Chapter 6

It’s nice to think of the world as a kind place where you may never face any legal problems. However, if you study the statistics, you will find that there’s a good chance that at some point you will wind up with a lawsuit on your hands. More than one. According to attorney Jay Mitten, the average person in the US encounters seven lawsuits in his or her lifetime. With it, comes an unscrupulous lawyer adding fuel and fanning the flames of your problems.

This is even more likely for regular people who own their own businesses. As such, unexpected lawsuits—perhaps frivolous attempts to snatch your wealth—may be delivered to your doorstep at any time. One thing is certain for most people. It doesn’t matter whether a lawsuit comes through a business or personal matter. It could be a divorce, or even a tax issue. Whenever you wind up in court, you want your assets, or at least some of them, to remain protected. As such, many turn to offshore banking combined with the proper legal tool to protect their assets from such unfortunate perils in life.

Why Offshore Banking?

So, why do people open offshore bank accounts? The United States only has 4.2% of the world’s population. However, it has 80% of the world’s lawyers and 96% of the world’s lawsuits. So, asset protection is the name of the game for Americans as this is the most onerous threat to their finances. Most people moving personal capital out of the country are focused on the concept of asset protection. Plus, they feel it necessary to protect their gains potential future threats—creditors, litigants, and divorces. Most legal attacks come from inside the US.

They also tend to use offshore accounts to minimize their tax payments. This is mostly on earned income coming in from other countries. The US taxes its people on worldwide income. However, companies such as Apple and Google shield funds offshore and enjoy tremendous tax savings. Unlike the US, some countries do not tax their citizens on worldwide income. Everyone cannot take advantage of this, however, so seek licensed tax advice first. Again, don’t just wing it an invent an “it should be this way” tax strategy in your mind. Get licensed tax advice.

For people participating in asset protection, they often place these assets in one of the several small, independent island-states. These regions find a market of interested foreigners ready for offshore banking services. Many of these countries have legislation that exempts the assets from judgments. Plus, some regions can provide a good deal of privacy for those investing in these accounts. Naturally, the law obligates one to follow the laws of his or her own country.

Offshore Asset Protection

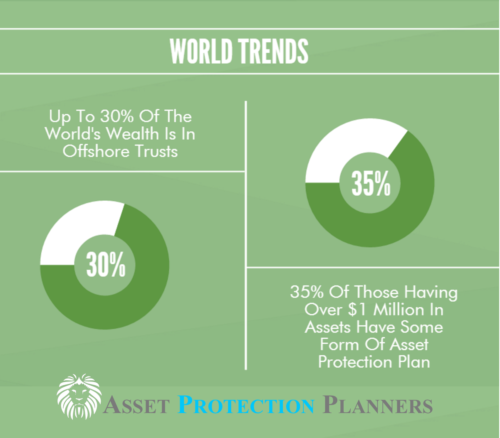

Asset protection sometimes takes quite a few forms. While there are lots of onshore choices, offshore vehicles are usually far more effective for the goal of asset protection. Notably, offshore trusts offer the utmost in asset protection. And remember, if you feel guilty at all about taking this route, don’t. After all, it’s your assets we are talking about—those you worked hard to acquire.

Know that at its core, asset protection isn’t anything more than risk administration. It is like buying an insurance policy; and usually much more protective and cost-effective. If you’re doing business today, then you understand how hard it is to earn a profit. Thus, erecting a fortress that both protects the fruits of your labor and saves you money is likely a wise maneuver.

If you operate more than one business you don’t want claims arising from one business to jeopardize the others. As such, you might want to think about an individual entity for each business. This approach puts each business into its own individual cubby hole. That way, a lawsuit against one enterprise won’t topple your entire empire. In addition, you maximize the strength of your asset protection strategy when you do so overseas. So, what are your options for offshore asset protection?

Nevis and Asset Protection

Nevis was one of the first offshore havens in modern times to offer asset protection and privacy statutes. It is one way to try and balance out the risk of operating multiple businesses. Companies in Nevis can also ward off sneak attacks that may come from unscrupulous lawyers. Using a company formation service, such as this one, you can set up an offshore business. Combining it with an offshore trust and/or offshore foundation from various jurisdictions worldwide can help ease restrictions.

Experts often recommend Nevis offshore businesses because their laws favor privacy and asset protection. The Nevis LLC, as of this writing, offers the most effective asset protection statutes of any offshore company.

Why Nevis?

Here are some reasons why the Nevis LLC (especially when combined with a Nevis trust) is an excellent asset protection tool:

- One needs to put up a $100,000 bond before filing a lawsuit to pursue a judgment against one’s membership interest in a Nevis LLC.

