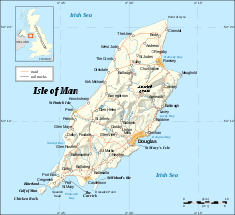

The Isle of Man is often called “Mann”, is an island located in the Irish Sea between Northern Ireland and England. It is a self-governing English crown dependency with Queen Elizabeth II its head of state, also known as the Lord of Mann which is represented by a Lieutenant Governor. The British government provides military defense and foreign relations on behalf of the Isle of Man. English is its native language.

The Isle of Man is a popular tax haven for British and foreign investors alike. The Companies Consolidation Act of 1931, which has been amended many times up until 1993, is the primary law regarding Isle of Man corporations. This law requires that the names of all directors, its registered agent, and office address be included in the public records. However, nominees can be appointed to provide corporate owners’ confidentiality.

Benefits

The Isle of Man offers many benefits and opportunities as an offshore jurisdiction to incorporate including the following:

• No Corporate Taxes: The primary benefit of an Isle of Man corporation is there are no corporate taxes. However, citizens of the U.S. and other countries whose worldwide incomes are taxed must declare their Isle of Man income to their tax authorities.

• No Minimum Capital: In the Isle of Man, no minimum capital requirement exists. Many corporations are formed with just declaring two pence Sterling as their capital.

• Bearer Shares: For ultimate privacy, an Isle of Man corporation can issue “bearer” shares with no name on the corporate share certificates other than “bearer” meaning whoever possesses the bearer share is the owner. In addition, there are not records revealing who the actual owner is of the bearer shares.

• Single Shareholder: A minimum of only on shareholder for an Isle of Man corporation has been allowed since 1993.

• Less Bureaucracy: Far less red tape and bureaucratic paperwork is required to form an Isle of Man corporation compared to the British or Irish legal systems.

• Less Filing Requirements: Isle of Man corporations do not have to file any type of accounting or annual financial summaries to the government.

• Superior Workforce: The Isle of Man’s workforce is well educated and highly skilled.

Corporate Name

Every Isle of Man corporate name must be unique and not similar to any other Isle of Man corporation’s name. The corporation’s name can be in any language. However, the corporate name cannot imply government or royal patronage.

Another requirement is that corporate names implying multi-national presence or high capitalization must obtain government approval for inclusion of words like “European” or “International”. In addition, government approval for usage of words like “Fiduciary”, “Trust”, “Trustees”, “Group” or “Holdings” are required.

Corporations seeking to provide the following services must obtain appropriate government licenses with usage of such services in the corporate name must be approved which includes: “bank”, “loans”, “savings”, “assurance”, “insurance”, “co-operative”, “building society”, “Chamber of Commerce”, “council”, “trust”, “finance”, and “municipal” or their foreign-language equivalents.

Office Address and Local Agent

Every Isle of Man corporation must have a local registered office and local agent. The local registered office is for official process services and official notices. Corporations are allowed to have a main office address anywhere in the world.

Shareholders

Only one shareholder is required to form an Isle of Man corporation. In addition, the minimum single share requirement can have a zero par value.

Directors and Officers

A minimum of one director is required for an Isle of Man corporation, and the assigned director does not have to be an Isle of Man resident. However, the corporation must appoint one resident company secretary. There is no requirement for having a managing director. Both the appointed director and secretary must be natural persons.

Directors are required to have their names included in the public records, but confidentiality is available if the corporation chooses to appoint nominees.

Authorized Capital

There is no minimum capital for an offshore corporation. Normally, the corporation’s registered agent only issues two £1.00 shares. The maximum authorized capital available is £2,000.

Taxes

Isle of Man corporations do not pay corporate or income taxes. However, if they own land and real property, the income generated is taxed at a 10% rate.

Annual Fees

The annual renewal fees are approximately 1,050 Euros.

Public Records

The only information regarding an Isle of Man corporation which is part of the public records are the office address and the names of the directors. However, the corporation can appoint nominee directors for privacy.

Accounting and Audit Requirements

Isle of Man corporations are required to file annual tax returns, even if no taxes are owed. The responsibility for preparing tax returns lies with the directors while the registered agent must file the return.

Offshore corporations do not need to prepare accounting records for tax filing. However, accounting records do need to be kept with the registered agent. Also, an offshore company will not have its accounts audited if two of the following requirements are met:

– its annual turnover is GBP 5.6 million or less;

– its balance sheet total is GBP 2.8 million or less;

– its average number of employees is 50 or fewer.

Annual General Meeting

No annual general meeting is required.

Time Required for Incorporation

The estimated time required for incorporation in the Isle of Man is 3 to 5 days once the corporate name is approved.

Shelf Corporations

Shelf corporations are available in the Isle of Man for faster incorporation.

Conclusion

The Isle of Man offers their corporations many benefits including no taxes, single shareholder, no minimal capital, the option to issue bearer shares for privacy, and less paperwork to form a corporation. In addition, the island offers a superior workforce.