A Nevis LLC has tremendous asset protection benefits. So, let’s get straight to the point and talk about the 10 main advantages of a Nevis LLC. First we will take a look at the benefits. Afterwards, you will find a detailed explanation of each item. We will discuss opening a bank account and discuss the charging order protection.

10 Advantages of a Nevis LLC

- The Nevis LLC provides asset protection for both multi-member and single member companies. That is, it protects the members from losing their companies or the assets inside from personal lawsuits. We call this “charging order” protection. (This is not the case for single member US LLCs in 47 of the 50 states, as of this writing.)

- One must post a bond in Nevis courts before filing a lawsuit associated with a Nevis LLC. This bond was $100,000 with the 2015 amendment. The legislature changed this in 2018 to any amount the court decides (including, but not limited to, greater than $100,000).

- Transferring assets to a Nevis LLC does not trigger tax consequences associated with most other types of offshore companies. This is because LLC’s are generally tax-neutral where taxes flow through the company to the members.

- There is a two years statute of limitations on fraudulent conveyance after assets are placed inside of a Nevis LLC. Thus, after this time, courts will refuse to hear a case for the purpose of charging a member’s interest.

- Fraudulent transfer accusations require a very high level of proof. Even if a creditor beats the statute of limitations, the law requires proof beyond a reasonable doubt. (This is a very high legal hurdle.)

- There is not a limit to the number of members one can add to the LLC.

- US Bankruptcy courts cannot generally touch Nevis LLC assets when properly structured (unlike US LLCs).

- Unlike US LLCs, Nevis courts do not allow foreclosure of a member’s interest in the company.

- There is a method for releasing a lien against someone’s ownership interest in an LLC. That is, someone else (spouse or children, for example) can obtain the debtor’s LLC membership free of the lien.

- US courts constantly rule that the courts where company was formed should interpret inter-company agreements; not where the LLC members live. This includes operating agreements, and transfers of membership interest mentioned above.

Nevis LLC Laws

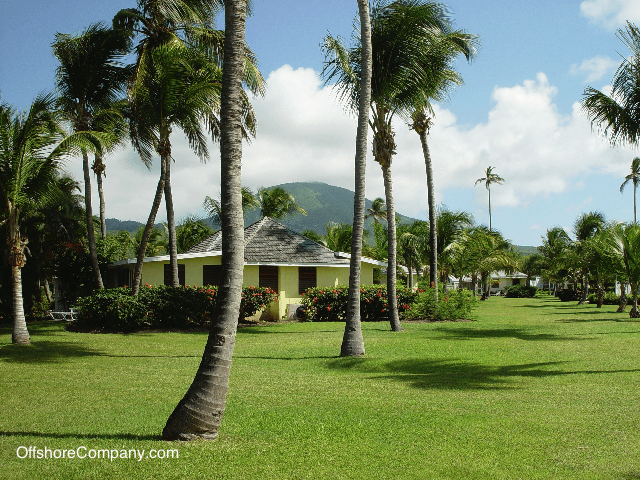

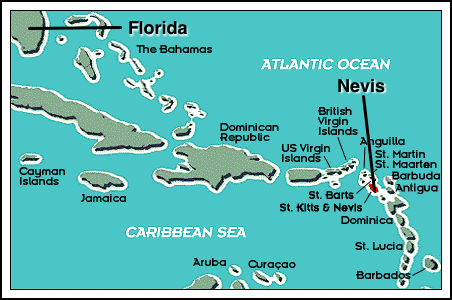

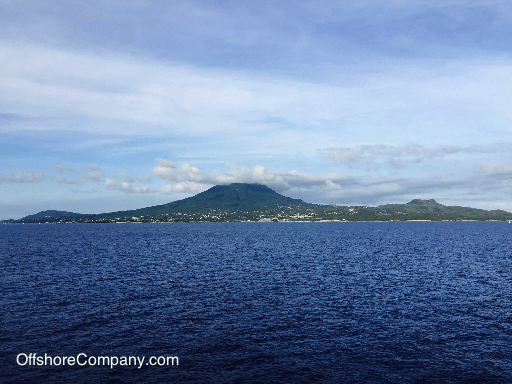

A Nevis LLC is a limited liability company formed under statutes enacted in the Caribbean island of Nevis. Nevis enacted LLC statutes in 1995 and amended them in 2015, further enhancing its asset protection features. The island of Nevis makes up part of the Federation of Saint Kitts and Nevis. It is located about 1300 miles southeast of Florida and about 300 miles east of Puerto Rico. It has, since 1984 when government enacted the Nevis Business Corporation Ordinance, promoted itself as an asset protection haven.