- The fraudulent transfer statute of limitations is a mere two years. That means that when you put assets into a Nevis LLC, two years afterwards, Nevis the courts will not hear the case.

- On top of this, creditor needs to prove beyond a reasonable doubt the owner of the Nevis LLC funded the LLC to keep the assets from that creditor.

- Asset protection that keeps a creditor from seizing the company or the assets it holds is granted to single-member in addition to multi-member LLCs.

- Even if one does obtain a charging order, it expires in three years and the creditor cannot renew it.

Even more powerful than the Nevis LLC is the Nevis asset protection. To put it in stronger terms, the Nevis trust is one of the most effective asset protection tools in the world. When a US court says “turn over the money” the offshore trustee says, “sorry, you don’t have jurisdiction here.” When we establish a Nevis trust we put a Nevis LLC inside. That way, the client is the manager of the LLC when times are good. Then when he or she is hit with a legal attack, the trustee (our law firm in Nevis) can step in and activate the asset protection fortress.

Belize and Asset Protection

Belize offers offshore company formation and offshore banking. After Nevis, it is one of the better choices for asset protection and privacy. “Belize is one of the countries that I would go to hide my money and to live if I had to,” said Dennis Lormel, a former head of the FBI’s Financial Crimes Section. “The fact is that I’m going to be protected down there, and the (U.S.) government is probably not going to be able to extradite me or get into my bank accounts.” Naturally, it is only recommended that you use offshore banking for one of the many legitimate, legal purposes.

After Nevis, thee Belize LDC combined with the Belize trust are two of the more powerful asset protection tools worldwide. Here is why.

Why Belize?

- Capital contributions (funds contributed to establish the LDC) are exempt from a fraudulent transfer claim from a creditor.

- The statute of limitations on fraudulent conveyance for a Belize LDC is very short. It is only one year from its established and funded or only two years from the time the asset was transferred into it.

The Belize trust has similar benefits and is even more powerful than the LDC. Usually we set up a Belie trust with a Belize LDC inside. As with the Nevis LLC, the client is the manager of the Belize LDC until the “bad thing” happens. Then when a creditor attacks, the Belize truste steps in and protects the assets. Your local courts do not have jurisdiction over Belize trustees. So, they cannot compel the trustee to comply.

The statute of limitations on fraudulent transfer for a Belize trust is as short as can be. For divorce proceeds or inheritance claims the statute of limitations is zero. That is, as soon as one transfers such assets into the trust, the trust protects them.

Shielding Your Assets

To insulate your assets from unscrupulous lawyer claims, you’ll need to evaluate your risk and the value and type of your assets. Offshore financial planning offers a vast range of choices which aren’t available domestically. To begin with, before you launch any advanced planning to shield your personal assets, here is what to do. First, you must make certain you have a great, solid asset protection foundation.

Essentially, you must place the assets into the proper legal tools. Moreover, you must select the proper jurisdictions in order to attain the desired protection. You can diversify your assets within these legal tools in banks located in jurisdictions that do not recognize foreign judgments. It’s fairly straightforward and quick to establish. In addition, by doing so you can safeguard your assets and identity when conducting business internationally. Let us know that these are your desires and we will show you how.

The Cook Islands trust or Nevis trust combined with an offshore LLC inside the trust is a good combination. As stated above, when the US courts demand that you bring the money back, our offshore law firm can refuse to comply.

Shadow Companies for Financial Protection

Interestingly, The Tribune-Review noted that around fifty percent of all of the world’s commerce makes its way through tax havens. One tax haven approach to offshore banking is getting a private bank account in a company name. As such, it shields money from just about anybody you wish to keep money from. This may include creditors, lawyers, ex-spouses, or other financial vultures.

“Having an anonymous company is really handy for a whole range of…activities, and getting an anonymous company is pretty easy,” said Jason Sharman, an offshore banking academic at Griffith University in Australia. Making a company can be fast and easy. In fact, this is our specialty and during the workdays, our firm forms offshore companies on a daily basis. Getting the offshore bank account for your offshore company can take a bit more time and effort. So get help from someone who has experience in the industry. Again, this is something we also do daily – helping clients open offshore accounts. When you do the same, you will likely find it very worthwhile when it comes to protecting yourself from a financial attack.

Some offshore bank accounts require just a couple thousand dollars for their opening deposits. Others, especially a Swiss bank account, needs a decent amount of money to fund. Swiss banking often requires from $250,000 to $1 million to open the account.

Offshore Trusts for Asset Protection

Offshore asset protection planning has become the subject of controversies the past few years. The very best asset protection plan is to make an irrevocable trust having a special power of appointment. This is because the law doesn’t consider trust assets as property of the Settlor. Keep in mind, when you buy the trust, you’re not just purchasing a trust. In addition, you are purchasing the experience of the individual writing the trust.

