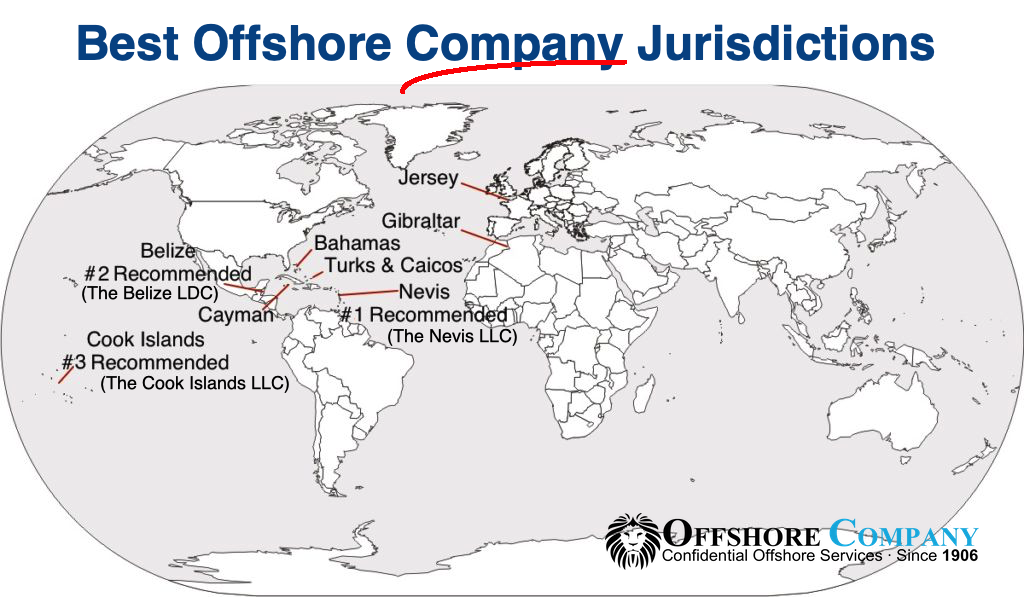

There are a number of legal tools at your disposal for global wealth planning. The Nevis LLC or Cook Islands LLC combined with an offshore trust is one of the strongest combinations for asset protection from lawsuits. Not only this, but by and large the most common of these are through the formation of offshore vehicles such as LLCs (Limited Liability Companies) and trusts. Both of these legal tools have some overlap in their purpose. Conversely, they have some distinct differences in their features and benefits.

Our purpose here is is to give you a breakdown of each of these products so that it may help you understand the pros and cons of each. In turn, you may determine which may be most suitable for you own personal circumstances. We will use the example of establishing these in Nevis – one of the most popular jurisdictions for some of the most comprehensive asset protection available as well as the Cook Islands.

Offshore Limited Liability Companies

So, what is an LLC? A limited liability company or LLC is the U.S version of a private limited company or PLC (British terminology). At its most basic level, an LLC is a hybrid business entity. As such, it has some characteristics of both a corporation and a partnership or a sole proprietorship. To be more specific, the business structure of an LLC combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. Pass-through taxation is one of the benefits of an LLC. Rather than paying corporate taxes, an LLC’s profits will pass through to its members. Members report the taxes on their personal tax returns. The government taxes profits are only once, at each member’s individual income tax rate.

Limited liability also means the members are usually not personally responsible for the LLC’s debts and lawsuits. If an LLC files for bankruptcy, the members typically do not have to use personal money to pay the company’s debts. Hence if the LLC faces a lawsuit, the members in most cases do not risk losing their home to cover a settlement.

Due to the asset protection features of the legislation governing Nevis LLCs and trusts, there is an ever-increasing demand for asset protection offshore structures and since its inception, Nevis has become a popular offshore jurisdiction. This is because it offers this extra layer of protection from the strong arm of foreign governments and creditors than your conventional LLC.

Offshore Nevis LLC Detail

Here are some bullet points to give a bit more detail of some of the features and benefits of a Nevis LLC:

- An LLC can be formed within 24 hours of submitting the necessary forms and fees.