Establishing an LLC offshore can provide as additional layer of asset protection over US LLCs. You receive the most protection when you hold the assets in a foreign account in the company name. This is because these assets are outside the reach of US courts. Plus some foreign jurisdictions have LLC statutes that offer superior asset protection compared to US statutes.

The Island of Nevis, in particular, enacted favorable LLC laws in 1995. A US person, in turn, can use a Nevis LLC plus an offshore bank account or investment account. They often use this combination to help protect the funds from domestic lawsuits. Alternatively, one can use the company to run a business in the United States. Doing the latter is, first, just a matter forming a company. Next, one files foreign qualification papers in the state where one wishes to operate.

Naming Your Nevis LLC

The government needs to give special approval for companies containing certain words. Restricted words in the name of the company include the following: Assurance, Bank, Building Society, Chamber of Commerce, Chartered, Co-operative, Fund, Imperial, Insurance, Investment, Loans, Municipal, Royal, or University.

Favorable 2015 Amendment

The Nevis legislature amended the Ordinance in 2015, which further increased the asset protection benefits of a Nevis LLC. First of all, Nevis allows single member limited liability companies (SMLLCs). Plus they give SMLLCs the same protection as multi-member ones, unlike the majority of US states. That is, Nevis law establishes a charging order lien as a creditor’s exclusive remedy. So let’s say a creditor attacks a debtor’s ownership interest in a Nevis LLC formation. If so, LLC protects the assets that the LLC holds (such as it’s bank and/or brokerage accounts). This is the case even if only one person owns it. Thus, someone with a judgment against the owner of a Nevis LLC cannot take the LLC nor the assets inside.

Benefits in US Law

Better yet, suppose a US person or company has the charging order. The IRS requires a US person holding the charging order to pay taxes on that portion of member’s the profits that the company earns. Moreover, they owe the taxes whether they actually receive the distributions or not (Rev. Rul. 77-137). This is because the one who has the right to receive the distributions is the one responsible for the tax bill. So it doesn’t matter if the LLC actually distributes the profits or not. One more time, yes, the IRS would require the one who sued you to pay your Nevis LLC member’s tax bill. This is so even if you decide not to make distributions to them from your company. Charging order liens in Nevis expire after three years and are not renewable.

Operating a Nevis LLC

A US citizen who transfers assets to an offshore single member LLC does not trigger tax consequences. Normally, transferring assets to other types of offshore entities would do so. Nevis does not recognize foreign judgments. Management in our Nevis office knows of no case where a US creditor has ever obtained a charging order lien through Nevis courts to enable them to enforce a judgment from the US.

It gets even better. The 2015 amendment reduced the fraudulent transfer statute of limitations in Nevis to only two years. That means this. Suppose you transfer assets into a Nevis LLC. Two years later the courts will refuse to hear the case. Even better, the creditor must prove their case beyond a reasonable doubt. That is they must prove, to that level, that the debtor transferred assets to a Nevis LLC to hinder or delay creditors.

So, informing the courts that you simply moved assets into the Nevis LLC to diversify internationally may cast enough reasonable doubt. You can use this as a defense against fraudulent transfer accusations and keep creditors at bay. Moreover, the 2015 amendment makes a creditor post a $100,000 US bond before filing legal documents. Thus, to enforce a judgment against a Nevis LLC member is very expensive. In 2018, the Nevis government went a step further. They allowed the Nevis High Court to set a bond amount even higher (or lower) than the $100,000 US cap.

Protection in US Courts

On the other hand, US courts consistently hold that creditors can foreclose a debtor’s interest in a US single member LLC through US state court proceedings. US LLCs have the charging order lien protection as well. However, US courts consistently break through the protection afforded by US LLC statutes. Not in Nevis.

How does this help in US court? Additional amendments made in 2015 to Nevis LLC statutes can be very beneficial to defend assets held therein from attacks in US courts. The 2015 amendment to the Nevis LLC statutes possess verbiage protecting members who have charging order liens on their interest in the company. Other LLC members, who do not have liens on their membership, can obtain that member’s interest. For example, let’s suppose a husband, wife and two children own a company. The father gets a judgment against himself and his interest in the LLC obtains a charging order. The wife or children can obtain his interest in the LLC free from the charging order. Alternatively, he can redeem his own interest in the LLC with other assets, including assets that are exempt from judgment creditors.

