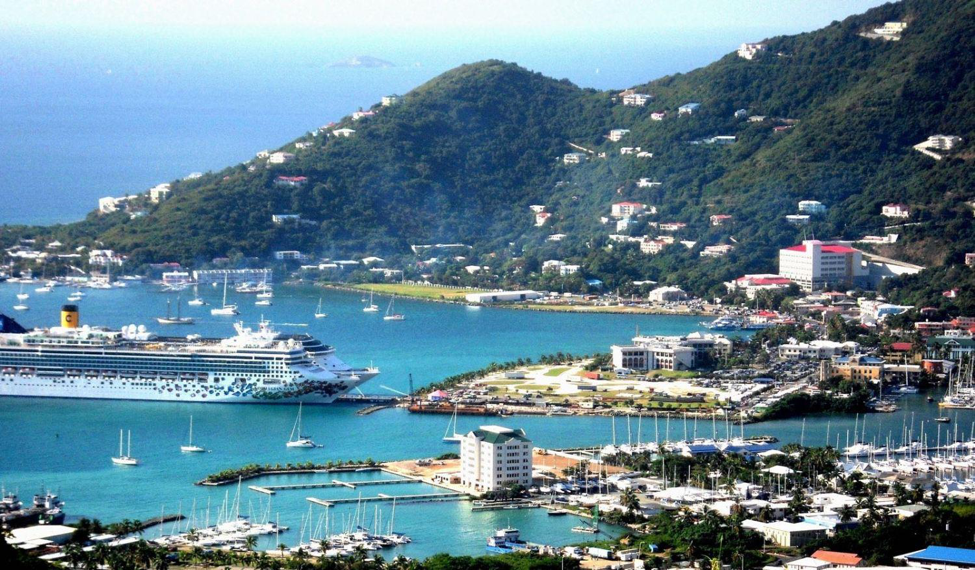

The British Virgin Islands (BVI) are part of the Virgin Islands archipelago located in the Caribbean to the east of Puerto Rico. The other islands are the Spanish Virgin Islands and the U.S. Virgin Islands. Many also call BVI the “Virgin Islands” and are a British overseas territory.

British Virgin Islanders are classified as British Overseas Territories citizens with entitlement to become full UK citizens. However, this territory is not part of the European Union (EU), yet those in Europe consider them Europeans.

The BVI land area consists of 58 square miles (150 square kilometers) and include main islands of Anegada, Jost Van Dyke, Tortola, and Virgin Gorda. The capital, Road Town, is located on Tortola, the largest island. The population of BVI is estimated at about 31,000 with approximately 23,500 living on Tortola.

BVI Company Types

The BVI Business Companies Act of 2004 permits the formation of five kinds of business companies:

- Business companies that are restricted by shares;

- Business companies restricted by a guarantee stating the company cannot issue shares;

- Business companies that are both restricted by a guarantee and can issue shares;

- Business companies that are unlimited but cannot issue shares; and

- Business companies that are unlimited and can issue shares.

BVI Company Benefits

Proceeding with BVI company set up can provide the following BVI company benefits:

- Popular Jurisdiction: The British Virgin Islands Business Company (BVI BC) is the most popular offshore legal entity in the world. Over 40% of all global offshore corporations are registered in the BVI.

- English: The official language in the BVI is English.

- One Shareholder: BVI corporations can have have a minimum of only one shareholder. There is no maximum number of shareholders.

- No Income or Corporate Taxes: The British Virgin Islands government does not require BVI Corporations to pay corporate or income tax. However, the US government requires its citizens to report all income to their tax authorities. Many other countries require their residents to pay tax on worldwide income as well.

- Clean Reputation: Neither The Financial Action Task Force (FATF on Money Laundering) or The Organization for Economic Cooperation and Development (OECD) has ever blacklisted the British Virgin Islands as a country forming offshore corporations. This means that international finance watchdog organizations. have long considered BVI as “white” (clean) financially.

- Privacy: BVI corporations do not need to share information about their officers, directors, owners, or shareholders. The BVI Register does not provide information identifying any of these names. So, they never appear on any public records.

