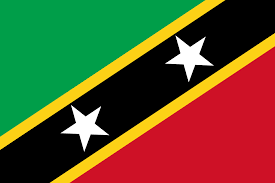

This is an update regarding Nevis LLC and Nevis corporation legislation. Due to the recent visit to the Federation by the OECD. The Financial Services Regulatory Commission has proceeded to update of its legislative and regulatory framework to ensure its compliance with international standards.

Such legislative updates include but are not limited to the various tax and information exchange arrangements with foreign countries and mutual legal assistance in criminal matters with foreign countries.

Nevis Company Laws

In light of this the Legislation were recently amended to state that:

A corporation/company which does not carry on business in Saint Christopher and Nevis, shall not be subject to any corporate tax, income tax, withholding tax, stamp tax, asset tax, exchange controls, or other fees or taxes based upon or measured by assets or income originating outside of Saint Christopher and Nevis or in connection with other activities outside of Saint Christopher and Nevis or in connection with matters of corporate administration which may occur in Saint Christopher and Nevis.

Any dividend paid by a corporation which does not carry on business in Saint Christopher and Nevis to its shareholders, shall be exempt from any tax or withholding provisions of the laws of Nevis which would otherwise be applicable to such corporation or the recipient of the dividend.

No corporation/company shall be considered to be carrying on business in Nevis solely because it engages in one (1) or more of the following activities:

(a) maintaining bank accounts in Nevis;

(b) holding meetings of directors or shareholders in Nevis;

(c) maintaining corporate or financial books and records in Nevis;

(d) maintaining an administrative office in Nevis with respect to assets, business or activities done outside of Nevis;

(e) maintaining a registered agent in Nevis;

(f) investing in shares of a Nevis company, international business corporations, or investing in the interest of Nevis limited liability companies, acting as a partner of a partnership registered under the Partnership Act or the Limited Partnership Act, or as a beneficiary of an international trust or a qualified foreign trust; or

(g) acquires real property in a local, industrial or tourist facility provided always that such property shall be situated in a project or development approved and authorized by the Nevis Island Administration.

Effective Dates

Any corporation/company that wishes to carry on business pursuant to subsection (1) shall do so only if it is incorporated in Nevis on or before the 31st of December, 2018.

Notwithstanding the provisions of the above, the Nevis tax exemptions granted to all corporations /companies were set to cease 30th June, 2021. However, updates in 2020 have confirmed the Nevis government’s commitment to allow Nevis tax free* income for offshore companies that operate outside of St. Kitts and Nevis.

*Note, this it tax-free in Nevis. You may still be subject to taxes where you reside and/or are a citizen.