Nevis LLC Charging Order Protection

In addition, the new statutes provide that even if a member has a charging order, he can still contribute additional capital. Plus, if there are two or more members, the member that is free to make distributions may do so without the need to make distributions to the charged member that would result in seizure of that portion of the distribution.

The two prior conditions have to do with the inner workings of the LLC and its members. In just about all US jurisdictions, issues having to do with inner-company matters and among the LLC members are regulated by the jurisdiction where the entity was formed and not by where the members or owners live.

Nevis LLC Administration

A US person operating a Nevis LLC may need to do a simple, one-time filing of the IRS Form 8832. Whereas, by default, US single-member LLCs receive sole-proprietor or “disregarded entity” tax treatment and multi-member LLCs are taxed as partnerships, offshore LLCs need to file the 8832. As such, a Nevis LLC is considered tax-neutral and should have no effect on taxation to the US person. Nonetheless, so we don’t appear to be giving tax advice, we recommend consulting with a CPA who is experienced with offshore structures.

Another nice feature of the Nevis LLC is that members or managers do not have to live in Nevis. For example, the manager of a Nevis LLC may be a member and may also be a debtor with a judgment against himself or herself. That person may live in the Unites States or any other county on the globe. If someone has a judgment, that person can have a significant amount of control over the Nevis LLC, which can hold assets in any country. The Nevis LLC can hold assets in the US, Nevis or anywhere else. The Nevis LLC may have a bank account in California, Nevis, Switzerland or elsewhere.

Nevis LLC Manager

Whereas it is possible, it is not optimal from an asset protection standpoint if a judgment debtor is also the manager of his own Nevis LLC. It is better to appoint a manager who lives outside of the US. Since US courts do not have jurisdiction over offshore LLC managers, a US judge cannot successfully enforce an order for the foreign person to send the funds back to the US. So, a properly drafted operating agreement will not allow a judgment debtor to remove a foreign manager, otherwise a US judge could order him to do so. Our Nevis affiliate organization is licensed and bonded by an insurance company to act in the best interest of clients. So, if there is a 100% chance of the creditor seizing the assets if they remain in the US, two choices come to mind.

Option one is to do nothing and let someone seize your hard-earned assets. Option two is to temporarily have our trust company/law firm take the reigns. Our trust company has gone through the intensive backgrounds checks necessary to obtain a Nevis license. Plus an insurance company backs its actions. In which scenario are the odds more in your favor? For those who do not have trusted friends or family members residing abroad, there are very reputable, longstanding trustee companies that have never taken a client’s money that can step in as initial co-managers or successor managers who can protect you when the “bad thing” happens.

Trust + LLC = Optimal Asset Protection

The ultimate asset protection arrangement involves an asset protection trust in Nevis or the more popular jurisdiction of the Cook Islands. In this arrangement, the offshore trusts holds all of the membership interest in the Nevis LLC. The client (and/or his or her spouse) is the beneficiary of the trust and is the manager of the Nevis LLC. The Nevis LLC, in turn, holds one or more bank accounts. The client is the signature on the bank account. When the bad thing happens, the trustee of the trust can step in as manager of the LLC, putting the client in a position of impossibility if a local judge orders him to repatriate the funds. There is no “fraudulent transfer” of assets when the position of manager changes because there are no assets being transferred. Only a position in the company changes.

When choosing a trustee, it is important to make sure that it is someone you can trust. If the trustee has a license in Nevis or the Cook Islands you can rest assured that the government has run significant background checks on its officers, directors and owners. In addition, local regulators frequently audit and scrutinize the trust companies. Because a sizable amount of the revenue in these jurisdictions comes from the offshore services industry, these countries work very hard to uphold the reputation of their respective jurisdictions. Incidentally, you will discover that the offshore management companies run a much more thorough background check on you than you will on them. They want to make sure they are doing business with reputable individuals operating with legal sources of funds. Maintaining their licenses depend on it.

Protection in a Legal Emergency

What you will find is that when you have a legal emergency and you want a Nevis LLC provider to come to the rescue, they do not manage your assets for you directly. Just like a managed investment account in the US, they assign an investment professional at a money management firm to invest your money for you, with your guidance. So if you need to have a trustee step in as manager of your Nevis LLC, they employ a bank’s investment manager in Switzerland, for example to handle your investments. The investment firm will typically contact you, propose a portfolio, and then seek your input.