In order to protect you, a professional must draft it properly based on both statute and actual case law experience. So, this is not a do it yourselfer. Get help. After all, this is your money. There are many forms of trusts. Each type has distinctive purposes or goals.

Possessing an offshore trust just may be your best option in regards to safeguarding your assets. In fact, we have found the offshore trust the strongest tool available.

People use offshore trusts for more than avoiding the normal creditor. For example, they do it for someone looking to ransack their wealth in a workers compensation case. We can also use them to protect your assets from unscrupulous lawyers suing for a car wreck, a fire that does more damage than your insurance covers, etc.

As with other asset protection techniques , it is best to put the trust to work before a lawsuit strikes. That way, it is able to best safeguard you. Yes, you can use it as a post-lawsuit fortress. But pre-planning is ideal. An offshore trust, for this purpose, is drafted as an asset protection trust. That is, the end purpose is to guard your assets.

What Not to Do

While offshore trusts may offer asset protection planning opportunities, you should approach this option wisely. You need to make sure your provider has experience and drafts the trust properly. Plus, an organization who has a longstanding relationship with the trustee should guide its creation.

Transferring assets out of the USA into a global trust to prevent a present creditor from collecting might be a fraudulent conveyance. However, this is merely a civil matter that generally holds no criminal consequences. A better term for this phrase is a “voidable transaction.” In fact, this is the precise phrase that the Uniform Law Commission now uses. This is because the word fraudulent tends to lead the uninformed to thinking that is more serious than it really is.

Offshore Banking Tax Laws

Basically, there is one catch with these types of offshore investment accounts. That is to make sure to follow United States “tax haven” laws. These laws include making sure to do things like:

- Reporting any asset transfers into a foreign trust to the IRS.

- Distributions from an offshore trust that are received by an American can possibly be taxed to that individual.

- All undistributed earnings may be taxed as income.

- Account for any accumulated earnings in an offshore trust that may have been generated in prior years. Otherwise, a distribution may cause the American to pay income taxes on those years. This is just as if it were income earned in previous years. If the income was not reported previously, you may be required to pay both penalties and interest. The bottom line is that offshore earnings are tax neutral. You do not pay more or less in taxes if you hold your funds offshore or onshore.

- The IRS will ask you (or your CPA) to file a simple tax form. The form clarifies the value of the assets inside of the trust. In addition, you will name the actual beneficiaries of the trust. If you fail to file this report you may earn a fine, of among other things, a $10,000 late fee. If you fail to file the report altogether, it can get even more onerous. So, be sure to have your accountant complete and file the simple forms on time.

The “Translation”

In other words, the IRS does not care if you have an offshore account. Having an offshore account does not raise “red flags,” as some erroneously believe. They only care that you report your income. Whether you earn a profit onshore or offshore, report what you earn. So, it is not offshore or onshore that matters to the IRS. It is reporting your earnings that matters, no matter where those earnings occur.

Offshore Corporate and Trust Tax Tips

There are some important tax tips you should be aware of as grantor, transferor, or executor of a foreign estate. Those moving assets into a foreign trust as well as U.S. beneficiaries of foreign trust should know the following information. Similarly, if you’re holding your foreign assets as in an international company, there are other things you need to know. Specifically, take the appropriate action if you fall into any of the below categories:

- You are a shareholder in possession of 10% or more of an offshore corporation. Plus, more than half the stock of the corporation has five or fewer American owners.

- Five or fewer Americans are involved with your offshore company’s stock. In addition, 60% and above of that company’s income is from investments.

- You have shareholder control of an offshore company holding 50% or more of assets as investment assets. In addition, you are making 75% and above of the gross income with similar investment income.

Are any of the above is true? If so, you need to be sure to report the income on your personal tax returns. So, be sure to consult with a CPA who is experienced with international entities. Most of the CPAs knowledgeable in this arena are from larger cities which have a high number of wealthy individuals. Your friendly neighborhood CPA from Bugtussle, Kentucky would likely be in over his head. You can still use your local guy or gal for your basic filings. But for offshore filings, get someone who knows the territory.

Conclusion

Clearly, you should set up an offshore asset protection trust with your eyes wide open. It offers a way to place your assets beyond the reach of creditors. So, with smart planning, and awareness of the individual tax filings, you can do things right. Plus, you can hide your assets from unscrupulous lawyers. Just rest assured, there are effective and powerful ways to protect yourself from legal danger. So many other regular people do so every day.

Dr. Kristy Nelson

| [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] | [10] | [11] | [12] | [Bonus] |