BVI Company Formation Cost

The cost for an offshore company in the BVI is shown in the order process on this website. The BVI formation costs consists of the government fees, formation fee and required agent/office fee, document shipping, etc. A BVI company must be established through an agent (such as this one). There are are numbers and an inquiry form on this page to proceed with BVI company registration or for added support.

Corporate Name

BVI corporations must select a unique corporate name that is not similar to already existing corporation names. Typically, three versions of the corporate name are submitted with the hope that one of them will be approved.

BVI Office Address and Local Agent

BVI corporations must have a local registered agent and a local office address. This address will be used for process service requests and official notices. Post office boxes are not acceptable office addresses. However, the registered agent can make its office address designated as the corporation’s local office address.

BVI Company Shareholders

BVI corporations are required to have at least one shareholder. It is recommended that shares be issued immediately after incorporation otherwise the directors become liable for all contracts initiated by the corporation. The names of the shareholders, much like the directors, are not filed in any public records and kept private unless the company decides to file them.

BVI corporations can issue shares with or without par value in any currency.

BVI Company Directors and Officers

BVI corporations are required to have at least one director. A company secretary is not required.

The corporation’s directors to not need hold BVI residency status, and can be either private persons or business entities.

Authorized Capital

There is no authorized capital requirement in the BVI.

Taxes

BVI corporations are not required to pay corporate taxes to the BVI government.

Annual Fees

BVI corporations pay reasonable annual renewal fees. This changes periodically so inquire for specifics.

Public Records

BVI corporations do not need to share information about officers, directors, owners, or shareholders in any public records. None of this information is filed with the Register. Confidentiality is maintained, as these names are not disclosed in the public records.

The only company records that are made available to the public are the Articles of Association and Memorandum.

Accounting and Audit Requirements

Offshore corporations in the BVI are not required to keep annual records. However, BVI local corporations are required to publish their annual financial statements, and they must be audited once a year by an independent auditor.

Annual General Meeting

Annual general meetings must be held by BVI corporations. There is no requirement for annual general meetings to be held locally as they can be held anywhere in the world.

Time Required for Incorporation

BVI corporations can expect the entire process to take about three to six days. The time for completion depends on the approval of the corporate name registration, as well as, how quickly and accurately the applicant completes its registration and provides the due diligence documents. After formation, allow for additional time for shipping of the documents.

BVI Company Due Diligence Requirements

In order to establish a professional relationship, the law requires and our BVI company affiliate office needs to hold the following for each shareholder, director and beneficial owner of the company:

- A bank reference letter from a major international bank addressed to our BVI staff affiliate office. This must be an original on the bank’s letterhead. The reference letter should state how long you have been a client of the bank and must state if the relationship with the bank has been handled in a satisfactory and businesslike manner or similar wording.

- A professional reference letter, typically from an attorney’s firm, professional accountants firm, and or an auditors firm which has known you for at least two years and it must be addressed to BVI staff affiliate office. This professional reference letter should be an original on the firm’s letterhead and must state how long you have done business with their firm and must a provide professional reference.

- A color or very clear notarized copy of each director’s passport (the signature page and picture page)

- An extensive statement explaining the exact nature of the business (etc. what type of activities the company will engage in, and the main source of funds which will be used to finance this company and its business activities).

- Proof and confirmation of each director’s residential address (etc. latest copy of a utility bill no more than 2 months old).

Please keep in mind, if you are also opening a bank account or other services with us, you will be required to provide multiple sets of the original due diligence mentioned above. Therefore, when requesting items such as reference letters, utility bills, notarized passports/identification, you may want to request multiple originals.

Shelf Corporations

Shelf corporations are available in the BVI for faster incorporation.

BVI Company Formation Conclusion

British Virgin Islands (BVI) corporations receive many benefits including: incorporating in the most popular jurisdiction in the world where English is the official language and has a clean reputation with international finance watchdog organizations, no corporate or income taxes, only one shareholder required to incorporate; and strict privacy for owners, shareholders, directors and officers.