So, like US managed accounts, you let the manager know your risk tolerances and the institution will come up with a proposal for you to approve within the Nevis LLC. So you can have them choose the appropriate mix of stock, bonds, precious metals and/or interest-bearing investments to meet your comfort level. In the case of Switzerland, a banker from that jurisdiction will often eventually fly in to meet with you personally when he is in the area visiting other clients. You will have online access to your account so you can check your investments. You may also receive paper statements and investment confirmations from your Nevis LLC account if you request them.

Advantages of a Nevis LLC

There are multiple Nevis LLC advantages, including the following:

- Exempt from Nevis taxes

- Inexpensive initial formation and annual maintenance

- Can be established within 24 hours

- Can operate a business in the US or other jurisdiction.

- Does not require paid-up capital

- The company is protected from seizure by a judgment creditor

- The assets inside of the company are protected from a judgment against a member.

- Single-member LLCs are legal

- Single-member LLCs receive the same asset protection as multi-member LLCs

- Members (owners) and managers (those who run the company) are not filed in the public records

- A manager of the LLC can control 100% of the company

- A manager is not required to be an owner yet can control 100% of the company and its assets.

- A person or legal entity from any country can be a manager or member.

- There are not any foreign exchange controls

- Can merge with an LLC from another jurisdiction

- A US corporation or LLC may convert to becoming a Nevis LLC

Legislation

The Nevis LLC is created under the Nevis Limited Liability Company Ordinance 1995 and as amended in 2015. The statutes were originally based on the company statutes in the very favorable US State of Delaware.

The Nevis Limited Liability Company (Amendment) Ordinance, 2015 (the “Ordinance”) was enacted on July 1, 2015. There were two major asset protection revisions. First, there was a restatement of the section dealing with charging orders. Second, there was a new section added regarding fraudulent transfers.

The main change to the charging order section is that the charging order is the sole remedy that is available to any judgment creditor (including a bankruptcy trustee). That is whether the Nevis LLC has only one or has multiple members, Nevis courts will not allow seizure of the LLC or the assets held therein. Moreover, the the law does not allow the charging order to include amounts that arise from fines, penalties or punitive damages.

The statutes do not consider the charging order against a Nevis LLC as a lien on that member’s interest in the company. The one who has the charging order may not jump in and become a member, so the original owner retains his ownership. They cannot exercise the rights of any member. The holder of the order cannot interfere with any management decisions. Furthermore, they cannot liquidate or seize any assets of the company. They cannot restrict the company’s activities. Moreover, they cannot dissolve the entity.

Charging Order Expiration 3 Years

Unlike a US judgment that typically lasts for 10 years with a 10 year renewal (for a total of 20 years), a Nevis LLC charging order is not renewable and has to expire after three (3) years after it is filed. Moreover, the company can continue to seek additional investments from its members and can hold onto the distributions that would usually go to the the charged member.

In Section 43A, a new statement was added dealing with fraudulent transfers into the company. This section addresses creditors who try to seize assets that a judgment debtor has transferred into the company. Taking after Nevis and Cook Islands trust law, this section says that a creditor needs to prove beyond a reasonable doubt that the reason for the transfer was to defraud that particular creditor and that the member, thereby, was made insolvent. Moreover, the calculation includes the entire fair market value of the member’s interest in the LLC. So, if the fair market value of the member’s assets were greater than the amount of the creditor’s claim when the transfer was made, the courts do not consider the transfer to have been made with fraudulent intent.

Conclusion

In summary, unless the client says, “Yes I put my assets in the Nevis LLC in order to keep them away from you Mr. Creditor,” and gives some other legitimate reason for moving the funds, the reasonable doubt statute should suffice to prevent a charging order against the LLC. Even if a creditor receives a charging order against the LLC, the statutes make it virtually impossible to obtain company assets.

The sooner one puts assets into a Nevis LLC the better. The reason is that there is a two year statute of limitations for a creditor to file claim against a member’s interest. Even more painful for the one filing the lawsuit, the statutes require a creditor to post a ($100,000, for example) cash bond up front with the courts before filing. So, the legislature has riddled Nevis LLC statutes with multiple barriers to prevent creditors from getting to a member’s assets.