Top Recommended Offshore Company Jurisdictions

The following are the offshore company jurisdictions that offer a combination of asset protection, lawsuit protection and privacy. You can also see the comparison chart for offshore LLCs by clicking this link.

- Nevis – Privacy, Convenience and Stability. Learn why the Island of Nevis is one of the most popular jurisdictions today. Above all, check out the most powerful offshore tool: the Nevis LLC.

- Belize – Companies, IBC (International Business Company) and Banking. In addition, you will see that Belize offers with a wide variety of offshore incorporation options. For example, the Belize LDC, Belize’s alternative to the LLC offers some unique asset protection benefits.

- Bahamas – Tax Free, Privacy and Low Fees. In addition, you can read about the variety of options available to you in the Bahamas.

- British Virgin Islands – Maximum Security, Asset Protection and Privacy. Moreover, you can research how offshore companies and IBC’s in BVI help protect your wealth.

Click here for a complete list: offshore company jurisdictions.

Offshore Company Information

Offshore companies are entities such as corporations or limited liability companies (LLCs) that are filed outside of one’s country of residence. People who incorporate companies offshore do so, among other things, when interested in asset protection, business expansion and financial privacy. In addition, the information below summarizes the reasons why people form these entities:

- Privacy

- Asset Protection

- Tax Savings (depending on your jurisdiction)

- Lawsuit Protection

- Flexible Business Laws

- Business Expansion

- International Financial Diversification

- Confidentiality

Offshore Company Formation Strategies

Here, you will see a list of several offshore asset protection strategies, their costs and benefits. In addition, this section discusses essential aspects of offshore planning, including companies, offshore banking and trusts, how they are structured and why. More importantly, we can establish a corporate bank account for each company that you establish through our service. Furthermore, you can learn about offshore banking here.

First, many offshore jurisdictions have extraordinarily advantageous legal systems for those seeking asset protection and financial privacy. Consider these offshore company formation benefits and facts. Notably, the US has 4.4% of the world’s population, yet 70% of the world’s lawyers and 96% of the world’s lawsuits. Moreover, unlike other countries in the world, we do not have a loser pays legal system. On the contrary, in other countries the loser of a lawsuit has to pay both his attorney fees and his opponents. Consequently, their laws make lawsuits much less frequent.

Offshore Company = Moat with Alligators

In the US if you are involved in a lawsuit and win, you’re still out your own legal expenses, so you still lose. On the other hand, suing an offshore company is much more difficult. For example, let’s say a legal opponent chose to sue your offshore company. He or she may have to post a bond to have the case sent through a review board. They, in turn, determine whether or not the case would even make it to a court. Frequently, the bond is non refundable. As a result, not many people file lawsuits. So, this is a strong layer of lawsuit protection. In other words, just by taking advantage of an offshore jurisdiction’s legal statutes you dramatically decrease the odds of someone suing you.

With a Nevis LLC, for example, the 2015 amendment made a creditor to post a $100,000 bond before they can bring any action to collect a judgment against a member the company. The Nevis lawmakers improved the statutes in 2018 giving the Nevis courts the authority to set the bond for any amount. The money saved by keeping your finances away from prying eyes, thus, preventing lawsuits, safeguarding your assets from litigation and the increased financial privacy are some of the many reasons for going offshore. Another favorable jurisdiction for LLCs is the Cook Islands. Incidentally, you can read this article on the Nevis LLC vs. Cook Islands LLC that compares the two entities.

Types of Offshore Companies

Another key point is that offshore companies offer much greater financial privacy than domestic entity types. Examples of these include corporations, limited liability companies or international business companies (IBCs). There are many offshore jurisdictions that more favorable laws that the US, Canada or the UK. These jurisdictions compete for international clientele. As a result, their laws favor privacy of ownership, privacy for to officers and directors and non-recognition of foreign judgments.

Offshore Incorporation

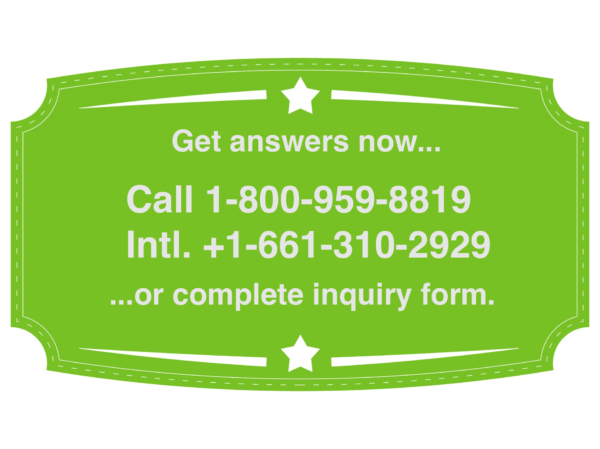

As can be seen, the odds of a lawsuit striking an American business owner is high. After all, many attorneys litigate just to survive. In fact, some never see the inside of a courtroom. That is, they use the legal system to pressure business leaders into unreasonable settlements. You can learn more about how offshore company incorporation can help with your protection needs by calling OffshoreCompany.com or by completing the form on this page. We form thousands of business structures every year, helping thousands of Americans with their protection and privacy needs and offering guidance through all of the offshore company formalities.