Chapter 11

Offshore Banking Jurisdictions Listed in Order

Here is a list of the best and most recommended offshore banking jurisdictions. Fortunately, we have conducted extensive research. Therefore, we can offer tips and advice to make your job easy. As such, these countries have laws that provide for financial safety, privacy, convenience and offer a competitive return on investment.

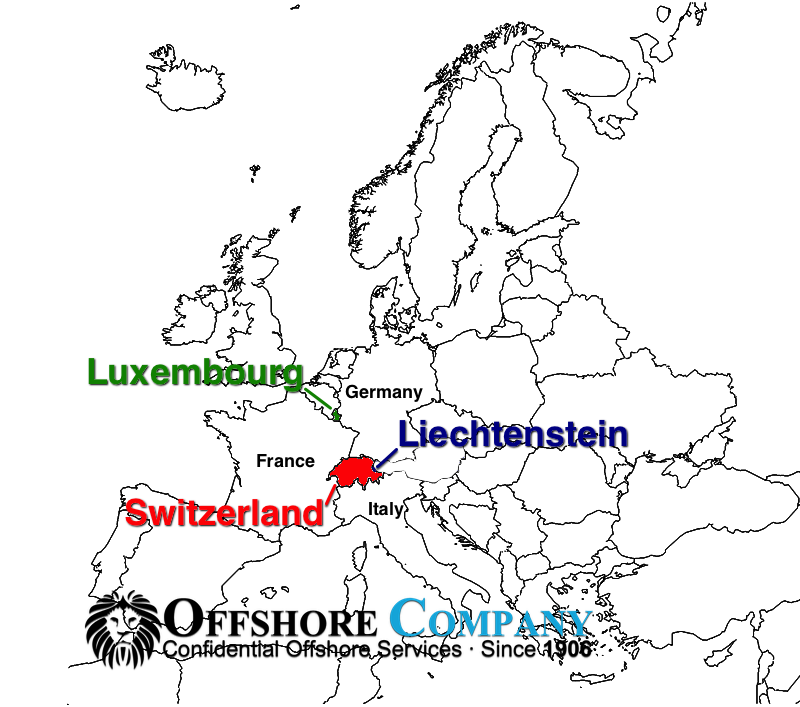

For initial deposits of over $250,000:

- Switzerland

- Luxembourg

- Lichtenstein

OffshoreCompany.com specializes in bank accounts in Switzerland and other favorable jurisdictions. So, please complete a consultation form or use one of the phone numbers on this page. In addition, you can visit our entire section on Swiss Banking.

For deposits under $250,000, here are the recommended jurisdictions:

- Cook Islands

- Caribbean (many countries – call the phone number above for details)

- Belize

Banking In Europe

In tax haven countries, account opening scrutiny is lower. On the other hand, privacy is higher. In the European jurisdiction, however there are agreements that increase the due diligences requirements for member banks. Thus, potential account holders need to produce extra know-your-customer documentation. They called this agreement the European Union Savings Tax Directive 2005.

Then, in December 2014, the Council of the European Union adopted Directive 2014/107/EU. This provides for bank/government cooperation on tax issues (“EU Mutual Assistance Directive”). Thus, banks report earned interest and dividends, as well as other depositor income. Through it, countries mutually exchange tax information with other countries.

These directives may adversely affect the banking privacy in certain countries that are subject to it. In addition, the EU Tax Directive may limit the confidentiality and privacy of the depositors in the offshore banks. To be clear, this applies only to the banks situated in the jurisdictions that are under these statutes.

Countries Under the EU Banking Directive

As of this writing, the member countries of the European Union are as follows:

Austria, Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom. In addition to EU countries, the directive also includes agreements between the EU and Andorra, Liechtenstein, Monaco, San Marino, and Switzerland.

Any jurisdictions that are part of a commonwealth are subject to the EU Tax Directive. In addition, any countries that are under the governance of, or a consigner of these nations are as well. Others may also willingly comply, such as Switzerland and the United States.

Stated simply, the 2014 is an agreement among the EU Member States as well as a list of nearby countries. It, specifically, allows for the exchange of financial or transactional information . The EU calls this agreement the “automatic exchange of information option” and is the hallmark of the Directive.

The Offshore jurisdictions that are not subject to EU laws or directives do not participate in this agreement. Thus, they afford depositors of those jurisdictions increased levels of confidentiality.

