A St. Lucia International Trust designed for foreigners offers strong protection of the assets. In addition, they offer strict confidentiality laws to protect their privacy. Plus, the statutes offer perpetual or 120 year life spans.

The St. Lucia International Trust Act of 2002 (hereinafter the “Act”) governs the formation, activities, and termination of trusts. This Act, additionally, protects foreigners from other countries’ laws, creditors, and forced heirships.

Background

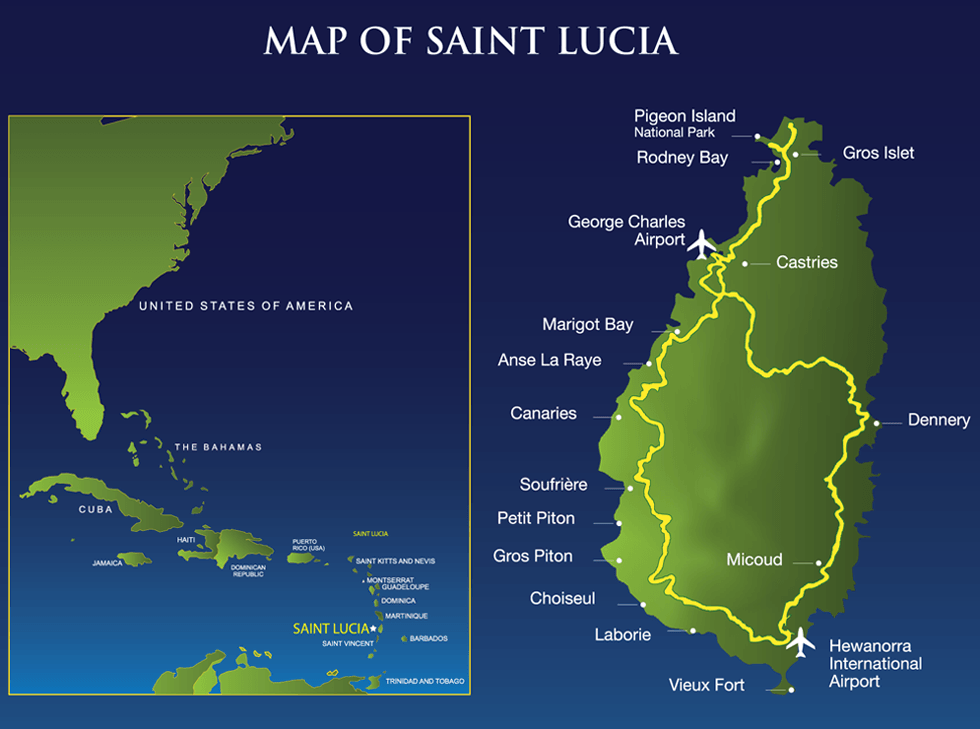

Saint Lucia (St. Lucia) is an island country located in the Caribbean. It was colonized by both the French and the British which affects its political system and judicial system.

After gaining its independence from the United Kingdom in 1979, it maintains ties to the United Kingdom as its monarch is the UK’s Queen Elizabeth II. As a result, English is its official language.

British Common Law dominates its judicial system while its Civil Code is based upon Canada’s Quebec system and French laws.

Benefits

A St. Lucia International Trust offers these types of benefits:

• Designed for Foreigners: International trusts laws were created especially for foreigners.

• No Taxation: International trusts and non-resident beneficiaries are exempt from all taxes. However, U.S. taxpayers must disclose all global income just like others residing in countries taxing global income must report all income to their tax agencies.

• Asset Protection: St. Lucia courts do not recognize foreign court judgments or laws affecting international trusts and their assets.

• Privacy: The names of the settlor and beneficiaries along with descriptions and location of assets are never included in public records.

• Confidential: Trustees violating confidentiality laws are subject to severe penalties including a $100,000 USD fine.

• Estate Planning: Some trusts have perpetual lifespans and others have 120 years. An ideal estate planning structure preserving a family’s assets and succession for many generations.

• Fast Formation: An international trust can be formed and registered in one business day depending upon the speed of the preparer.

• English: After many years of British rule, English remains its official language.

St. Lucia International Trust Name

Trusts must select a name which does resemble a legal entities name in Saint Lucia.

To avoid confusion with other legal entities, a trust is required to have its name end with the word “Trust”.

Types of Trusts

International trusts can be “Purpose” trusts where a specific purpose (charitable or non-charitable) for the trust is declared, The other type is a “Protective” trust where the beneficiaries’ interests can be suspended, reduced, or terminated upon specific events occurring.

Duration

The rules against perpetuities and the rules against accumulation will not be enforced against trusts. Protective trusts have a maximum lifespan of 120 years. Purpose trusts may be perpetual with an unlimited timespan.