- There is no minimum capital contribution that must be made by a member to the LLC.

- Single Member LLCs are allowed.

- It may be managed by the members directly, or by manager(s) independent of the members.

- Can easily transfer existing foreign LLCs to Nevis.

- Liability is limited to the LLC and cannot be passed onto its members or managers.

- Foreign judgments are not enforceable in Nevis, except in certain circumstances where a charging order will be recognised by the court.

- The LLC may conduct lawful business in any part of the world, managers and members are not required to be residents of Nevis.

- There is no public register. Information may only be obtained from the Company itself.

- Information on the LLC must be kept confidential unless otherwise required by law.

- The LLC is tax exempt in Nevis (though you may need to pay taxes in your home country).

Offshore Asset Protection Trusts

A foreign asset protection trust (FAPT) is a significant step up from an LLC for protecting assets and is renowned for providing the highest level of security for personal assets. Those who most benefit from a FAPT include persons in high-risk occupations (such as physicians and lawyers), entrepreneurs , those with a high wealth profile, directors of public companies, and almost anyone who has a considerable amount in savings for retirement.

With such an arrangement the settlor gives complete control of their estate to trustees for the benefit of beneficiaries. Although this might initially be seen as a drastic measure, it is this requirement which provides the highest level of security for personal assets. This is because the assets held are out of the client’s control. They belong to the trustee who is completely independent of the settlor. The trustee is the legal owner of the trust assets, while the beneficiary has a beneficial interest where the trustee must manage and administer the assets for their benefit.

Many experts view a Nevis Trust or Cook Islands Trust as the strongest legal vehicles for asset protection in the world. The law in these jurisdictions contains a number of unique features, which make them significant deterrents to any unexpected future legal proceedings.

Nevis and Cook Islands Asset Protection Benefits

The most significant of these we’ve outlined below:

