A Suriname Limited Liability Company (NV) is the most popular legal entity that foreigners choose to create. Their LLC (NV) offers a low minimum share capital and only requires one shareholder who can be the only director for greater control. Foreigners may own 100% of the shares

Background

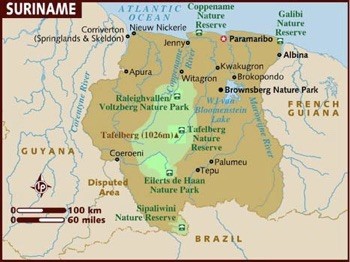

Suriname is the smallest country in South America. It is bordered by Brazil to its south, Guyana to its west, French Guiana to the east and situated on the northeast Atlantic coast.

Its official name is the “Republic of Suriname”. It has been a sovereign state since 1975. Before that it became a constituent country within the Kingdom of the Netherlands in 1954. As a result, Dutch is its official language.

Its political structure is described as a “parliamentary unitary republic” with an elected one house national assembly and a president. Their laws follow Dutch civil laws.

Their natural resources include: gold, oil, timber, iron ore, and others. The principal resource for exportation is alumina where large multi-national companies are active including Alcoa and BHP.

Benefits

A Suriname Limited Liability Company (NV) provides foreigners with the following benefits:

• Full Ownership by Foreigners: All of the shares in the LLC may be owned by foreigners.

• Privacy: The names of the shareholders and directors are kept out of the public records.

• Limited Liability: A shareholder’s liability to the LLC’s debts and losses is limited to his or her purchased shares.

• One Shareholder: The LLC may be formed with only one shareholder.

• One Director: A sole shareholder may become the sole director of the LLC for total control.

• Low Share Capital: Currently, the required authorized minimum share capital is 1,000 SRD which equal $134 USD.

• English: While not being an official language, English can be used in their legal documents along with a certified translation into Dutch.

Suriname Limited Liability Company (NV) Name

All LLC’s must select a name totally unique from the name of any other legal entity in Suriname. Verification of the proposed company name’s availability can be performed at the Chamber of Commerce and Industry.

A “Limited Liability Company” and its abbreviation “LLC” is translated into Dutch as “Naamloze Vennootschap” with an abbreviation of “NV”. Suriname LLC’s must either use the Dutch or English words or the abbreviation at the end of of their company name.

Limited liability

Shareholders are protected by having their liabilities for debts and losses by the LLC limited to the actual shares they purchased.

Registration

The registration of all new companies must be done at the Trade Register of the Chamber of Commerce and Industry. A notarized copy of the new company’s Articles of Association must be filed with the Chamber. In addition, a draft of the Bylaws (statutes) must be filed. Finally, a copy of the founder’s passport and country ID (like a driver’s license or national identity card) are filed.

Approval is obtained from the Cabinet of the President. Then the new company can register at the tax office of the Ministry of Finance to obtain a unique tax identification number for the new company.

If a business permit or license for a specific type of industry is required, application is made with the Business Licensing Department of the Ministry of Trade and Industry.

Shareholder

Only one shareholder is required to form the LLC. A legal entity may be a shareholder.

Shareholders are not restricted by nationality or global place of residence.

Director

Only one director is required to supervise the company. The sole shareholder can appoint him or herself as the sole director for greater control of the LLC. Legal entities are permitted to become directors who may be registered in any country. Natural persons appointed as directors may be citizens of any country.

Secretary

A company secretary is mandated by law. The company secretary should be familiar with local laws and filing requirements to make sure the LLC complies with all legal requirements.

Minimum Share Capital

The required minimum share capital to form the LLC is 1,000 Surinamese Dollar (SRD) which currently converts into $134 USD.

Taxation

Annual tax returns are required. However, small companies are not required to have them audited.

The corporate tax rate is 36% and is based on worldwide income.

The income tax rate is based on a sliding scale from 0% (income up to 2,646 SRD) up to 38% for income above 32,839 SRD. It is also based upon worldwide income.

Dividends are included in income taxes. Dividends withholding tax is 25%. LLC’s paying dividends to non-residents must withhold 25%.

There is no Value Added Tax (VAT) in Suriname.

Annual Meetings

Annual meetings for the shareholders are mandatory. Meetings may be held in any country.

Privacy

While the names of the founders are included in the Chamber’s records, they are not available to the public. The names of the directors and shareholders are never part of the public records.

Time to Form

The formation process for a new company can take up to one month for approval. However, the government allows a new company which has filed all required documents with the Chamber to operate while waiting for approval.

Conclusion

A Suriname Limited Liability Company (NV) offer foreigners the following benefits: total foreign ownership; privacy, one shareholder who can become the only director for complete control, low minimum share capital, limited liability, and English documents can be used with a certified translation.