Registration

A copy of the Trust Deed is prepared before the registration process begins, but its filing with the government only involves being stamped by the Registrar and immediately returned with no copies kept on file.

The following forms are filed with the Registrar:

• Written notification of the name and address of the trustee and location of the registered office.

• Written statement that the settlor transferred assets to the trust which did not leave the settlor insolvent or with the intent to defraud creditors.

• A written declaration by a local attorney certifying that the trust meets all requirements of an international trust as defined by the Act.

The registration process completes after all the required forms are filed and the Registrar approves them. The Registrar then issues a Certificate of Registration.

Registered Office and Trustee

The Act requires every trust to appoint a local licensed registered trustee to provide trustee services and to receive service of process and legal notices. While the registered trustee maintains a record of the names of the settlor and the beneficiaries, those records remain with the registered trustee and are not filed with the government or accessible to the public.

The registered trustee’s office serves as the official registered office for the trust.

Trust Deed

The trust deed contains the settlor’s wishes regarding the purpose, assets, beneficiaries, trustee, and protector. All of their rights, duties, and powers are included. The lifespan duration, and how assets are managed and administered to the beneficiaries are also included.

Settlor

The settlor is the person creating an international trust who can be a citizen and living in any other country.

Trustee

A trustee agrees to hold title of the settlor’s assets for the benefit of the beneficiaries under the terms of the trust deed and the Act.

The Act requires the appointment of a “registered trustee” who holds a valid license pursuant to the Registered Agent and Trustee Licensing Act to serve as a trustee for international trusts. Trustees are subject to strict confidentiality laws including a fine of $100,000 USD for any violations.

Beneficiaries

A trust benefits specific persons called “beneficiaries” who can be citizens of and living in any country. However, if a beneficiary is a resident of St. Lucia he or she will subject to local income taxation.

Protector

The Act allows for the appointment of a protector who can be the settlor, a beneficiary, or any other person the settlor selects. The purpose of a protector is to protect the beneficiaries, ensure the purposes of the trust are fulfilled, and to oversee the trustee. The trust deed provides whatever powers the settlor wishes for the protector to possess. These powers may include vetoing actions of the trustee, or removing and adding beneficiaries, or requiring how assets will be invested and income distributed to some or all of the beneficiaries.

The protector may be a natural person residing in any country.

Foreign Laws

St. Lucia courts will not recognize foreign laws related to the validity of a trust. Likewise, foreign judgments against an international trust are unenforceable.

A foreign court judgment creditor must file a claim against a trust or any of its assets with the courts in St. Lucia.

A two year statute of limitations exists in order to file a claim against an international trust and/or its assets. Before a lawsuit against a trust can commence, the claimant must post a $25,000 USD security bond to ensure court costs will be paid. These requirements protect a trust against unfounded or frivolous claims.

Forced heirship laws of other countries are not recognized by the Saint Lucia courts.

The Fraudulent Conveyance Law (Statute of Elizabeth) does not apply toward trusts or their assets.

Taxes

According to the Act, international trusts are exempt from:

• All income taxes (including corporate tax);

• All gift, inheritance, estate, and succession taxes;

• Stamp duty related to all instruments and transactions performed by the trustee involving trusts; and

• All foreign currency exchange controls.

Likewise, the beneficiaries are exempt from all taxes unless a resident of Saint Lucia subject to local income taxation of distributions from a trust.

Note: Every U.S. taxpayer and everyone subject to worldwide income taxation must report all income to their respective tax authorities.

Confidentiality

The trustee must keep all information concerning a trust private and confidential from all persons except the settlor, protector, and the beneficiaries. Violation of this results in severe penalties such as a $100,000 USD fine and suspension from all trustee activities and services licensing for four years.

Public Records

The Registrar does not keep a copy of the trust deed. None of the documents filed with the Registrar contains the names of the settlor or the beneficiaries.

While the registered agent keeps a record of the names of the settlor and the beneficiaries, those records are never filed with the government and are not available for public inspection.

Time to Form

An international trust can be formed and registered in one business day depending upon the time the preparer takes to write the trust deed and the registration forms.

Shelf Trusts

Due to the uniqueness of each trust, shelf trusts are not available to purchase in Saint Lucia.

Competing Jurisdictions

The most popular jurisdictions for asset protection trusts are Cook Islands and Nevis. From an asset protection standpoint, Cook Islands and Nevis have the strongest laws to secure assets. They each have long standing case law history. Plus they have proven trustworth jurisdictions.

Conclusion

A St. Lucia International Trust enjoys these benefits: total foreign participation, no taxes, privacy, confidentiality, fast formation, asset protection, estate planning, and English as the official language.