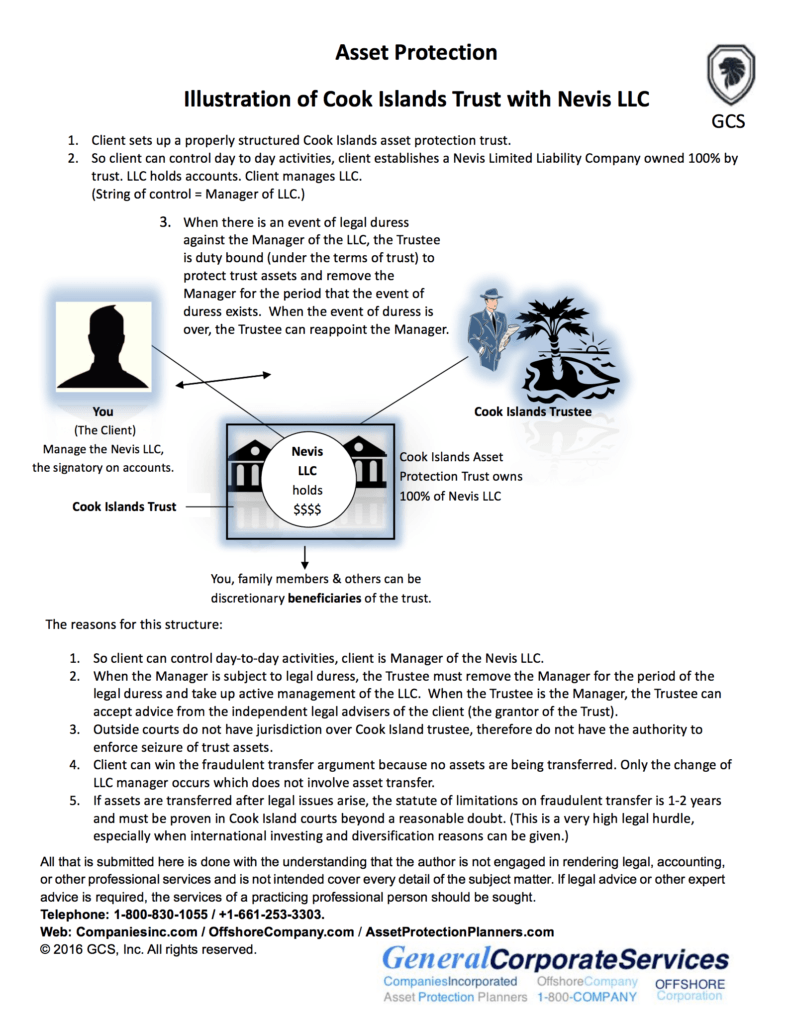

- Nevis or Cook Islands courts will not recognize judgments made by foreign courts. If a creditor does wish to pursue claims against assets held in a Nevis or Cook Islands trusts, they are required by law to file proceedings with Nevis or the Cook Islands courts. Creditors must physically travel to Nevis or the Cook Islands in order to do so.

- Nevis trusts and Cook Islands trusts have some of the shortest statutes of limitations on claims of fraudulent transfer provided by any jurisdiction offering asset protection trusts. There is a two year statute of limitations. Any assets placed in the trust before the earliest cause of action occurring or more than two years after are safe. However if disposition of assets took place within the two year period, and the creditor has not commenced action within one year from the date of settlement, a claim cannot be brought. Once the statute of limitations has run out, Cook Islands courts will dismiss any claims of fraudulent transfer. In addition to above, there are further hurdles that the creditor must overcome.

- The standard of proof is beyond reasonable doubt and not on a standard of probabilities; the settlor of the trust or member of the LLC must have had the principle intent to defraud at the time of such formation or disposition to such an extent that if render them insolvent or without property with which that creditor’s claim would be successful.

- The details of the beneficiaries and settlors of a trust in Nevis and the Cook Islands are not publicly registered. Only the name of the trust, the name of the trustee, and the date of the trust deed are required to be registered. Cook Islands records are not open to the general public.

- Trusts are exempt from Nevis or Cook Islands taxation, except for the payment of a U.S. citizens and those residing in other countries that tax worldwide income are however required to report all earnings to their respective tax authorities.

- The Nevis and Cook Islands allow trusts to exist in perpetuity (forever). Nearly all other countries do not allow this and require them to cease existence after an established maximum number of years, which is usually 80-125 years depending on the country.

How the Trust and LLC Works

The trust owns 100% of the LLC. The client is the initial manager of the LLC in most cases. The bank accounts are in the LLC name. Our offshore trustee / law firm offshore becomes the manager of the LLC when legal duress arises.

Settlors can deposit cash, title to real estate, investment accounts, and businesses into a the LLC. Again, the Nevis Trust or Cook Islands Trust owns the LLC. Even better, no assets within a Trust / LLC have to be located in the Cook Islands or Nevis. Thus, on can manage the assets remotely and with ease.

Because local courts have jurisdiction over local real estate we employ another strategy. We equity stripping liens (mortgages/deeds of trust) against the property. We initially record the liens as payable to the LLC. Then we have a third-party lender purchase the liens and place the proceeds in the offshore trust.

Conclusion

In conclusion both the Nevis LLC the Cook Islands LLC and trust are some of the most popular offshore global wealth planning solutions for asset protection. Although both have some similarities they also have a number of distinct differences and typically serve quite different purposes. If you are a beginning entrepreneur and perhaps cost is also an issue, the LLC may be your best option. It is also more suitable if asset diversification across multiple jurisdictions is appealing and you want a higher layer of protection compared to your domestic LLC. If however your number one priority is solely asset protection the establishment of the foreign asset protection trust will likely serve you incredibly well.

The above is just a brief introduction to two of the most popular asset protection products available for offshore asset planning. It’s important to note however that although an LLC or trust are often formed completely separately and unrelated, they can also be co-created and used in conjunction with each other to provide an extra level of sophistication.

If you would like to find out more about how either of these products may assist you or to find out more about some of our other financial products please do not hesitate to contact by calling the numbers above or completing a free consultation form on this page.