Other Banking Jurisdictions

There are many other offshore jurisdictions that provide many of the same benefits that the EU versions do. But they are not bound to the EU Directive. Needless to say, this is often an extremely important consideration for an investor or depositor seeking privacy. This is because you may want a specific benefit that a jurisdiction subject to EU Directive reporting cannot meet. Indeed, this is an important consideration. However, you should not automatically assume that it is always most advantageous to bank in a non-EU Directive adhering jurisdiction.

Suppose a potential depositor meets the initial deposit amount requirements. He has his banking goals in alignment with his bank and its jurisdiction. As such, established offshore locations such as Switzerland can better suit his needs. However, there are very competent jurisdictions not subject to the EU Tax Directive. They may have initial deposit requirements vastly lower than those of the “established” jurisdictions. For example, some jurisdictions like St. Vincent and Belize can require as little as $2000 US to start.

How Banking has Changed

Before the internet explosion of the mid-90’s and the 9/11 terrorist attacks, the banking world was much simpler. For example, account holders and potential depositors in offshore banks had to literally walk into a bank. This was required in order to open an account. Alternatively, they could simply send an authorized representative to do so. They had to establish accounts, transact funds, or formalize agreements in person. The old “lock box and key” method reigned supreme.

However, since the mid-90’s, there has been a big shift. There has been a veritable explosion in technology previously unimaginable in many service industries worldwide. This of course includes offshore banking.

Gone are the days of having to actually walk into the bank. Now, most of the services as close as your nearest keyboard. As you know, we now have world wide web access to accounts. We also have credit card like debit cards and the advent of electronic funds transfers. Furthermore, at our fingertips are virtual signatures, and the virtually limitless access to the internet. Thus, offshore banking has been revolutionized into a simpler solution for individuals and companies.

It doesn’t matter if your bank is in the Grand Canyon state or Grand Cayman. Most of the features that the banks offer are just a mouse click away. Let’s assume that you meet and adhere to all of the precautions and only engage in legal activities. If so, the confidentiality of any deposit or investment is as secure as it has ever been.

Additional Offshore Banking Information

Offshore bank accounts operate in the same manner as a typical domestic bank account. The bank opens the account. Thereupon, the client receives a bank account debit card or credit card. Depositors have online access. Doing wire transfers and performing the typical bank account transactions are easy. Simply log in online and follow the instructions. Offshore banks offer many of the same conveniences and many offer great customer service. When selecting your institution it is important that you choose the provider that is right for your scenario.

As stated, many offshore banking institutions will allow you to set up a bank account by depositing as little as $2000. In other cases, depending on the bank, you can deposit less. Moreover, all of the recommended offshore bank account providers are highly regulated and adhere to strict international privacy laws. Private accounts typically require a higher initial deposit. However those are negotiable depending on the overall account goals and projections.

OffshoreCompany.com researches the financial services providers around the world. We make sure that our clients can access their accounts via phone, fax, email and Internet. Moreover, we do our best to make sure they are attentive to the needs of our clients. Plus we want to make sure that we are as discreet and private.

Offshore Tax

Oftentimes, your offshore bank account balance will earn interest. You may also ask us to set up an offshore investment account. The interest and investment gains are usually free of local taxation in the bank’s jurisdiction. The interest rates are usually higher and the fees are competitive. Many fortune 500 companies, including oil companies take advantage of offshore banking. Some of the more popular tax haven jurisdictions have hundreds of first-rate banks from which to choose.

Financial institutions in private jurisdictions do not report customer account information to foreign governments. They do not even report it to their own. So it is up to the account holder to do so. As a responsible company, of course, we recommend that you comply with the tax laws of the jurisdiction to which you are obligated. Many countries, including the US tax worldwide income. So, first we help you establish your company and account. Then, we have CPAs who are very knowledgeable that and can assist on tax compliance for your international income.

OffshoreCompany.com establishes thousands of business structures, bank accounts, privacy and asset protection plans worldwide. Protecting and growing the finances of our clients are our biggest concerns.

Offshore banking institutions offer a wide variety of benefits, when it comes to privacy Switzerland is hard to beat. We have provided a complete section on Swiss banking where you can learn more about private bank accounts.

| [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] | [10] | [11] | [12] | [Bonus] |